Fractional ownership allows investors to buy partial shares of high-value assets such as real estate or collectibles, enabling diversified portfolios with lower capital. Exchange-traded funds (ETFs) provide instant diversification by pooling multiple securities into a single tradeable fund on stock exchanges, offering liquidity and lower management costs. Explore the unique benefits and risks of fractional ownership and ETFs to optimize your investment strategy.

Why it is important

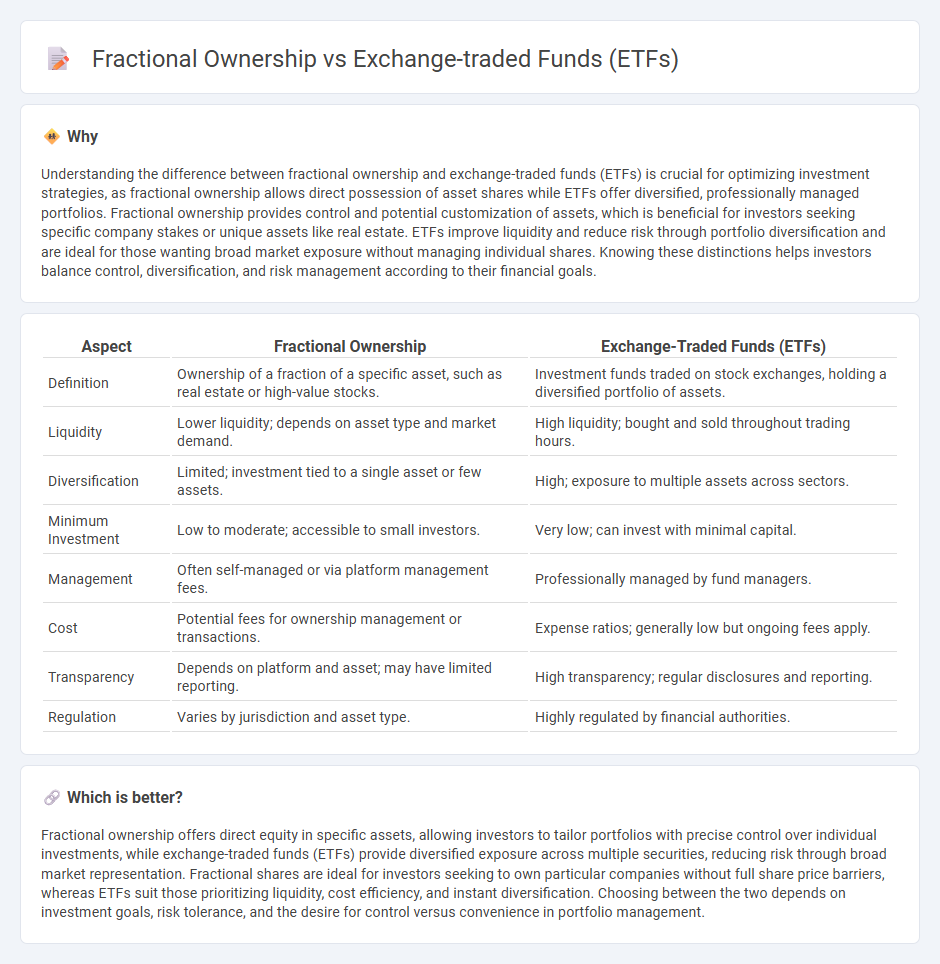

Understanding the difference between fractional ownership and exchange-traded funds (ETFs) is crucial for optimizing investment strategies, as fractional ownership allows direct possession of asset shares while ETFs offer diversified, professionally managed portfolios. Fractional ownership provides control and potential customization of assets, which is beneficial for investors seeking specific company stakes or unique assets like real estate. ETFs improve liquidity and reduce risk through portfolio diversification and are ideal for those wanting broad market exposure without managing individual shares. Knowing these distinctions helps investors balance control, diversification, and risk management according to their financial goals.

Comparison Table

| Aspect | Fractional Ownership | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Ownership of a fraction of a specific asset, such as real estate or high-value stocks. | Investment funds traded on stock exchanges, holding a diversified portfolio of assets. |

| Liquidity | Lower liquidity; depends on asset type and market demand. | High liquidity; bought and sold throughout trading hours. |

| Diversification | Limited; investment tied to a single asset or few assets. | High; exposure to multiple assets across sectors. |

| Minimum Investment | Low to moderate; accessible to small investors. | Very low; can invest with minimal capital. |

| Management | Often self-managed or via platform management fees. | Professionally managed by fund managers. |

| Cost | Potential fees for ownership management or transactions. | Expense ratios; generally low but ongoing fees apply. |

| Transparency | Depends on platform and asset; may have limited reporting. | High transparency; regular disclosures and reporting. |

| Regulation | Varies by jurisdiction and asset type. | Highly regulated by financial authorities. |

Which is better?

Fractional ownership offers direct equity in specific assets, allowing investors to tailor portfolios with precise control over individual investments, while exchange-traded funds (ETFs) provide diversified exposure across multiple securities, reducing risk through broad market representation. Fractional shares are ideal for investors seeking to own particular companies without full share price barriers, whereas ETFs suit those prioritizing liquidity, cost efficiency, and instant diversification. Choosing between the two depends on investment goals, risk tolerance, and the desire for control versus convenience in portfolio management.

Connection

Fractional ownership allows investors to buy partial shares of assets, increasing accessibility and diversification in portfolio management. Exchange-traded funds (ETFs) are investment vehicles that pool together fractional shares of various securities, providing low-cost exposure to broad market indexes or specific sectors. This connection enables investors to efficiently allocate capital, reducing barriers to entry and enhancing liquidity in financial markets.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity as they trade on stock exchanges like individual stocks, allowing investors to buy or sell shares throughout market hours at market prices. In contrast, fractional ownership often involves direct stakes in assets such as real estate or collectibles, which can be illiquid and harder to trade quickly or at transparent market values. Explore deeper insights into how liquidity differences impact investment strategies between ETFs and fractional ownership.

Diversification

Exchange-traded funds (ETFs) offer broad diversification by pooling assets from numerous companies into a single portfolio, reducing risk through exposure to various sectors and markets. Fractional ownership allows investors to buy portions of individual high-value stocks, enabling diversification even with limited capital, but it lacks the automatic sector and asset variety inherent in ETFs. Explore in-depth comparisons to understand which investment strategy best aligns with your diversification goals.

Accessibility

Exchange-traded funds (ETFs) provide broad market exposure by allowing investors to purchase a diversified portfolio through a single trade on stock exchanges, typically requiring a full share purchase. Fractional ownership enables investors to buy partial shares of high-priced stocks or ETFs, significantly lowering the entry barrier and enhancing accessibility for individuals with limited capital. Explore how these investment options compare in flexibility and affordability to make informed financial decisions.

Source and External Links

Exchange-Traded Fund (ETF) - An ETF is an exchange-traded investment product that pools money from various investors to invest in stocks, bonds, and other securities, similar to mutual funds but traded on national securities exchanges.

What is an ETF (Exchange-Traded Fund)? - ETFs combine the flexibility of stocks with the diversifying strengths of mutual funds, offering affordable access to a wide range of asset classes and potentially lower risk.

Exchange-Traded Funds and Products - ETFs are pooled investment opportunities that include baskets of stocks, bonds, and other assets, traded on exchanges and offering a unique share issuance and redemption mechanism through authorized participants.

dowidth.com

dowidth.com