Music royalties investing offers a steady income stream by earning revenue each time a song is played or licensed, while sports memorabilia investing relies on the appreciation of physical collectibles tied to athletes and sports history. Both markets present unique risks and rewards, with music royalties providing passive income and sports memorabilia often requiring a sharper eye for market trends and authenticity. Explore the differences in these alternative investments to determine which aligns best with your financial goals.

Why it is important

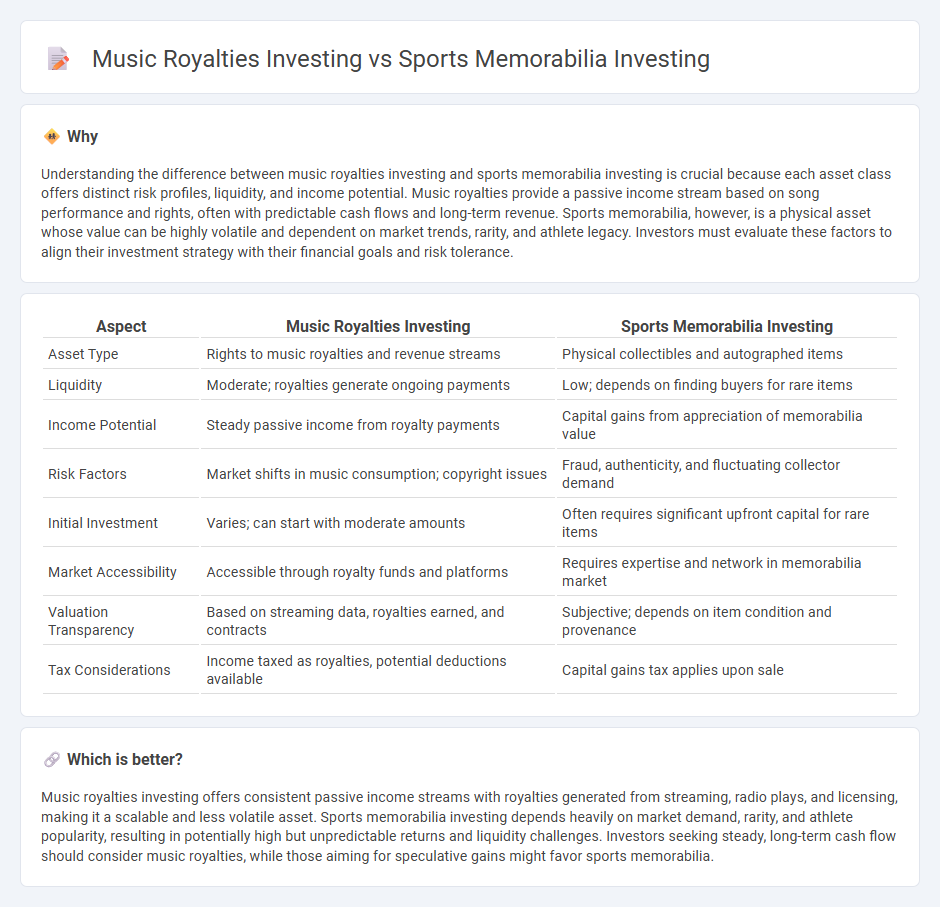

Understanding the difference between music royalties investing and sports memorabilia investing is crucial because each asset class offers distinct risk profiles, liquidity, and income potential. Music royalties provide a passive income stream based on song performance and rights, often with predictable cash flows and long-term revenue. Sports memorabilia, however, is a physical asset whose value can be highly volatile and dependent on market trends, rarity, and athlete legacy. Investors must evaluate these factors to align their investment strategy with their financial goals and risk tolerance.

Comparison Table

| Aspect | Music Royalties Investing | Sports Memorabilia Investing |

|---|---|---|

| Asset Type | Rights to music royalties and revenue streams | Physical collectibles and autographed items |

| Liquidity | Moderate; royalties generate ongoing payments | Low; depends on finding buyers for rare items |

| Income Potential | Steady passive income from royalty payments | Capital gains from appreciation of memorabilia value |

| Risk Factors | Market shifts in music consumption; copyright issues | Fraud, authenticity, and fluctuating collector demand |

| Initial Investment | Varies; can start with moderate amounts | Often requires significant upfront capital for rare items |

| Market Accessibility | Accessible through royalty funds and platforms | Requires expertise and network in memorabilia market |

| Valuation Transparency | Based on streaming data, royalties earned, and contracts | Subjective; depends on item condition and provenance |

| Tax Considerations | Income taxed as royalties, potential deductions available | Capital gains tax applies upon sale |

Which is better?

Music royalties investing offers consistent passive income streams with royalties generated from streaming, radio plays, and licensing, making it a scalable and less volatile asset. Sports memorabilia investing depends heavily on market demand, rarity, and athlete popularity, resulting in potentially high but unpredictable returns and liquidity challenges. Investors seeking steady, long-term cash flow should consider music royalties, while those aiming for speculative gains might favor sports memorabilia.

Connection

Music royalties investing and sports memorabilia investing both represent alternative asset classes that provide passive income and portfolio diversification outside traditional stocks and bonds. Both markets rely heavily on the cultural and emotional value attributed to unique intellectual properties and rare physical collectibles, driving demand and potential appreciation. Investors benefit from the scarcity and fan-driven demand in these sectors, which can lead to attractive long-term returns and reduced correlation with conventional financial markets.

Key Terms

**Sports memorabilia investing:**

Sports memorabilia investing involves acquiring items such as signed jerseys, game-used equipment, and rare collectibles that appreciate in value due to their historical significance and athlete association. Market trends show growing interest in vintage and limited-edition memorabilia, with high-profile auctions driving record prices and strong return potential for collectors and investors. Discover how to build a diversified sports memorabilia portfolio and identify key investment opportunities in this dynamic market.

Authenticity

Authenticity plays a critical role in sports memorabilia investing, where certified collectibles such as game-worn jerseys, signed balls, and limited-edition trading cards heavily influence asset value and market trust. In music royalties investing, authenticity is secured through verified rights ownership and transparent royalty streams, which determine consistent income generation and legal protection for investors. Explore more about how authenticity impacts returns and security in these unique investment arenas.

Provenance

Provenance plays a crucial role in both sports memorabilia and music royalties investing, as it verifies the authenticity and legal ownership of assets, thereby enhancing their market value. Sports memorabilia benefits from established chains of custody, player endorsements, and documented event connections, while music royalties require transparent rights management and royalty payment histories. Discover how understanding provenance can maximize returns and mitigate risks in these investment arenas.

Source and External Links

How to Invest in Sports Memorabilia - Focus on rare, authenticated items tied to legendary players or iconic events for potential appreciation and portfolio diversification, but understand the market requires significant research and expert advice.

Why You Should Invest In Sports Memorabilia - Strategic investing in high-quality, authentic memorabilia can yield significant returns, though the market is volatile and success depends on careful research and understanding market nuances.

Investing in Autographed Sports Memorabilia - Sports memorabilia can appreciate, but lacks the consistency and liquidity of traditional investments like stocks, making it a riskier and less reliable option for most investors.

dowidth.com

dowidth.com