Livestock investment platforms offer tangible asset opportunities by enabling investors to finance animal rearing projects such as cattle, poultry, and aquaculture, often yielding consistent returns through product sales like meat, milk, or eggs. Art investment platforms provide access to high-value, appreciating assets by allowing investors to acquire shares in artworks, benefiting from market trends and the cultural value of pieces by renowned artists. Explore more to understand which investment avenue aligns with your financial goals and risk tolerance.

Why it is important

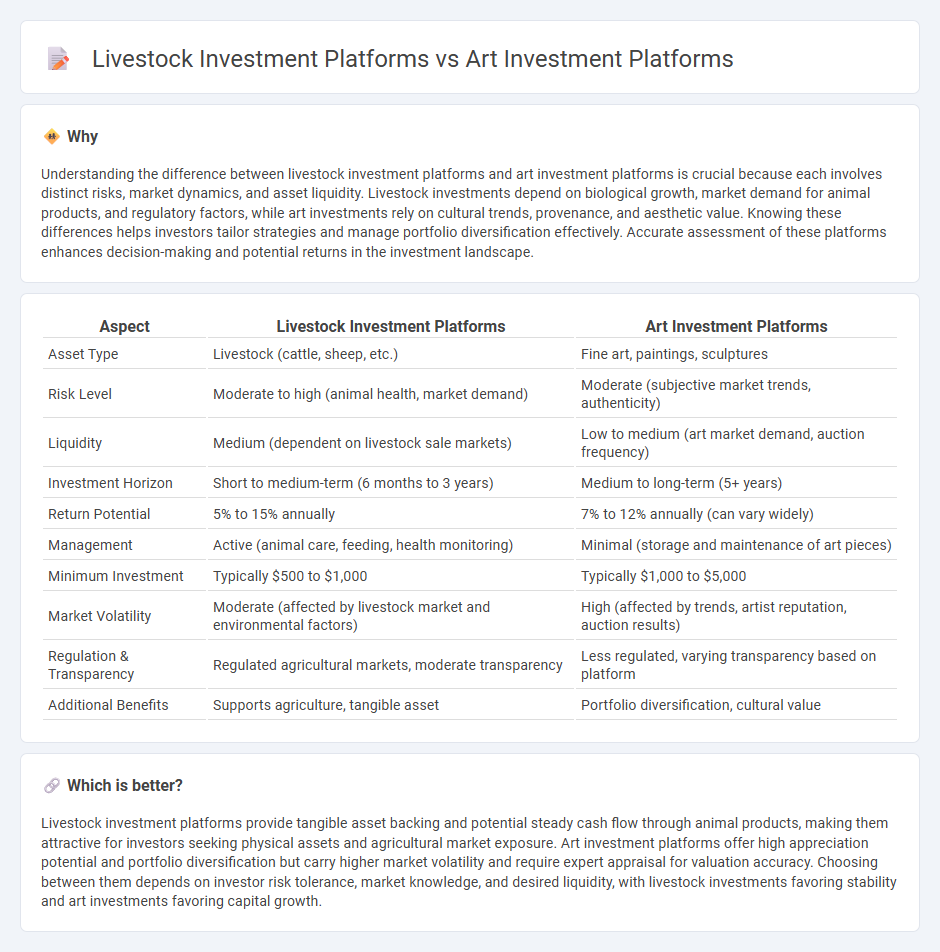

Understanding the difference between livestock investment platforms and art investment platforms is crucial because each involves distinct risks, market dynamics, and asset liquidity. Livestock investments depend on biological growth, market demand for animal products, and regulatory factors, while art investments rely on cultural trends, provenance, and aesthetic value. Knowing these differences helps investors tailor strategies and manage portfolio diversification effectively. Accurate assessment of these platforms enhances decision-making and potential returns in the investment landscape.

Comparison Table

| Aspect | Livestock Investment Platforms | Art Investment Platforms |

|---|---|---|

| Asset Type | Livestock (cattle, sheep, etc.) | Fine art, paintings, sculptures |

| Risk Level | Moderate to high (animal health, market demand) | Moderate (subjective market trends, authenticity) |

| Liquidity | Medium (dependent on livestock sale markets) | Low to medium (art market demand, auction frequency) |

| Investment Horizon | Short to medium-term (6 months to 3 years) | Medium to long-term (5+ years) |

| Return Potential | 5% to 15% annually | 7% to 12% annually (can vary widely) |

| Management | Active (animal care, feeding, health monitoring) | Minimal (storage and maintenance of art pieces) |

| Minimum Investment | Typically $500 to $1,000 | Typically $1,000 to $5,000 |

| Market Volatility | Moderate (affected by livestock market and environmental factors) | High (affected by trends, artist reputation, auction results) |

| Regulation & Transparency | Regulated agricultural markets, moderate transparency | Less regulated, varying transparency based on platform |

| Additional Benefits | Supports agriculture, tangible asset | Portfolio diversification, cultural value |

Which is better?

Livestock investment platforms provide tangible asset backing and potential steady cash flow through animal products, making them attractive for investors seeking physical assets and agricultural market exposure. Art investment platforms offer high appreciation potential and portfolio diversification but carry higher market volatility and require expert appraisal for valuation accuracy. Choosing between them depends on investor risk tolerance, market knowledge, and desired liquidity, with livestock investments favoring stability and art investments favoring capital growth.

Connection

Livestock investment platforms and art investment platforms both leverage alternative asset classes to diversify portfolios and generate non-traditional returns. These platforms connect investors with tangible assets--livestock such as cattle or sheep, and fine art pieces--offering potential for appreciation based on market demand, rarity, and underlying value. Utilizing blockchain technology and fractional ownership, both platforms enhance transparency, liquidity, and accessibility for investors seeking diversification beyond conventional stocks and bonds.

Key Terms

Asset Valuation

Art investment platforms provide asset valuation based on provenance, artist reputation, market trends, and rarity, often supported by expert appraisals and auction results. Livestock investment platforms assess asset value through breed quality, health records, productivity, and market demand in agriculture commodities. Explore more details to understand how asset valuation impacts your investment returns.

Liquidity

Art investment platforms often offer higher liquidity through fractional ownership and secondary markets, allowing investors to buy and sell shares quickly. Livestock investment platforms typically present lower liquidity due to the biological nature of animals, longer holding periods, and market dependency on health and growth cycles. Discover more about the liquidity dynamics between these investment avenues to make informed financial decisions.

Risk Diversification

Art investment platforms offer exposure to diverse artistic styles and historical periods, providing a hedge against market volatility through tangible assets with intrinsic cultural value. Livestock investment platforms diversify risk by linking returns to agricultural cycles and commodity markets, often benefiting from global demand for animal products and farm-to-table trends. Explore our detailed comparison to understand which investment strategy aligns best with your portfolio goals.

Source and External Links

Best Art Investments and Platforms in 2025 - Masterworks is highlighted as the leading platform for fractional art investment, offering shares in high-quality, blue-chip artworks with a track record of 14% average annual appreciation and both primary and secondary market trading, though it charges an annual 1.5% fee plus 20% of profits.

Top 6 Fractional Art Investment Platforms - The article lists Masterworks, Mintus, Particle, Timeless, Artex, and Goldframer as top platforms, detailing their focus on high-value art, accessibility for non-wealthy investors, and unique niches like Islamic art for ethically conscious portfolios.

How to Invest in Art - Moneywise - Explains that investors can gain art exposure through platforms like Masterworks (for direct art shares) or Yieldstreet (for art-focused funds), emphasizing ease of use, low minimums, and solid historical returns, but notes that liquidity may be lower than traditional investments.

dowidth.com

dowidth.com