Investing in song catalogs offers steady royalty income and intellectual property appreciation, while sports franchises provide significant brand value and community engagement with potential for high capital gains. Song catalog purchases benefit from the growing demand for digital streaming and licensing, whereas sports franchises thrive on ticket sales, merchandise, and media rights. Explore the distinct advantages and risks of each to make an informed investment decision.

Why it is important

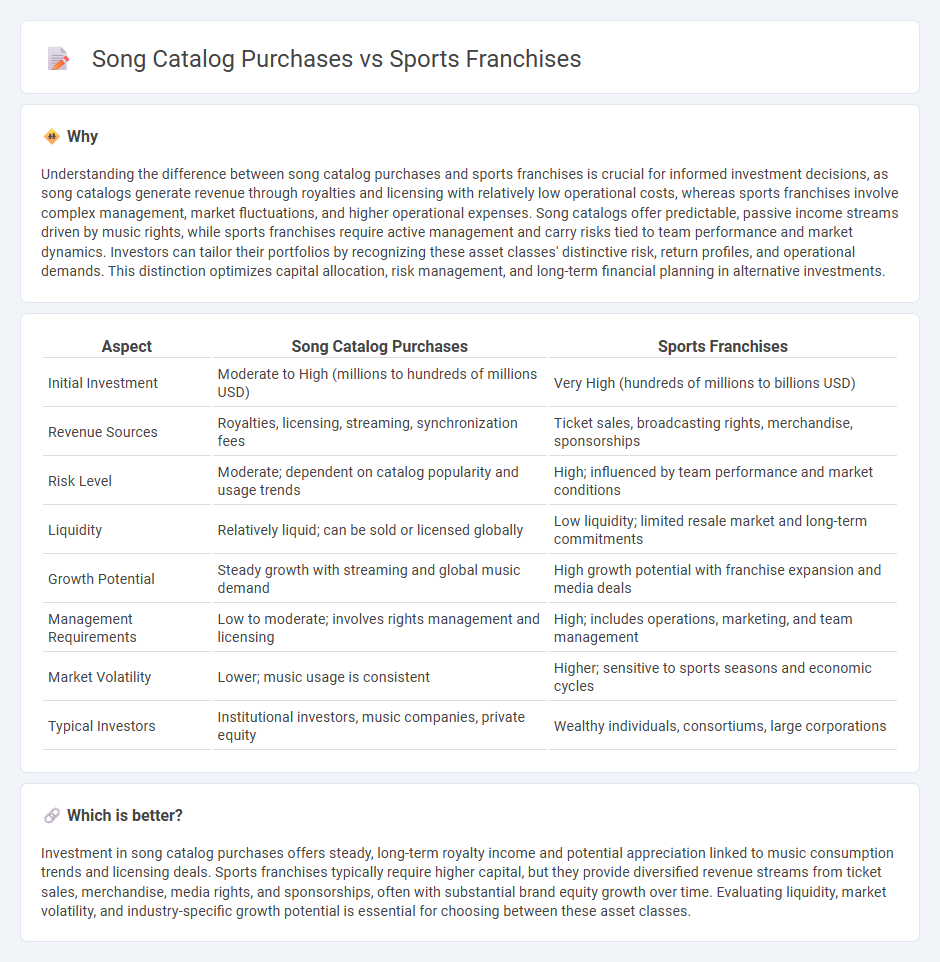

Understanding the difference between song catalog purchases and sports franchises is crucial for informed investment decisions, as song catalogs generate revenue through royalties and licensing with relatively low operational costs, whereas sports franchises involve complex management, market fluctuations, and higher operational expenses. Song catalogs offer predictable, passive income streams driven by music rights, while sports franchises require active management and carry risks tied to team performance and market dynamics. Investors can tailor their portfolios by recognizing these asset classes' distinctive risk, return profiles, and operational demands. This distinction optimizes capital allocation, risk management, and long-term financial planning in alternative investments.

Comparison Table

| Aspect | Song Catalog Purchases | Sports Franchises |

|---|---|---|

| Initial Investment | Moderate to High (millions to hundreds of millions USD) | Very High (hundreds of millions to billions USD) |

| Revenue Sources | Royalties, licensing, streaming, synchronization fees | Ticket sales, broadcasting rights, merchandise, sponsorships |

| Risk Level | Moderate; dependent on catalog popularity and usage trends | High; influenced by team performance and market conditions |

| Liquidity | Relatively liquid; can be sold or licensed globally | Low liquidity; limited resale market and long-term commitments |

| Growth Potential | Steady growth with streaming and global music demand | High growth potential with franchise expansion and media deals |

| Management Requirements | Low to moderate; involves rights management and licensing | High; includes operations, marketing, and team management |

| Market Volatility | Lower; music usage is consistent | Higher; sensitive to sports seasons and economic cycles |

| Typical Investors | Institutional investors, music companies, private equity | Wealthy individuals, consortiums, large corporations |

Which is better?

Investment in song catalog purchases offers steady, long-term royalty income and potential appreciation linked to music consumption trends and licensing deals. Sports franchises typically require higher capital, but they provide diversified revenue streams from ticket sales, merchandise, media rights, and sponsorships, often with substantial brand equity growth over time. Evaluating liquidity, market volatility, and industry-specific growth potential is essential for choosing between these asset classes.

Connection

Song catalog purchases and sports franchises represent lucrative investment opportunities driven by the growing demand for exclusive content and fan engagement. Both asset classes generate consistent revenue streams through licensing, royalties, and merchandise rights, attracting institutional and celebrity investors seeking portfolio diversification. Increasing digital consumption and media rights valuations amplify their value, linking these investments through the broader entertainment and sports industries.

Key Terms

Asset Valuation

Sports franchises often hold immense value due to their revenue streams from ticket sales, broadcasting rights, and merchandising, making asset valuation heavily reliant on market demand and brand equity. Song catalog purchases derive their value from anticipated royalty income, licensing deals, and streaming metrics, emphasizing future cash flow projections and intellectual property rights. Explore the nuances of asset valuation in both domains to better understand investment potential and risk factors.

Revenue Streams

Sports franchises generate diversified revenue streams including ticket sales, broadcasting rights, merchandise, sponsorship deals, and concession sales, making them robust assets with steady income potential. Song catalog purchases primarily earn through royalties from streaming platforms, licensing for commercials, films, and covers, offering passive yet scalable revenue tied to the artist's popularity and catalog size. Explore the nuances of these revenue models to understand investment opportunities and long-term profitability in entertainment and sports industries.

Intellectual Property

Sports franchises represent a unique form of intellectual property encompassing branding, trademarks, and media rights that drive substantial revenue through licensing and merchandising. In contrast, song catalog acquisitions primarily involve copyrights, providing continuous income via royalties, synchronization licenses, and streaming platforms. Explore the distinct financial dynamics and legal frameworks behind these IP investments for deeper insight.

Source and External Links

Sports franchises | EBSCO Research Starters - Sports franchises are professional teams operating within organized leagues, primarily in the U.S. and Canada, with roots in late 19th-century baseball and now encompassing major leagues like MLB, NFL, NBA, and NHL, reflecting both cultural significance and complex financial dynamics.

Professional sports league organization - Professional sports leagues in North America use a franchise system, where teams (franchises) have exclusive territorial rights and operate under a closed membership structure without promotion or relegation, ensuring stability and controlled expansion.

Sports Franchise Opportunities For Sale - The sports franchise industry includes not only professional teams but also youth and recreational programs like Skyhawks Sports Camps, with growing segments in children's fitness and emerging opportunities in eSports, reflecting diversification beyond traditional spectator sports.

dowidth.com

dowidth.com