Private credit funds provide direct lending opportunities to businesses, often offering flexible terms and higher yields than traditional bank financing. Syndicated loans involve multiple lenders pooling resources to share risk while financing large-scale projects or corporate needs. Explore the differences and benefits of private credit funds versus syndicated loans to make informed investment decisions.

Why it is important

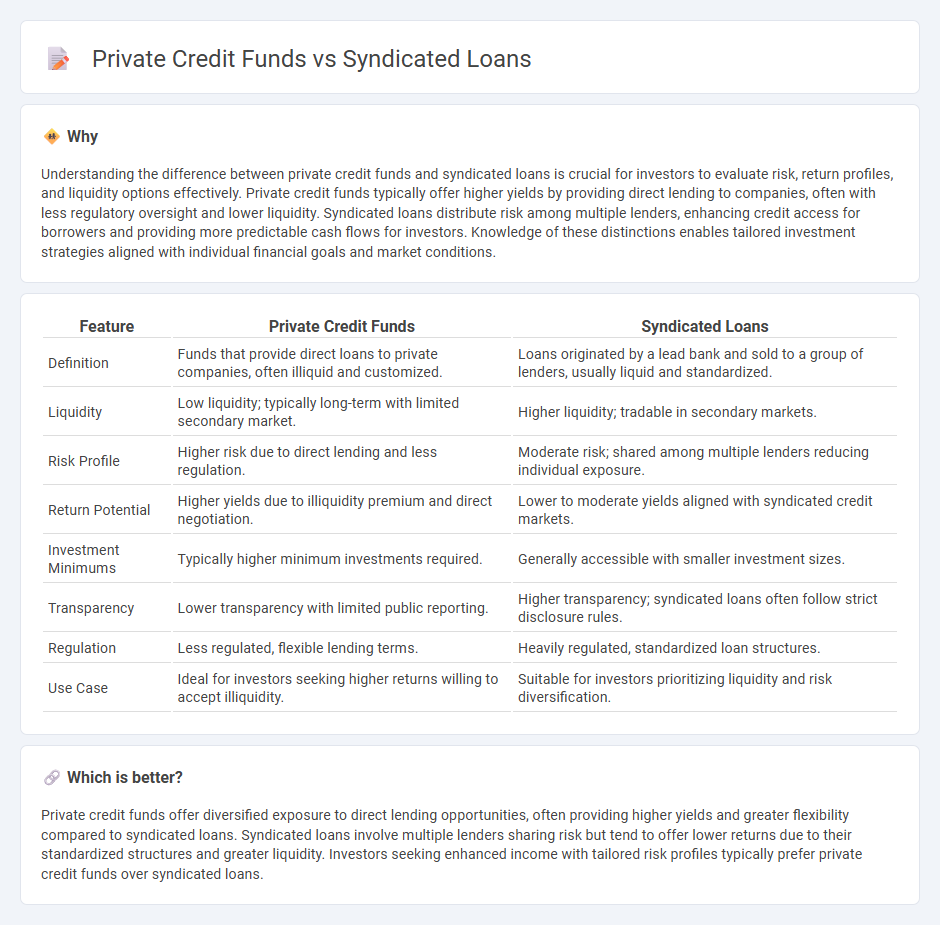

Understanding the difference between private credit funds and syndicated loans is crucial for investors to evaluate risk, return profiles, and liquidity options effectively. Private credit funds typically offer higher yields by providing direct lending to companies, often with less regulatory oversight and lower liquidity. Syndicated loans distribute risk among multiple lenders, enhancing credit access for borrowers and providing more predictable cash flows for investors. Knowledge of these distinctions enables tailored investment strategies aligned with individual financial goals and market conditions.

Comparison Table

| Feature | Private Credit Funds | Syndicated Loans |

|---|---|---|

| Definition | Funds that provide direct loans to private companies, often illiquid and customized. | Loans originated by a lead bank and sold to a group of lenders, usually liquid and standardized. |

| Liquidity | Low liquidity; typically long-term with limited secondary market. | Higher liquidity; tradable in secondary markets. |

| Risk Profile | Higher risk due to direct lending and less regulation. | Moderate risk; shared among multiple lenders reducing individual exposure. |

| Return Potential | Higher yields due to illiquidity premium and direct negotiation. | Lower to moderate yields aligned with syndicated credit markets. |

| Investment Minimums | Typically higher minimum investments required. | Generally accessible with smaller investment sizes. |

| Transparency | Lower transparency with limited public reporting. | Higher transparency; syndicated loans often follow strict disclosure rules. |

| Regulation | Less regulated, flexible lending terms. | Heavily regulated, standardized loan structures. |

| Use Case | Ideal for investors seeking higher returns willing to accept illiquidity. | Suitable for investors prioritizing liquidity and risk diversification. |

Which is better?

Private credit funds offer diversified exposure to direct lending opportunities, often providing higher yields and greater flexibility compared to syndicated loans. Syndicated loans involve multiple lenders sharing risk but tend to offer lower returns due to their standardized structures and greater liquidity. Investors seeking enhanced income with tailored risk profiles typically prefer private credit funds over syndicated loans.

Connection

Private credit funds often participate in syndicated loans by pooling capital from multiple investors to provide large-scale financing to borrowers, enhancing risk distribution and capital efficiency. Syndicated loans enable private credit funds to diversify their portfolios across various industries and geographies while accessing high-yield opportunities typically unavailable in traditional lending markets. This connection allows private credit funds to play a crucial role in middle-market financing, filling gaps left by conventional banks and institutional lenders.

Key Terms

Loan syndication

Syndicated loans involve multiple lenders pooling resources to provide large-scale financing, typically structured and overseen by lead banks, enhancing risk distribution and borrower access to capital. Private credit funds, in contrast, are managed investment vehicles that extend financing directly to borrowers, often offering tailored loan terms with potentially higher returns but increased risk exposure. Explore the strategic benefits and key differences of loan syndication to optimize capital raising and risk management strategies.

Direct lending

Direct lending through syndicated loans involves multiple lenders pooling resources to provide large-scale financing, often to mid-sized companies, with standardized terms and public market exposure. Private credit funds, by contrast, offer more flexible, customized financing solutions tailored to borrower needs, typically engaging in direct lending with less regulatory oversight and greater risk tolerance. Explore the nuances of direct lending strategies to understand how syndicated loans and private credit funds uniquely serve corporate borrowers.

Risk sharing

Syndicated loans distribute risk among multiple lenders, enhancing credit diversification and reducing exposure for each participant. Private credit funds typically assume full risk internally, allowing for flexible terms but concentrating credit risk within the fund's portfolio. Explore detailed comparisons of risk-sharing mechanisms in syndicated loans versus private credit funds to optimize your investment strategy.

Source and External Links

What Are Syndicated Loans and How Do They Work? - Truist Bank - Syndicated loans involve multiple lenders forming a syndicate to provide a large loan to a single borrower, sharing risks and offering flexible financing options like term loans, revolving credit, and letters of credit for purposes such as capital expenditures, refinancing, or acquisitions.

Syndicated loans - Managed Funds Association (PDF) - A syndicated loan is financing provided by a group of lenders to one borrower, allowing risk sharing when funding needs exceed a single lender's capacity, with terms that can include fixed or floating interest rates and lines of credit.

Syndicated Financing | Loan Agency | Funding the Future - Syndicated loans are large financings coordinated by an arranger bank that splits portions of the loan among multiple lenders, reducing individual credit risk and supporting corporate buyouts, refinancing, and other large borrowing needs.

dowidth.com

dowidth.com