Wine investing offers a unique asset class with potential for appreciation driven by rarity, provenance, and vintage quality, appealing to connoisseurs and collectors. Classic car investing combines passion with value growth, influenced by factors such as historical significance, condition, and market demand. Explore the distinctive advantages and risks of each investment to make an informed decision.

Why it is important

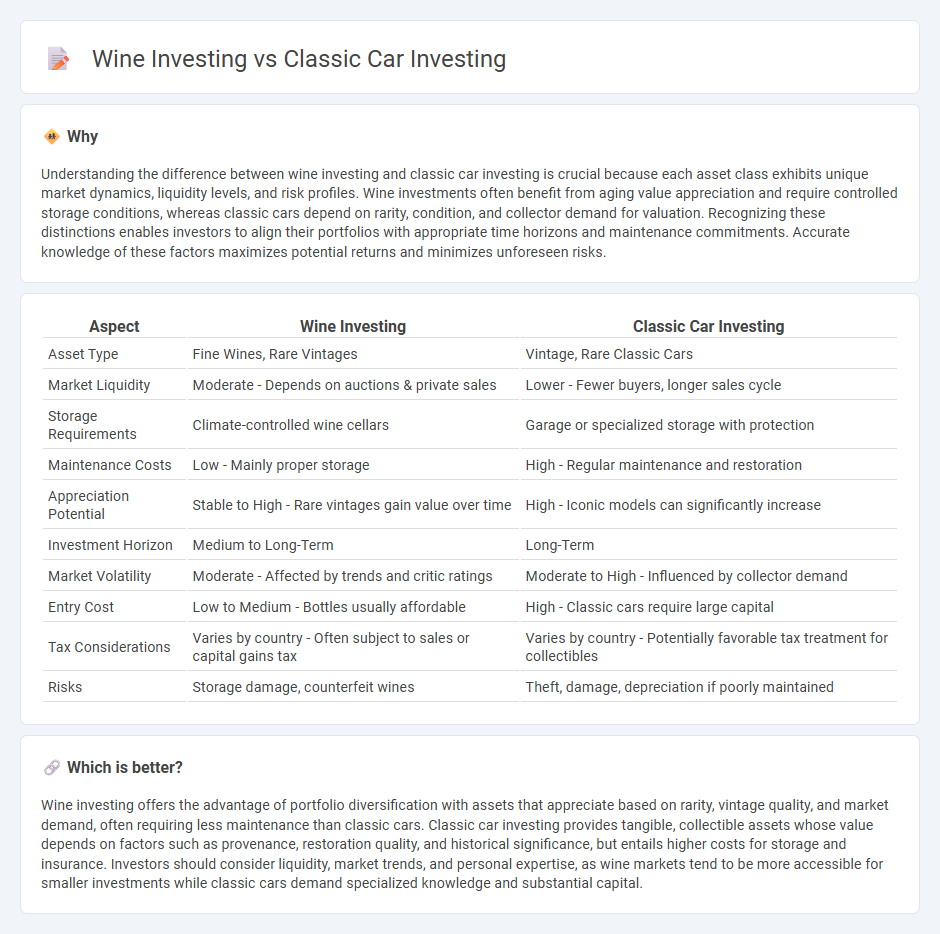

Understanding the difference between wine investing and classic car investing is crucial because each asset class exhibits unique market dynamics, liquidity levels, and risk profiles. Wine investments often benefit from aging value appreciation and require controlled storage conditions, whereas classic cars depend on rarity, condition, and collector demand for valuation. Recognizing these distinctions enables investors to align their portfolios with appropriate time horizons and maintenance commitments. Accurate knowledge of these factors maximizes potential returns and minimizes unforeseen risks.

Comparison Table

| Aspect | Wine Investing | Classic Car Investing |

|---|---|---|

| Asset Type | Fine Wines, Rare Vintages | Vintage, Rare Classic Cars |

| Market Liquidity | Moderate - Depends on auctions & private sales | Lower - Fewer buyers, longer sales cycle |

| Storage Requirements | Climate-controlled wine cellars | Garage or specialized storage with protection |

| Maintenance Costs | Low - Mainly proper storage | High - Regular maintenance and restoration |

| Appreciation Potential | Stable to High - Rare vintages gain value over time | High - Iconic models can significantly increase |

| Investment Horizon | Medium to Long-Term | Long-Term |

| Market Volatility | Moderate - Affected by trends and critic ratings | Moderate to High - Influenced by collector demand |

| Entry Cost | Low to Medium - Bottles usually affordable | High - Classic cars require large capital |

| Tax Considerations | Varies by country - Often subject to sales or capital gains tax | Varies by country - Potentially favorable tax treatment for collectibles |

| Risks | Storage damage, counterfeit wines | Theft, damage, depreciation if poorly maintained |

Which is better?

Wine investing offers the advantage of portfolio diversification with assets that appreciate based on rarity, vintage quality, and market demand, often requiring less maintenance than classic cars. Classic car investing provides tangible, collectible assets whose value depends on factors such as provenance, restoration quality, and historical significance, but entails higher costs for storage and insurance. Investors should consider liquidity, market trends, and personal expertise, as wine markets tend to be more accessible for smaller investments while classic cars demand specialized knowledge and substantial capital.

Connection

Wine investing and classic car investing are connected through their status as alternative asset classes that combine passion with potential financial gain. Both markets rely heavily on rarity, provenance, and proper preservation to enhance value, attracting investors who appreciate tangible, non-correlated assets. Trends in global wealth and auction market performance consistently demonstrate the growing appeal of fine wine and vintage automobiles as long-term stores of value.

Key Terms

Classic car investing:

Classic car investing offers tangible asset value appreciation driven by rarity, historical significance, and brand prestige, with models like the Ferrari 250 GTO and Porsche 911 commanding high auction prices. Unlike wine, classic cars require maintenance, storage, and insurance considerations but provide enjoyment and potential for significant long-term returns. Discover in-depth insights and strategies to maximize your classic car investment portfolio.

Provenance

Provenance plays a crucial role in both classic car investing and wine investing as it establishes authenticity, historical significance, and a traceable ownership lineage that can significantly enhance value. Classic cars with impeccable provenance often command higher auction prices and attract serious collectors, while exceptional wine provenance ensures quality, origin, and proper storage history, all critical for long-term appreciation. Explore detailed comparisons and strategies to optimize your investment portfolio by understanding provenance in these unique asset classes.

Rarity

Classic car investing hinges on rarity defined by limited production models, historical significance, and unique restoration status, driving demand among passionate collectors. Wine investing depends on scarcity due to vintage quality, vineyard reputation, and limited bottle availability, often influenced by aging potential and market trends. Explore deeper insights into how rarity shapes these alternative investment markets for informed portfolio diversification.

Source and External Links

How to Invest in Classic Cars - SmartAsset - Provides tips on investing in classic cars, emphasizing research, budgeting, and patience as key strategies for success.

Investing in Collectible Cars | Wealthspire - Offers insights into the collectible car market, focusing on historical significance, brand legacy, condition, and rarity to guide investment decisions.

Cars | Rally - Highlights Rally's passion-led investing in the classic car market, showcasing specific models and their financial performance over time.

dowidth.com

dowidth.com