Designer sneaker portfolios offer dynamic growth potential driven by limited-edition releases and strong cultural demand, while luxury watch portfolios provide enduring value supported by brand heritage and scarcity. Both asset classes benefit from global market trends and collector enthusiasm, making them viable alternatives to traditional investments. Explore the distinct advantages and strategies behind designer sneaker and luxury watch portfolios to diversify your investment approach.

Why it is important

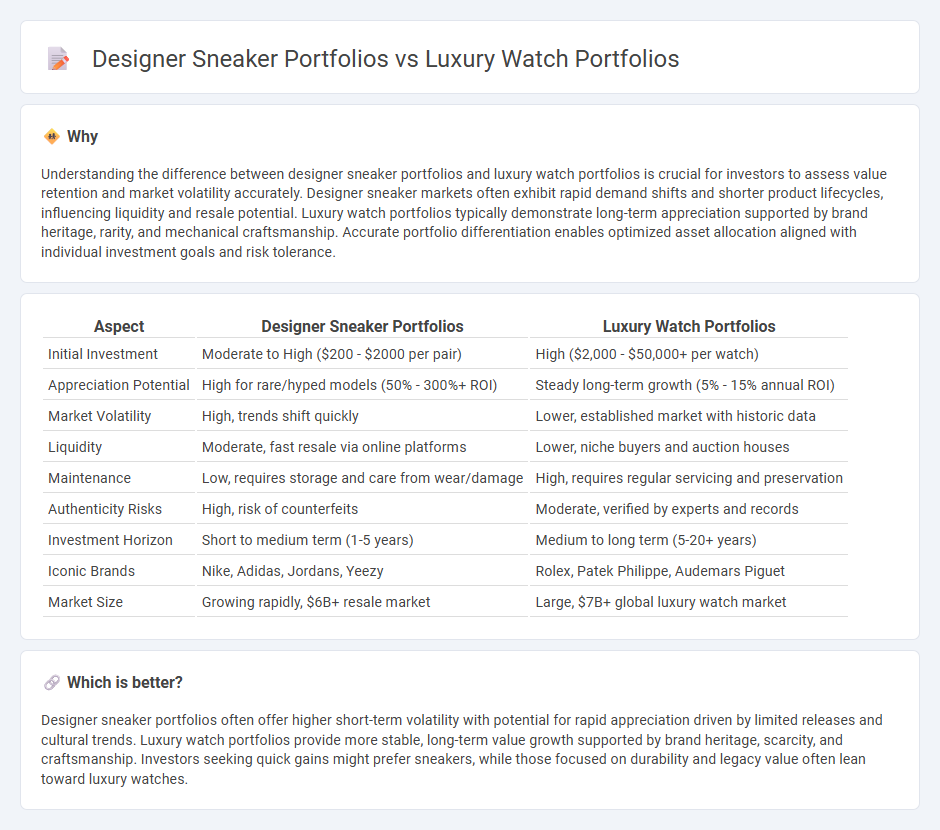

Understanding the difference between designer sneaker portfolios and luxury watch portfolios is crucial for investors to assess value retention and market volatility accurately. Designer sneaker markets often exhibit rapid demand shifts and shorter product lifecycles, influencing liquidity and resale potential. Luxury watch portfolios typically demonstrate long-term appreciation supported by brand heritage, rarity, and mechanical craftsmanship. Accurate portfolio differentiation enables optimized asset allocation aligned with individual investment goals and risk tolerance.

Comparison Table

| Aspect | Designer Sneaker Portfolios | Luxury Watch Portfolios |

|---|---|---|

| Initial Investment | Moderate to High ($200 - $2000 per pair) | High ($2,000 - $50,000+ per watch) |

| Appreciation Potential | High for rare/hyped models (50% - 300%+ ROI) | Steady long-term growth (5% - 15% annual ROI) |

| Market Volatility | High, trends shift quickly | Lower, established market with historic data |

| Liquidity | Moderate, fast resale via online platforms | Lower, niche buyers and auction houses |

| Maintenance | Low, requires storage and care from wear/damage | High, requires regular servicing and preservation |

| Authenticity Risks | High, risk of counterfeits | Moderate, verified by experts and records |

| Investment Horizon | Short to medium term (1-5 years) | Medium to long term (5-20+ years) |

| Iconic Brands | Nike, Adidas, Jordans, Yeezy | Rolex, Patek Philippe, Audemars Piguet |

| Market Size | Growing rapidly, $6B+ resale market | Large, $7B+ global luxury watch market |

Which is better?

Designer sneaker portfolios often offer higher short-term volatility with potential for rapid appreciation driven by limited releases and cultural trends. Luxury watch portfolios provide more stable, long-term value growth supported by brand heritage, scarcity, and craftsmanship. Investors seeking quick gains might prefer sneakers, while those focused on durability and legacy value often lean toward luxury watches.

Connection

Designer sneaker portfolios and luxury watch portfolios both serve as alternative investment assets leveraging rarity, brand prestige, and market demand to generate high returns. The value of these portfolios is driven by limited editions, historical significance, and strong resale markets, often correlating with trends in fashion and collector interest. Investors diversify across these luxury collectibles to capitalize on appreciation potential and hedge against traditional market volatility.

Key Terms

Asset Liquidity

Luxury watch portfolios offer high asset liquidity due to their global demand, brand heritage, and limited edition releases, allowing quicker resale at premium prices. Designer sneaker portfolios also demonstrate strong liquidity driven by hype culture, limited drops, and collaborations, but typically exhibit higher volatility and shorter market cycles. Explore detailed comparisons on asset liquidity to optimize your investment strategy.

Market Volatility

Luxury watch portfolios exhibit lower market volatility due to their status as tangible assets with enduring value and limited supply, often appreciating over time during economic uncertainty. Designer sneaker portfolios experience higher volatility driven by fluctuating consumer trends, rapid releases, and hype cycles, which can lead to unpredictable price swings. Explore the dynamics of luxury watch and sneaker markets to understand their investment risks and opportunities more deeply.

Authentication

Luxury watch portfolios emphasize rigorous authentication through serial numbers, manufacturer certificates, and expert appraisals to guarantee originality and value retention. Designer sneaker portfolios rely on advanced technologies such as blockchain verification, holographic tags, and in-depth provenance tracking to combat counterfeiting in the streetwear market. Discover more about the cutting-edge authentication methods shaping the luxury and designer goods industries.

Source and External Links

Invest in luxury watches - Offers investment opportunities in top luxury watch brands including Rolex, Patek Philippe, and Audemars Piguet with portfolio options spanning 2 to 10 years and allowing company or individual investors to build diversified watch portfolios.

Luxury Watches: A Timeless Investment in Portfolio Diversification - Highlights how luxury watches, especially from brands like Audemars Piguet and Patek Philippe, serve as low-risk, non-correlated assets for portfolio diversification and have a booming secondary market worth around $24 billion.

Top Luxury Watch Investments for 2025 - Details the most promising luxury watches to include in 2025 portfolios, emphasizing rarity, limited editions, and models from Patek Philippe, Rolex, Audemars Piguet, and Richard Mille as key investment picks.

dowidth.com

dowidth.com