Collectibles investment focuses on acquiring tangible items such as art, antiques, and rare memorabilia that may appreciate in value over time based on rarity and demand. Venture capital involves providing funding to early-stage startups with high growth potential, seeking significant equity returns through business success. Explore the unique risks and rewards associated with each to determine which investment strategy aligns with your financial goals.

Why it is important

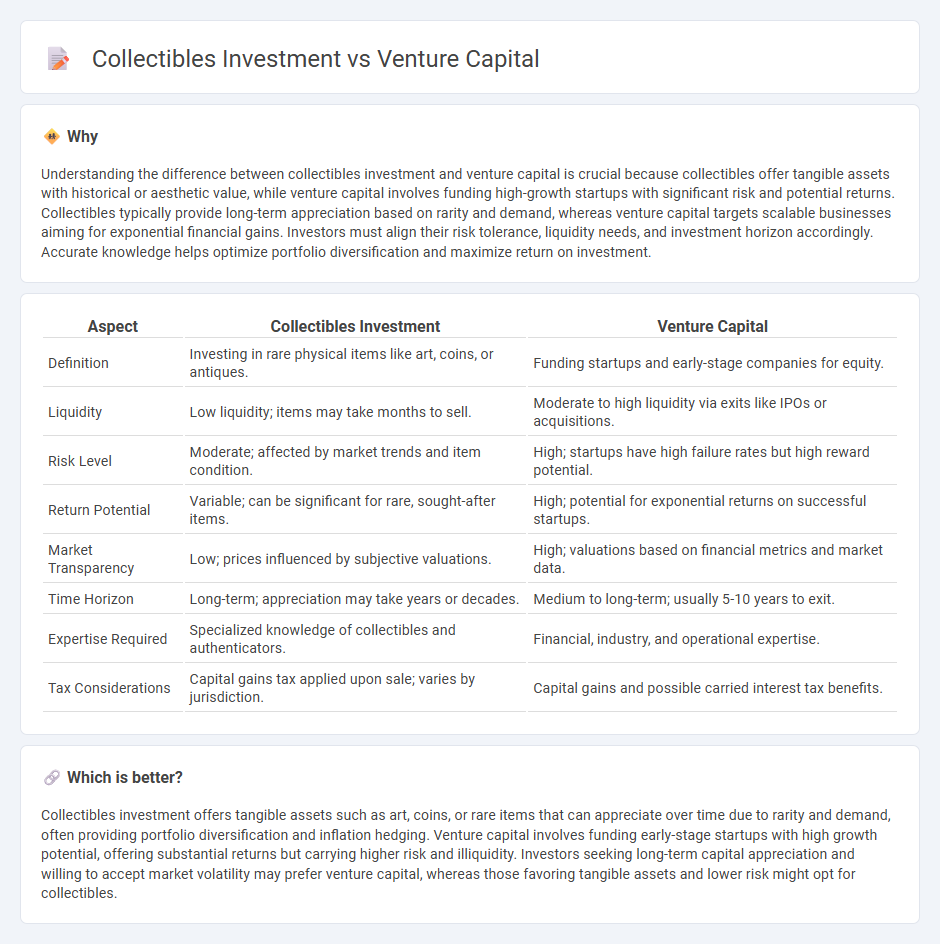

Understanding the difference between collectibles investment and venture capital is crucial because collectibles offer tangible assets with historical or aesthetic value, while venture capital involves funding high-growth startups with significant risk and potential returns. Collectibles typically provide long-term appreciation based on rarity and demand, whereas venture capital targets scalable businesses aiming for exponential financial gains. Investors must align their risk tolerance, liquidity needs, and investment horizon accordingly. Accurate knowledge helps optimize portfolio diversification and maximize return on investment.

Comparison Table

| Aspect | Collectibles Investment | Venture Capital |

|---|---|---|

| Definition | Investing in rare physical items like art, coins, or antiques. | Funding startups and early-stage companies for equity. |

| Liquidity | Low liquidity; items may take months to sell. | Moderate to high liquidity via exits like IPOs or acquisitions. |

| Risk Level | Moderate; affected by market trends and item condition. | High; startups have high failure rates but high reward potential. |

| Return Potential | Variable; can be significant for rare, sought-after items. | High; potential for exponential returns on successful startups. |

| Market Transparency | Low; prices influenced by subjective valuations. | High; valuations based on financial metrics and market data. |

| Time Horizon | Long-term; appreciation may take years or decades. | Medium to long-term; usually 5-10 years to exit. |

| Expertise Required | Specialized knowledge of collectibles and authenticators. | Financial, industry, and operational expertise. |

| Tax Considerations | Capital gains tax applied upon sale; varies by jurisdiction. | Capital gains and possible carried interest tax benefits. |

Which is better?

Collectibles investment offers tangible assets such as art, coins, or rare items that can appreciate over time due to rarity and demand, often providing portfolio diversification and inflation hedging. Venture capital involves funding early-stage startups with high growth potential, offering substantial returns but carrying higher risk and illiquidity. Investors seeking long-term capital appreciation and willing to accept market volatility may prefer venture capital, whereas those favoring tangible assets and lower risk might opt for collectibles.

Connection

Collectibles investment and venture capital both focus on high-potential asset growth, leveraging rarity and market trends to generate substantial returns. Collectibles like art, rare coins, or vintage items rely on scarcity and cultural value, similar to how venture capital targets innovative startups with unique products or technologies. Both strategies demand deep market knowledge and risk tolerance, aiming for exponential appreciation through informed asset selection and market timing.

Key Terms

Risk Tolerance

Venture capital investment involves high risk tolerance due to the uncertainty of startup success and potential for significant loss or gain. Collectibles investment typically presents moderate risk with value influenced by market demand, rarity, and condition, leading to more stable, long-term appreciation. To understand which option aligns with your financial goals, explore detailed risk assessments and investment strategies.

Liquidity

Venture capital investments typically have lower liquidity due to long lock-in periods and illiquid private equity stakes, often requiring years before potential exits via IPOs or acquisitions. Collectibles investment offers higher liquidity, with the ability to quickly sell assets like rare coins, art, or memorabilia in secondary markets or auctions, albeit with variable price volatility. Explore the nuances of liquidity dynamics between venture capital and collectibles to optimize your investment strategy.

Due Diligence

Due diligence in venture capital investment involves thorough analysis of a startup's market potential, financial health, management team, and scalability prospects. In collectibles investment, due diligence centers on authenticity verification, provenance, condition, and historical significance to assess value and future appreciation potential. Explore deeper insights into due diligence techniques tailored for these investment types to enhance your decision-making.

Source and External Links

What is Venture Capital? - Venture capital is a form of private equity financing that turns ideas and high-potential innovations into high-growth companies, providing not only funding but also strategic and operational guidance, with the aim of creating significant economic impact, jobs, and large-scale, publicly traded companies over a long investment horizon.

What is Venture Capital? | J.P. Morgan - Venture capital provides financing--typically in exchange for equity--to startups developing novel technologies with the potential for substantial value creation, despite high risks of failure, and investors typically pursue outsized returns through company exits such as IPOs or acquisitions, spreading investments across many companies to mitigate risk.

Fund your business | U.S. Small Business Administration - Venture capital is an alternative to traditional financing, focusing on high-growth companies that receive capital in exchange for equity and often require founders to cede some control, with investors actively participating in company governance and providing funding in stages as the company meets key milestones.

dowidth.com

dowidth.com