Psychedelic stocks have emerged as high-growth investments driven by expanding medical research and shifting regulations, while Real Estate Investment Trusts (REITs) offer steady income through diversified property portfolios and dividend yields. Investors weigh the high volatility and innovation in psychedelics against the stability and predictable cash flow provided by REITs. Explore the detailed comparisons to determine which investment aligns with your financial goals.

Why it is important

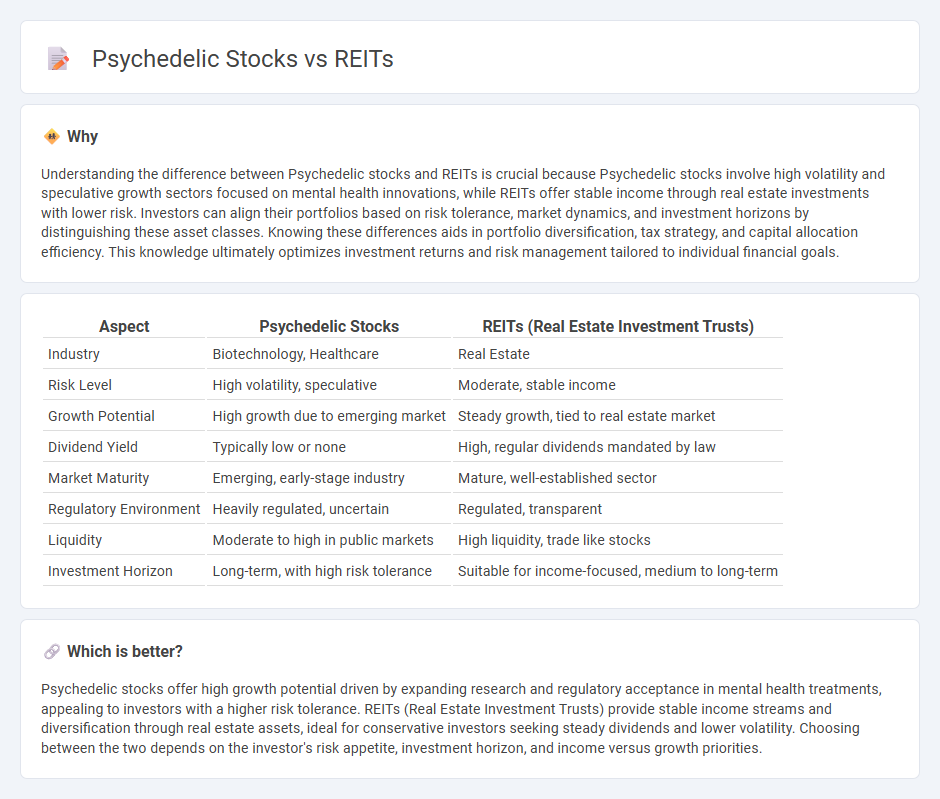

Understanding the difference between Psychedelic stocks and REITs is crucial because Psychedelic stocks involve high volatility and speculative growth sectors focused on mental health innovations, while REITs offer stable income through real estate investments with lower risk. Investors can align their portfolios based on risk tolerance, market dynamics, and investment horizons by distinguishing these asset classes. Knowing these differences aids in portfolio diversification, tax strategy, and capital allocation efficiency. This knowledge ultimately optimizes investment returns and risk management tailored to individual financial goals.

Comparison Table

| Aspect | Psychedelic Stocks | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Industry | Biotechnology, Healthcare | Real Estate |

| Risk Level | High volatility, speculative | Moderate, stable income |

| Growth Potential | High growth due to emerging market | Steady growth, tied to real estate market |

| Dividend Yield | Typically low or none | High, regular dividends mandated by law |

| Market Maturity | Emerging, early-stage industry | Mature, well-established sector |

| Regulatory Environment | Heavily regulated, uncertain | Regulated, transparent |

| Liquidity | Moderate to high in public markets | High liquidity, trade like stocks |

| Investment Horizon | Long-term, with high risk tolerance | Suitable for income-focused, medium to long-term |

Which is better?

Psychedelic stocks offer high growth potential driven by expanding research and regulatory acceptance in mental health treatments, appealing to investors with a higher risk tolerance. REITs (Real Estate Investment Trusts) provide stable income streams and diversification through real estate assets, ideal for conservative investors seeking steady dividends and lower volatility. Choosing between the two depends on the investor's risk appetite, investment horizon, and income versus growth priorities.

Connection

Psychedelic stocks and Real Estate Investment Trusts (REITs) intersect through emerging healthcare infrastructure investments focusing on mental health facilities and research centers. Investors are increasingly exploring REITs that acquire properties leased to companies developing psychedelic therapies, creating a unique synergy between real estate and biotech sectors. This connection highlights the growing economic potential of the psychedelic industry beyond pharmaceuticals, emphasizing asset-backed investment opportunities.

Key Terms

Asset Diversification

REITs offer stable income through real estate asset diversification, reducing portfolio volatility with tangible property holdings across commercial, residential, and industrial sectors. Psychedelic stocks represent a high-growth, high-risk segment driven by innovation in mental health treatments and regulatory developments, with diversification opportunities across biotech firms, drug development, and wellness applications. Explore detailed comparisons and tailored strategies to optimize your asset diversification in these dynamic markets.

Regulatory Environment

REITs operate within a well-established regulatory framework governed by the Securities and Exchange Commission (SEC) and specific tax rules, ensuring transparency and investor protections. Psychedelic stocks face a rapidly evolving regulatory landscape, with shifting policies around drug approval, decriminalization initiatives, and FDA trials impacting market risks and opportunities. Explore the regulatory nuances influencing both sectors to better inform investment strategies.

Dividend Yield

REITs typically offer higher dividend yields, averaging around 4% to 7%, making them attractive for income-focused investors seeking stability. Psychedelic stocks, often in early-stage development with limited or no dividends, prioritize growth potential over immediate income generation. Explore detailed comparisons to understand how dividend yield impacts long-term investment strategies.

Source and External Links

Real estate investment trust - Wikipedia - A REIT is a company that owns and typically operates income-producing real estate such as office buildings, apartments, shopping centers, and hotels, and may be publicly traded or private, with main types including equity REITs and mortgage REITs.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale income-producing real estate and typically operate properties rather than develop them, with distinctions between publicly traded and non-traded REITs.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies owning or financing income-producing real estate that provide investors with regular income, diversification, and long-term capital appreciation, often trading on major stock exchanges.

dowidth.com

dowidth.com