Royalty streams provide investors with a percentage of ongoing revenue generated by intellectual property or business assets, offering a steady income based on performance. Crowdfunding pools capital from numerous investors to fund projects or startups, often in exchange for early access or equity, spreading risk and enabling broad participation. Explore the advantages and risks of each investment strategy to determine which aligns best with your financial goals.

Why it is important

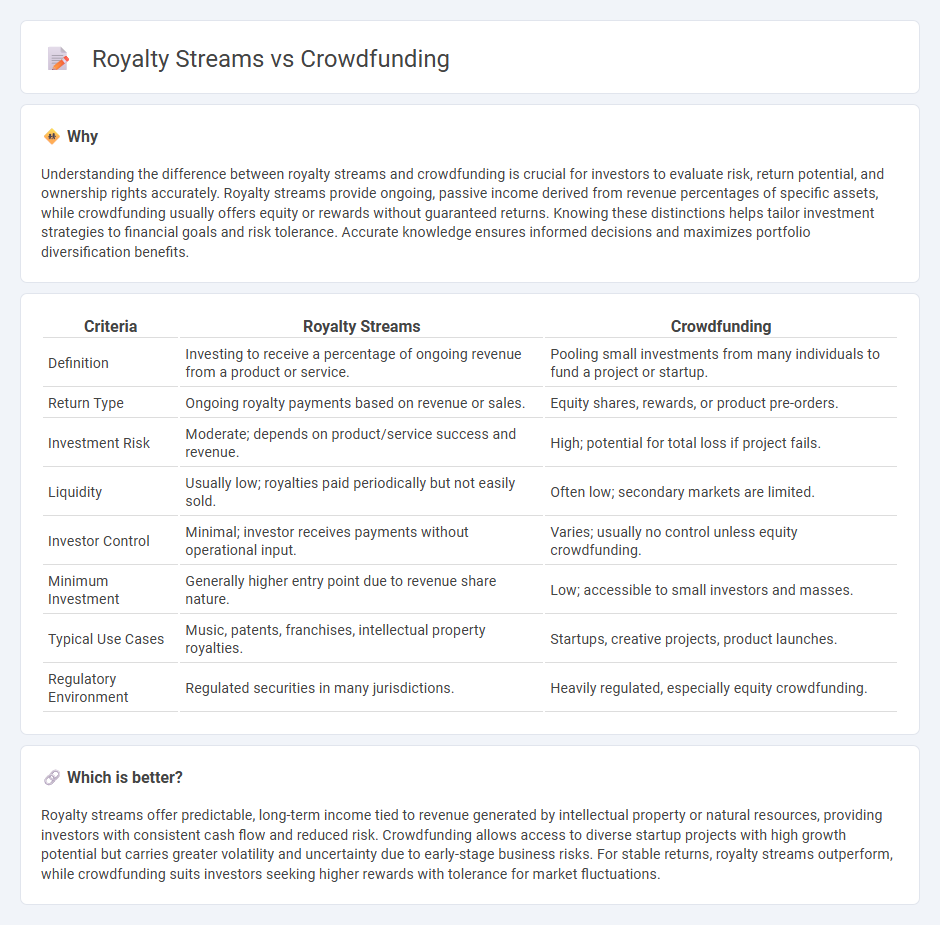

Understanding the difference between royalty streams and crowdfunding is crucial for investors to evaluate risk, return potential, and ownership rights accurately. Royalty streams provide ongoing, passive income derived from revenue percentages of specific assets, while crowdfunding usually offers equity or rewards without guaranteed returns. Knowing these distinctions helps tailor investment strategies to financial goals and risk tolerance. Accurate knowledge ensures informed decisions and maximizes portfolio diversification benefits.

Comparison Table

| Criteria | Royalty Streams | Crowdfunding |

|---|---|---|

| Definition | Investing to receive a percentage of ongoing revenue from a product or service. | Pooling small investments from many individuals to fund a project or startup. |

| Return Type | Ongoing royalty payments based on revenue or sales. | Equity shares, rewards, or product pre-orders. |

| Investment Risk | Moderate; depends on product/service success and revenue. | High; potential for total loss if project fails. |

| Liquidity | Usually low; royalties paid periodically but not easily sold. | Often low; secondary markets are limited. |

| Investor Control | Minimal; investor receives payments without operational input. | Varies; usually no control unless equity crowdfunding. |

| Minimum Investment | Generally higher entry point due to revenue share nature. | Low; accessible to small investors and masses. |

| Typical Use Cases | Music, patents, franchises, intellectual property royalties. | Startups, creative projects, product launches. |

| Regulatory Environment | Regulated securities in many jurisdictions. | Heavily regulated, especially equity crowdfunding. |

Which is better?

Royalty streams offer predictable, long-term income tied to revenue generated by intellectual property or natural resources, providing investors with consistent cash flow and reduced risk. Crowdfunding allows access to diverse startup projects with high growth potential but carries greater volatility and uncertainty due to early-stage business risks. For stable returns, royalty streams outperform, while crowdfunding suits investors seeking higher rewards with tolerance for market fluctuations.

Connection

Royalty streams and crowdfunding are connected through investor participation in funding creative projects or businesses in exchange for future revenue shares. Crowdfunding platforms enable investors to finance ventures and receive royalty payments based on the project's income, providing a steady cash flow tied to the project's success. This model aligns investor returns directly with the performance of the underlying asset, creating a symbiotic financial relationship.

Key Terms

Equity Stake

Equity stake crowdfunding enables investors to acquire ownership shares in startups, potentially leading to significant capital gains as the company grows. Royalty streams provide a fixed income based on future revenues without equity dilution, appealing to investors seeking steady cash flow. Explore detailed comparisons to understand which funding method aligns with your investment goals.

Revenue Sharing

Revenue sharing models like royalty streams offer investors a percentage of future income, aligning their returns with the project's financial success. Crowdfunding typically involves one-time contributions without ongoing profit sharing, making royalty streams a more attractive option for sustained revenue participation. Discover the key differences and benefits between crowdfunding and royalty stream investments to make informed funding decisions.

Passive Income

Crowdfunding and royalty streams both offer viable avenues for generating passive income, with crowdfunding enabling individuals to support projects in exchange for potential financial returns or rewards, while royalty streams provide ongoing payments based on revenue from intellectual property or sales. Royalty streams often require initial creative or investment efforts but can yield long-term, stable income, whereas crowdfunding relies on collective financial backing with potential high-risk and variable returns. Discover more about optimizing passive income strategies by exploring the advantages and challenges of crowdfunding and royalty streams.

Source and External Links

Crowdfunding - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, without relying on standard financial intermediaries.

What is crowdfunding? Here are four types to know - Crowdfunding allows entrepreneurs to raise money for projects or businesses through the collective effort of friends, family, customers, and individual investors, primarily online, as an alternative to traditional financing methods.

Small Business Financing: A Resource Guide: Crowdfunding - Crowdfunding involves using online platforms to collect small amounts of money from many individuals, and can take the form of donation-, reward-, or equity-based models, depending on the type of project or business.

dowidth.com

dowidth.com