Crowdlending platforms enable multiple investors to fund loans directly to businesses, offering diversified risk and relatively lower entry barriers compared to traditional funding methods. Angel investing involves affluent individuals providing capital for startups in exchange for equity, typically requiring higher investment amounts but potentially yielding greater returns. Explore the key differences between crowdlending platforms and angel investing to determine the best strategy for your investment goals.

Why it is important

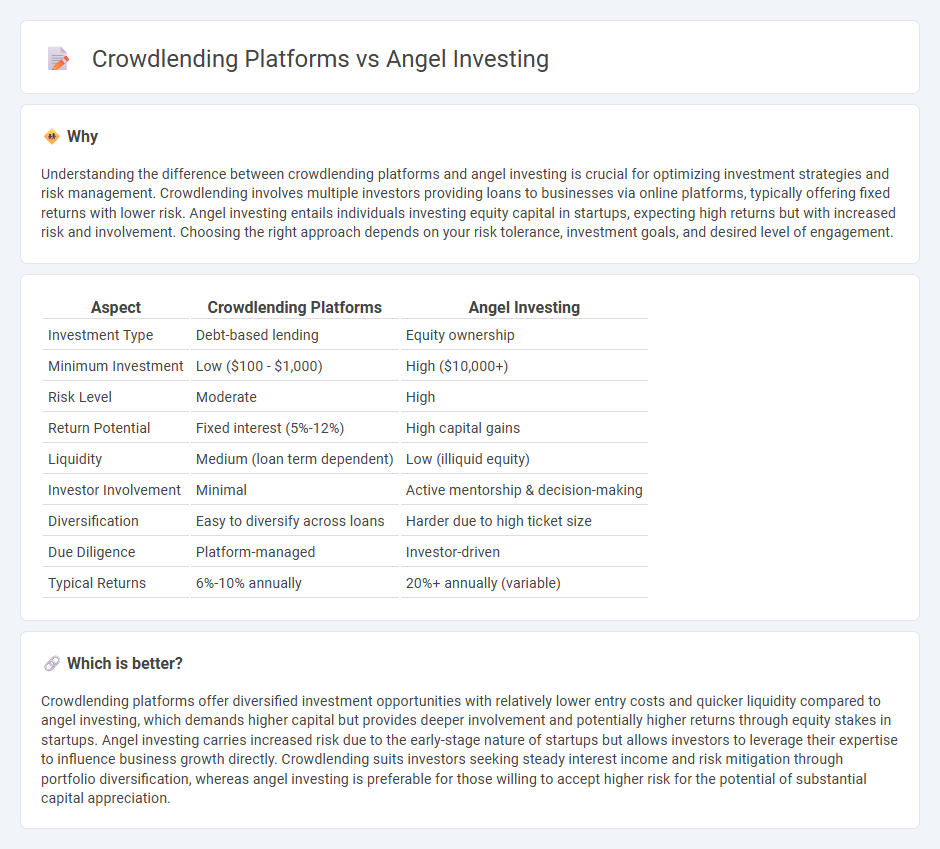

Understanding the difference between crowdlending platforms and angel investing is crucial for optimizing investment strategies and risk management. Crowdlending involves multiple investors providing loans to businesses via online platforms, typically offering fixed returns with lower risk. Angel investing entails individuals investing equity capital in startups, expecting high returns but with increased risk and involvement. Choosing the right approach depends on your risk tolerance, investment goals, and desired level of engagement.

Comparison Table

| Aspect | Crowdlending Platforms | Angel Investing |

|---|---|---|

| Investment Type | Debt-based lending | Equity ownership |

| Minimum Investment | Low ($100 - $1,000) | High ($10,000+) |

| Risk Level | Moderate | High |

| Return Potential | Fixed interest (5%-12%) | High capital gains |

| Liquidity | Medium (loan term dependent) | Low (illiquid equity) |

| Investor Involvement | Minimal | Active mentorship & decision-making |

| Diversification | Easy to diversify across loans | Harder due to high ticket size |

| Due Diligence | Platform-managed | Investor-driven |

| Typical Returns | 6%-10% annually | 20%+ annually (variable) |

Which is better?

Crowdlending platforms offer diversified investment opportunities with relatively lower entry costs and quicker liquidity compared to angel investing, which demands higher capital but provides deeper involvement and potentially higher returns through equity stakes in startups. Angel investing carries increased risk due to the early-stage nature of startups but allows investors to leverage their expertise to influence business growth directly. Crowdlending suits investors seeking steady interest income and risk mitigation through portfolio diversification, whereas angel investing is preferable for those willing to accept higher risk for the potential of substantial capital appreciation.

Connection

Crowdlending platforms and angel investing both provide alternative funding sources for startups, connecting individual investors with emerging businesses seeking capital. Crowdlending enables multiple investors to collectively fund projects through loans, while angel investors typically contribute equity and mentor entrepreneurs, enhancing business growth potential. The synergy between these methods broadens access to capital, increases investment diversification, and supports early-stage company development.

Key Terms

Equity

Angel investing offers equity stakes in startups, allowing investors to own a portion of the company and potentially benefit from its long-term growth and profits. Crowdlending platforms provide debt-based financing where investors receive fixed interest payments without equity ownership, reducing risk but limiting upside potential. Explore the key differences and advantages of equity-focused angel investing versus debt-driven crowdlending to make informed investment decisions.

Debt

Angel investing involves providing capital to startups in exchange for equity, while crowdlending platforms enable individuals to lend money to businesses or projects, generating returns through debt repayment. Debt-focused crowdlending offers predictable income streams and reduced risk compared to equity stakes, making it attractive for investors seeking steady returns without ownership dilution. Explore the detailed differences and benefits of these investment approaches to make informed financial decisions.

Risk

Angel investing involves higher risk due to direct equity stakes in startups, often resulting in illiquid investments with uncertain returns. Crowdlending platforms offer comparatively lower risk by providing debt-based funding with scheduled repayments, but they face risks like borrower default and platform insolvency. Explore detailed comparisons and risk mitigation strategies to make informed investment decisions.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investors are wealthy individuals who invest personal funds in startups in exchange for equity or convertible debt, often helping founders move from initial capital stages to professional financing rounds, while providing mentorship, networks, and strategic support to de-risk the business and prove the concept to later investors.

Angel Investors - The Hartford Insurance - Angel investors typically use their own net worth to fund promising small businesses beyond the startup phase, exchanging equity for capital and often providing patient, smaller investments with a desire for eventual exit strategies such as public offerings or acquisitions.

Angel investor - Wikipedia - Angel investing involves individual investors providing early-stage capital to startups, with data from the UK highlighting typical investment sizes, equity shares acquired, and return rates, while noting the growing role and impact of angel investments in technology sectors.

dowidth.com

dowidth.com