Litigation funding provides financial support to plaintiffs involved in legal disputes, enabling access to justice without upfront legal costs. Microfinance offers small loans and financial services to underserved populations, promoting economic development and entrepreneurship. Explore the key differences and benefits of litigation funding versus microfinance to enhance your investment strategy.

Why it is important

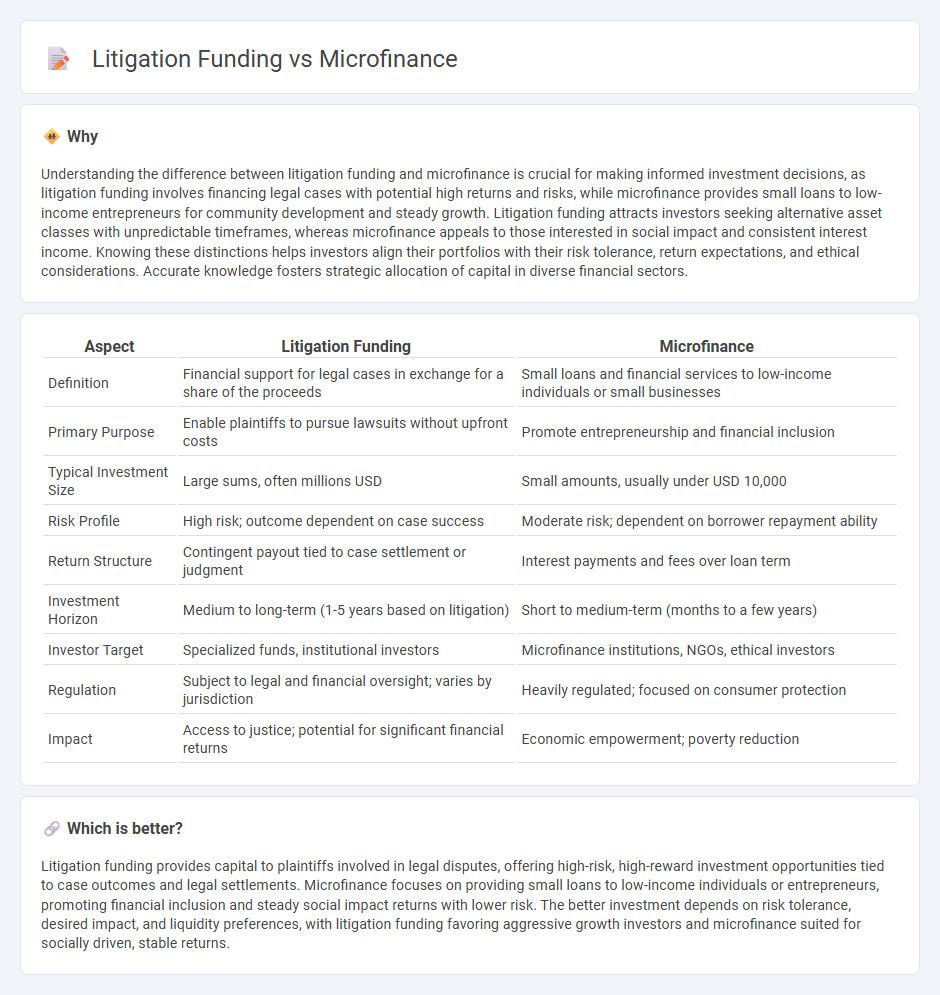

Understanding the difference between litigation funding and microfinance is crucial for making informed investment decisions, as litigation funding involves financing legal cases with potential high returns and risks, while microfinance provides small loans to low-income entrepreneurs for community development and steady growth. Litigation funding attracts investors seeking alternative asset classes with unpredictable timeframes, whereas microfinance appeals to those interested in social impact and consistent interest income. Knowing these distinctions helps investors align their portfolios with their risk tolerance, return expectations, and ethical considerations. Accurate knowledge fosters strategic allocation of capital in diverse financial sectors.

Comparison Table

| Aspect | Litigation Funding | Microfinance |

|---|---|---|

| Definition | Financial support for legal cases in exchange for a share of the proceeds | Small loans and financial services to low-income individuals or small businesses |

| Primary Purpose | Enable plaintiffs to pursue lawsuits without upfront costs | Promote entrepreneurship and financial inclusion |

| Typical Investment Size | Large sums, often millions USD | Small amounts, usually under USD 10,000 |

| Risk Profile | High risk; outcome dependent on case success | Moderate risk; dependent on borrower repayment ability |

| Return Structure | Contingent payout tied to case settlement or judgment | Interest payments and fees over loan term |

| Investment Horizon | Medium to long-term (1-5 years based on litigation) | Short to medium-term (months to a few years) |

| Investor Target | Specialized funds, institutional investors | Microfinance institutions, NGOs, ethical investors |

| Regulation | Subject to legal and financial oversight; varies by jurisdiction | Heavily regulated; focused on consumer protection |

| Impact | Access to justice; potential for significant financial returns | Economic empowerment; poverty reduction |

Which is better?

Litigation funding provides capital to plaintiffs involved in legal disputes, offering high-risk, high-reward investment opportunities tied to case outcomes and legal settlements. Microfinance focuses on providing small loans to low-income individuals or entrepreneurs, promoting financial inclusion and steady social impact returns with lower risk. The better investment depends on risk tolerance, desired impact, and liquidity preferences, with litigation funding favoring aggressive growth investors and microfinance suited for socially driven, stable returns.

Connection

Litigation funding and microfinance intersect through their shared goal of democratizing access to capital and financial resources. Both provide alternative funding solutions--litigation funding offers financial support for legal cases, while microfinance extends small loans to underserved populations. This connection empowers individuals and small enterprises to pursue justice and economic growth without reliance on traditional financial institutions.

Key Terms

Loan Portfolio (Microfinance)

Microfinance loan portfolios consist of small, high-volume loans typically extended to low-income individuals or small businesses, emphasizing risk diversification and social impact. These portfolios rely on rigorous credit assessment and repayment tracking to ensure sustainability and financial inclusion. Explore how microfinance loan portfolio strategies compare to litigation funding for deeper insights.

Case Merit Assessment (Litigation Funding)

Case merit assessment in litigation funding involves a thorough evaluation of the legal strengths, potential risks, and financial viability of pursuing a claim before funding is approved, ensuring that only meritorious cases receive support. Microfinance, in contrast, primarily provides small loans to individuals or businesses without detailed legal scrutiny, focusing on financial inclusion rather than legal case evaluation. Discover more about how case merit assessment shapes the efficacy of litigation funding.

Risk/Return Profile

Microfinance investments typically offer moderate returns with lower risk as they fund small-scale entrepreneurs and underserved markets, promoting financial inclusion and steady cash flows. Litigation funding entails higher risk due to the uncertainty and long duration of legal cases but can yield substantial returns if the lawsuit is successful. Explore further to understand how these distinct risk/return profiles impact investment strategies.

Source and External Links

Microfinance - Definition, Benefits, Drawbacks, Models - Microfinance provides financial services such as small loans, savings, and insurance to individuals lacking access to traditional banking, aiming to support entrepreneurs in impoverished areas to become self-sustainable and promote economic development.

Microfinance 101: All you need to know - Kiva - Microfinance includes a suite of financial services to the "unbanked" population worldwide, overcoming barriers like lack of ID, collateral, or access to banks, to help people gain financial stability and grow businesses.

Microfinancing Basics - My Own Business Institute - Microfinance delivers small loans and increasingly, savings and insurance to entrepreneurs excluded from mainstream finance, emphasizing careful loan eligibility, repayment, and choosing appropriate microlenders.

dowidth.com

dowidth.com