Virtual land real estate represents a burgeoning digital asset class within the metaverse, offering investors opportunities for speculative growth and virtual development. Infrastructure investment, by contrast, focuses on physical systems like transportation, utilities, and communication networks that provide stable, long-term returns through essential services. Explore deeper insights to understand how these distinct investment avenues can diversify and strengthen your portfolio.

Why it is important

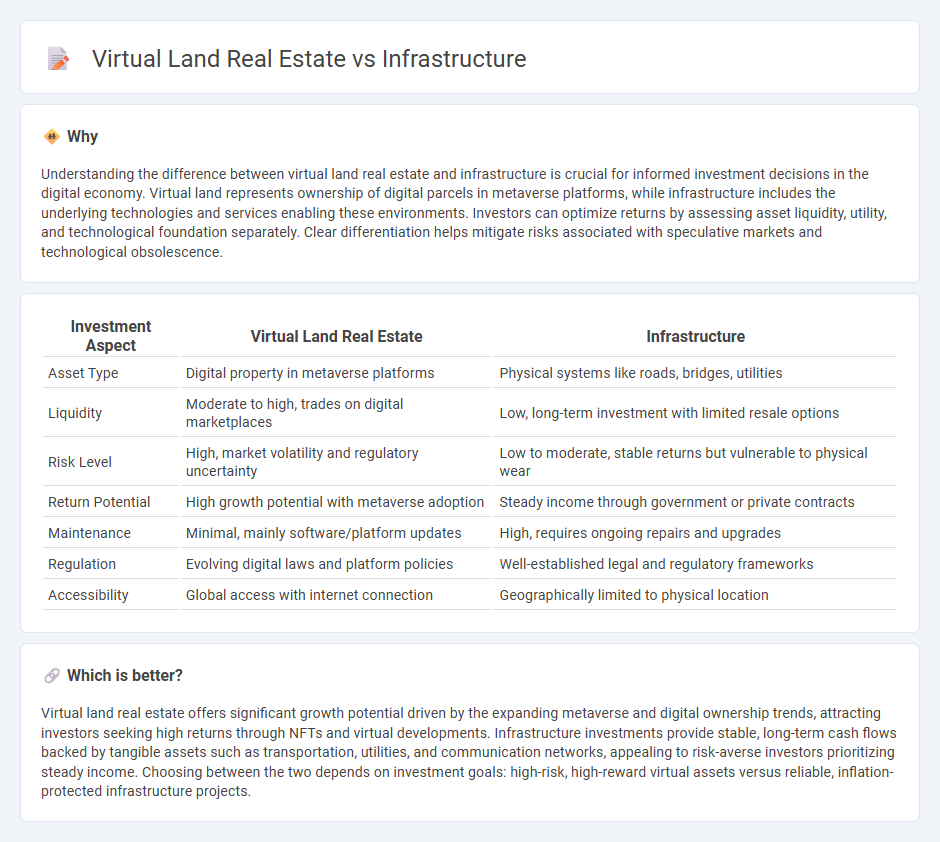

Understanding the difference between virtual land real estate and infrastructure is crucial for informed investment decisions in the digital economy. Virtual land represents ownership of digital parcels in metaverse platforms, while infrastructure includes the underlying technologies and services enabling these environments. Investors can optimize returns by assessing asset liquidity, utility, and technological foundation separately. Clear differentiation helps mitigate risks associated with speculative markets and technological obsolescence.

Comparison Table

| Investment Aspect | Virtual Land Real Estate | Infrastructure |

|---|---|---|

| Asset Type | Digital property in metaverse platforms | Physical systems like roads, bridges, utilities |

| Liquidity | Moderate to high, trades on digital marketplaces | Low, long-term investment with limited resale options |

| Risk Level | High, market volatility and regulatory uncertainty | Low to moderate, stable returns but vulnerable to physical wear |

| Return Potential | High growth potential with metaverse adoption | Steady income through government or private contracts |

| Maintenance | Minimal, mainly software/platform updates | High, requires ongoing repairs and upgrades |

| Regulation | Evolving digital laws and platform policies | Well-established legal and regulatory frameworks |

| Accessibility | Global access with internet connection | Geographically limited to physical location |

Which is better?

Virtual land real estate offers significant growth potential driven by the expanding metaverse and digital ownership trends, attracting investors seeking high returns through NFTs and virtual developments. Infrastructure investments provide stable, long-term cash flows backed by tangible assets such as transportation, utilities, and communication networks, appealing to risk-averse investors prioritizing steady income. Choosing between the two depends on investment goals: high-risk, high-reward virtual assets versus reliable, inflation-protected infrastructure projects.

Connection

Virtual land real estate represents digital parcels within metaverse platforms, serving as foundational assets for infrastructure development such as data centers, virtual offices, and entertainment venues. Investment in virtual land facilitates the creation and expansion of interconnected digital infrastructure, enhancing user experiences and enabling new economic opportunities. This synergy drives value appreciation in virtual land markets by integrating technological advancements with immersive virtual environments.

Key Terms

Tangible Assets

Tangible assets in infrastructure real estate include physical properties like roads, bridges, and buildings that provide long-term value and utility, contrasted with virtual land in metaverse platforms which lacks physical presence yet holds digital ownership and speculative investment potential. Infrastructure real estate offers measurable asset value backed by physical resources, whereas virtual land's value depends on user engagement and platform growth in the digital ecosystem. Explore more about the differences and investment opportunities in tangible versus virtual real estate assets.

Digital Ownership

Digital ownership of virtual land real estate involves acquiring rights to unique, blockchain-verified plots within metaverse platforms, contrasting with physical infrastructure that requires tangible assets and maintenance. Virtual land offers decentralized control, scarcity verified through NFTs, and potential revenue streams via digital developments or leasing. Explore how digital ownership transforms real estate investment and asset management in emerging virtual economies.

Capital Expenditure

Capital expenditure in infrastructure involves significant investment in physical assets such as roads, buildings, and utilities, requiring long-term funding and maintenance. Virtual land real estate capital expenditure focuses on acquiring and developing digital plots in metaverse platforms, which typically entails lower upfront costs but depends heavily on platform value and user engagement. Explore deeper insights into the financial implications and strategic choices between these two forms of real estate investment.

Source and External Links

Infrastructure - Wikipedia - Infrastructure consists of public and private physical structures like roads, bridges, airports, water supply systems, and more, funded through government spending, private investment, and international aid with varying shares globally and challenges in maintenance and upgrading due to underinvestment.

Infrastructure Investment and Jobs Act - A 2021 U.S. law allocating funding for diverse infrastructure projects including transportation, broadband, water systems, electric vehicle charging, and environmental cleanup to improve and modernize national infrastructure.

Infrastructure | FEMA.gov - Defines public infrastructure in the U.S. to include roads, bridges, transit, ports, railroads, airports, water and electrical systems, utilities, broadband, and energy facilities including EV charging stations.

dowidth.com

dowidth.com