Hedge fund replication offers investors a cost-effective strategy to mimic hedge fund returns by using systematic models and liquid assets, reducing fees and enhancing transparency compared to traditional hedge funds. Direct indexing allows investors to customize portfolios by directly owning individual securities, enabling tax-loss harvesting and personalized exposure to specific market segments. Explore the advantages and differences between hedge fund replication and direct indexing to optimize your investment strategy.

Why it is important

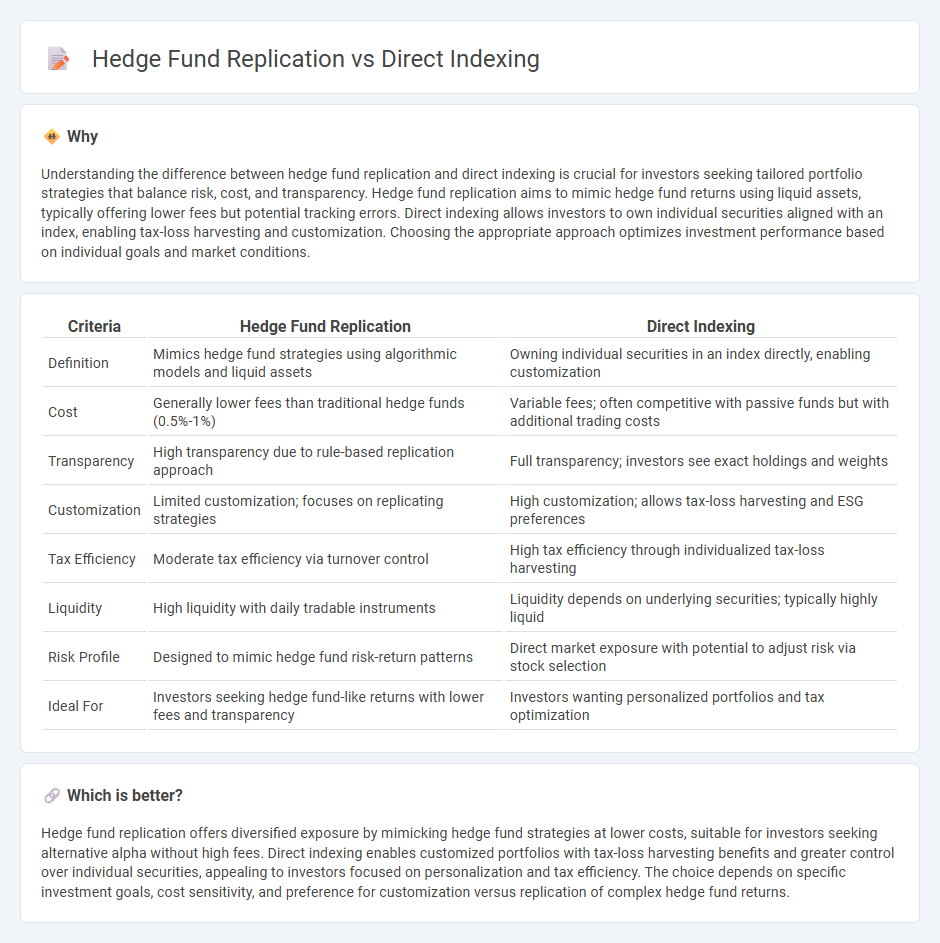

Understanding the difference between hedge fund replication and direct indexing is crucial for investors seeking tailored portfolio strategies that balance risk, cost, and transparency. Hedge fund replication aims to mimic hedge fund returns using liquid assets, typically offering lower fees but potential tracking errors. Direct indexing allows investors to own individual securities aligned with an index, enabling tax-loss harvesting and customization. Choosing the appropriate approach optimizes investment performance based on individual goals and market conditions.

Comparison Table

| Criteria | Hedge Fund Replication | Direct Indexing |

|---|---|---|

| Definition | Mimics hedge fund strategies using algorithmic models and liquid assets | Owning individual securities in an index directly, enabling customization |

| Cost | Generally lower fees than traditional hedge funds (0.5%-1%) | Variable fees; often competitive with passive funds but with additional trading costs |

| Transparency | High transparency due to rule-based replication approach | Full transparency; investors see exact holdings and weights |

| Customization | Limited customization; focuses on replicating strategies | High customization; allows tax-loss harvesting and ESG preferences |

| Tax Efficiency | Moderate tax efficiency via turnover control | High tax efficiency through individualized tax-loss harvesting |

| Liquidity | High liquidity with daily tradable instruments | Liquidity depends on underlying securities; typically highly liquid |

| Risk Profile | Designed to mimic hedge fund risk-return patterns | Direct market exposure with potential to adjust risk via stock selection |

| Ideal For | Investors seeking hedge fund-like returns with lower fees and transparency | Investors wanting personalized portfolios and tax optimization |

Which is better?

Hedge fund replication offers diversified exposure by mimicking hedge fund strategies at lower costs, suitable for investors seeking alternative alpha without high fees. Direct indexing enables customized portfolios with tax-loss harvesting benefits and greater control over individual securities, appealing to investors focused on personalization and tax efficiency. The choice depends on specific investment goals, cost sensitivity, and preference for customization versus replication of complex hedge fund returns.

Connection

Hedge fund replication and direct indexing both aim to enhance investment strategies by improving diversification and risk management while reducing costs. Hedge fund replication uses advanced quantitative models to mimic hedge fund returns through liquid assets, often leveraging direct indexing techniques to construct customized, tax-efficient portfolios. Direct indexing complements replication by allowing investors to hold individual securities aligned with specific investment factors, thereby capturing hedge fund-like exposures in a transparent, scalable manner.

Key Terms

Customization

Direct indexing allows investors to tailor portfolios by selecting individual securities that align with specific values, tax strategies, and risk preferences, offering unmatched customization. Hedge fund replication, by contrast, seeks to mimic fund returns through quantitative models but lacks the granular control over asset choice and tax efficiency. Explore how customization in direct indexing can enhance portfolio management strategies.

Factor Exposure

Direct indexing offers precise control over factor exposures by allowing investors to tailor portfolios to specific risk factors such as value, momentum, or quality, unlike hedge fund replication which relies on statistical models that may not capture all nuances. Hedge fund replication strategies often use factor-based ETFs or futures to mimic hedge fund returns but can struggle with timing and dynamic adjustments to changing market conditions. Explore more about optimizing factor exposures and improving investment outcomes with tailored strategies.

Tracking Error

Direct indexing offers lower tracking error by enabling personalized portfolio construction aligned with specific investor objectives and tax considerations, whereas hedge fund replication typically exhibits higher tracking error due to reliance on factor-based models and synthetic strategies. Tracking error in direct indexing often stays within 1-2%, enhancing precision in mirroring benchmark returns, compared to hedge fund replication strategies that can exceed 3-5% tracking error because of model limitations and asset liquidity constraints. Explore how tracking error nuances impact portfolio performance and risk management for deeper insights.

Source and External Links

Direct Indexing: What It Is and Its Benefits | Morgan Stanley - Direct indexing involves owning the individual stocks of an index directly in a taxable account, allowing for customizations and potential tax advantages over traditional mutual funds or ETFs.

What Is Direct Indexing? - Parametric Portfolio Associates - Direct indexing lets investors own individual securities directly in a separately managed account, enabling portfolio customization such as socially responsible exclusions and tax loss harvesting.

UNLEASHING THE POWER OF DIRECT INDEXING | Russell Investments - Direct indexing differs from ETFs or mutual funds by giving investors direct ownership and ability to create customized portfolios that may deviate from the index, fitting complex or specific investment goals.

dowidth.com

dowidth.com