Sports memorabilia trading offers unique investment opportunities through rare collectibles like autographed jerseys and vintage cards, often appealing to passionate niche markets. Precious metals investing provides stability and inflation hedging by leveraging assets such as gold, silver, and platinum known for their enduring value and liquidity. Explore the advantages and risks of both to determine which aligns best with your financial goals.

Why it is important

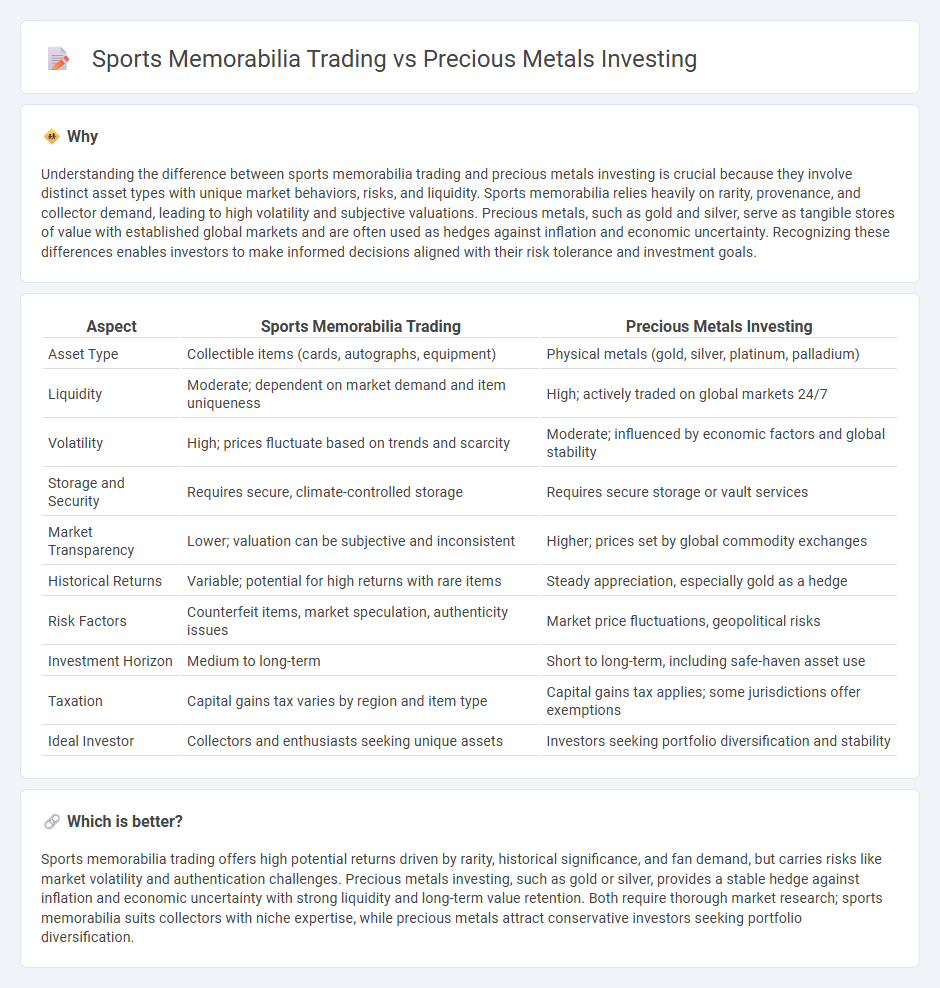

Understanding the difference between sports memorabilia trading and precious metals investing is crucial because they involve distinct asset types with unique market behaviors, risks, and liquidity. Sports memorabilia relies heavily on rarity, provenance, and collector demand, leading to high volatility and subjective valuations. Precious metals, such as gold and silver, serve as tangible stores of value with established global markets and are often used as hedges against inflation and economic uncertainty. Recognizing these differences enables investors to make informed decisions aligned with their risk tolerance and investment goals.

Comparison Table

| Aspect | Sports Memorabilia Trading | Precious Metals Investing |

|---|---|---|

| Asset Type | Collectible items (cards, autographs, equipment) | Physical metals (gold, silver, platinum, palladium) |

| Liquidity | Moderate; dependent on market demand and item uniqueness | High; actively traded on global markets 24/7 |

| Volatility | High; prices fluctuate based on trends and scarcity | Moderate; influenced by economic factors and global stability |

| Storage and Security | Requires secure, climate-controlled storage | Requires secure storage or vault services |

| Market Transparency | Lower; valuation can be subjective and inconsistent | Higher; prices set by global commodity exchanges |

| Historical Returns | Variable; potential for high returns with rare items | Steady appreciation, especially gold as a hedge |

| Risk Factors | Counterfeit items, market speculation, authenticity issues | Market price fluctuations, geopolitical risks |

| Investment Horizon | Medium to long-term | Short to long-term, including safe-haven asset use |

| Taxation | Capital gains tax varies by region and item type | Capital gains tax applies; some jurisdictions offer exemptions |

| Ideal Investor | Collectors and enthusiasts seeking unique assets | Investors seeking portfolio diversification and stability |

Which is better?

Sports memorabilia trading offers high potential returns driven by rarity, historical significance, and fan demand, but carries risks like market volatility and authentication challenges. Precious metals investing, such as gold or silver, provides a stable hedge against inflation and economic uncertainty with strong liquidity and long-term value retention. Both require thorough market research; sports memorabilia suits collectors with niche expertise, while precious metals attract conservative investors seeking portfolio diversification.

Connection

Sports memorabilia trading and precious metals investing are connected through their shared appeal as alternative investment assets that can diversify traditional portfolios and hedge against market volatility. Both markets rely on rarity, authenticity, and historical significance to drive value appreciation over time, attracting collectors and investors who seek tangible assets with intrinsic and emotional worth. The liquidity and market demand for verified sports collectibles and precious metals like gold and silver offer unique opportunities for capital preservation and potential growth in uncertain economic climates.

Key Terms

**Precious metals investing:**

Precious metals investing involves acquiring assets like gold, silver, platinum, and palladium, which serve as hedges against inflation and economic uncertainty due to their intrinsic value and market liquidity. These metals are traded on global exchanges such as COMEX and LBMA, offering investors portfolio diversification and long-term wealth preservation. Explore the benefits and strategies of precious metals investing to enhance your financial portfolio.

Bullion

Bullion investing offers a stable, tangible asset class with intrinsic value tied to precious metals like gold, silver, platinum, and palladium, often serving as a hedge against inflation and economic uncertainty. Sports memorabilia trading, while potentially lucrative, is subject to market volatility and fluctuating demand influenced by athlete popularity and event significance. Explore detailed comparisons and strategies to optimize your investment portfolio with bullion.

Spot price

Spot prices of precious metals like gold and silver provide real-time market value, making them a transparent benchmark for investors. Sports memorabilia trading often lacks such standardized pricing, leading to greater variability and subjectivity in valuations. Explore the nuances of spot pricing to enhance your investment strategy.

Source and External Links

Investing in Precious Metals: A Guide for Beginners - Money - Investing in precious metals can be done via physical bullion (coins, bars), mining company stocks, or mutual funds, with each option offering different exposure and risks.

Seven things to consider when investing in precious metals - TD Bank - Precious metals diversify portfolios and can be invested in through ETFs, exchange-traded receipts, certificates, or shares of mining companies, each having distinct management fees and risks.

Gold, Silver, Platinum, and Palladium Trading - Fidelity Investments - Fidelity offers physical precious metals, mutual funds, and ETFs for investment, noting the market's volatility and the importance of these metals as a hedge against inflation and economic uncertainty.

dowidth.com

dowidth.com