Investing in collectible sneakers offers tangible assets with potential value appreciation driven by rarity, brand collaboration, and cultural trends, while intellectual property investment provides long-term revenue through licensing, royalties, and exclusive rights in technology, art, or patents. Collectible sneakers thrive on market demand and physical uniqueness, whereas intellectual property capitalizes on innovation and legal protections to generate passive income streams. Explore the distinct advantages and risks of each investment type to optimize your portfolio strategy.

Why it is important

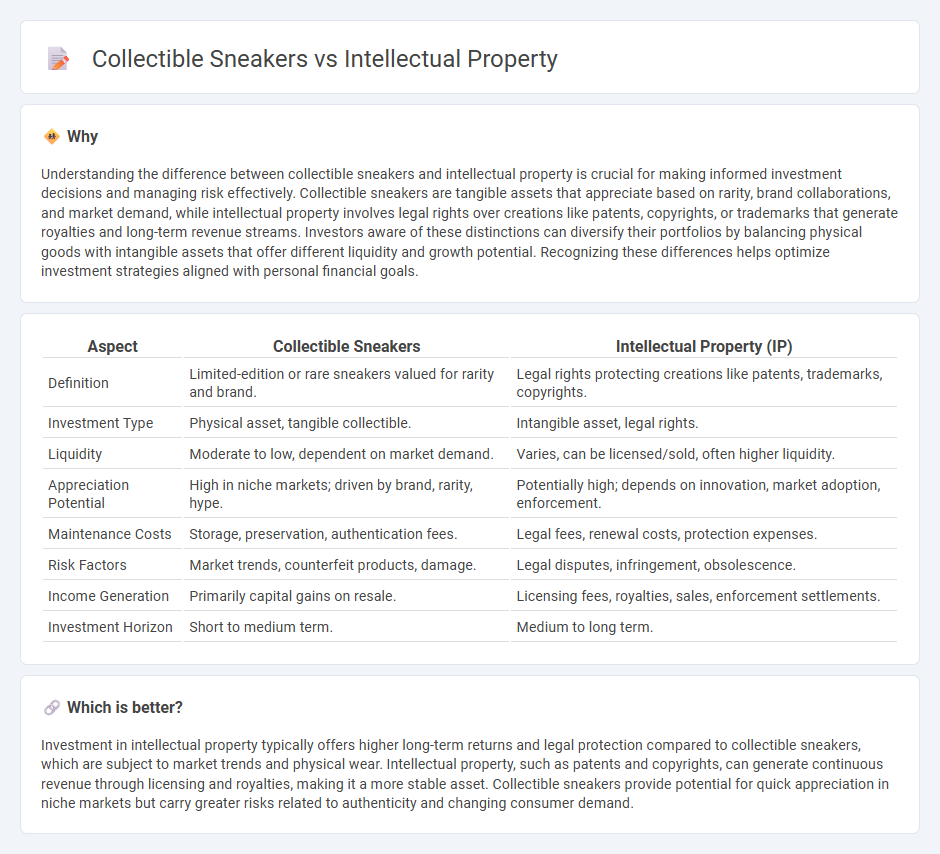

Understanding the difference between collectible sneakers and intellectual property is crucial for making informed investment decisions and managing risk effectively. Collectible sneakers are tangible assets that appreciate based on rarity, brand collaborations, and market demand, while intellectual property involves legal rights over creations like patents, copyrights, or trademarks that generate royalties and long-term revenue streams. Investors aware of these distinctions can diversify their portfolios by balancing physical goods with intangible assets that offer different liquidity and growth potential. Recognizing these differences helps optimize investment strategies aligned with personal financial goals.

Comparison Table

| Aspect | Collectible Sneakers | Intellectual Property (IP) |

|---|---|---|

| Definition | Limited-edition or rare sneakers valued for rarity and brand. | Legal rights protecting creations like patents, trademarks, copyrights. |

| Investment Type | Physical asset, tangible collectible. | Intangible asset, legal rights. |

| Liquidity | Moderate to low, dependent on market demand. | Varies, can be licensed/sold, often higher liquidity. |

| Appreciation Potential | High in niche markets; driven by brand, rarity, hype. | Potentially high; depends on innovation, market adoption, enforcement. |

| Maintenance Costs | Storage, preservation, authentication fees. | Legal fees, renewal costs, protection expenses. |

| Risk Factors | Market trends, counterfeit products, damage. | Legal disputes, infringement, obsolescence. |

| Income Generation | Primarily capital gains on resale. | Licensing fees, royalties, sales, enforcement settlements. |

| Investment Horizon | Short to medium term. | Medium to long term. |

Which is better?

Investment in intellectual property typically offers higher long-term returns and legal protection compared to collectible sneakers, which are subject to market trends and physical wear. Intellectual property, such as patents and copyrights, can generate continuous revenue through licensing and royalties, making it a more stable asset. Collectible sneakers provide potential for quick appreciation in niche markets but carry greater risks related to authenticity and changing consumer demand.

Connection

Collectible sneakers create significant investment value through their unique design trademarks, limited editions, and branding rights, which are protected under intellectual property laws. Intellectual property rights like trademarks and copyrights ensure exclusivity and authenticity, driving demand and market prices within the sneaker resale ecosystem. Investors leverage these protections to capitalize on the rarity and cultural significance of collectible sneakers, enhancing long-term portfolio diversification.

Key Terms

**Intellectual Property:**

Intellectual property (IP) protects brand trademarks, design patents, and copyrights essential to the value and authenticity of collectible sneakers, ensuring legal rights against counterfeiting and unauthorized reproductions. IP rights enable sneaker brands to maintain exclusivity and control over their unique designs, which significantly influence market demand and resale value. Discover more about how intellectual property shapes the sneaker industry and safeguards innovation.

Patent

Patents protect technological innovations in collectible sneakers, such as unique sole designs or specialized materials, to prevent unauthorized replication and secure market exclusivity. Intellectual property laws also cover trademarks and copyrights linked to sneaker branding and artistic elements, but patents specifically safeguard functional aspects that offer competitive advantages. Explore further how patent strategies enhance value and innovation in the collectible sneaker industry.

Trademark

Trademark protection plays a critical role in distinguishing collectible sneaker brands and preventing unauthorized use of logos, names, or designs. Intellectual property rights help maintain brand value and consumer trust by legally safeguarding unique sneaker trademarks in the competitive footwear market. Explore how trademarks influence collectible sneakers and enhance brand exclusivity and authenticity.

Source and External Links

intellectual property | Wex | US Law | LII / Legal Information Institute - Intellectual property refers to products of original human thought such as inventions, designs, software, and artistic works, categorized mainly as patents, copyrights, trademarks, and trade secrets, and it is protected by a set of rights allowing owners to control and monetize their creations for a limited time.

Intellectual Property Law | Georgetown Law - Intellectual property law protects and enforces ownership rights over inventions, writings, music, designs, and business secrets through distinct legal regimes like copyright, trademark, patent, and trade secret laws to incentivize innovation and prevent unauthorized use.

What Is Intellectual Property? - LegalZoom - Intellectual property encompasses creative works of the mind including literary, artistic, and commercial inventions, protected through legal frameworks for patents, trademarks, copyrights, and trade secrets, administered by government bodies such as the USPTO and Copyright Office.

dowidth.com

dowidth.com