Whale watching shares are high-value investments in companies specializing in marine tourism experiences, offering stable growth driven by increasing eco-conscious traveler demand. Penny stocks represent low-priced shares of smaller, often volatile companies with high risk but the potential for rapid gains in emerging markets. Explore in-depth comparisons to identify which investment aligns with your financial goals and risk tolerance.

Why it is important

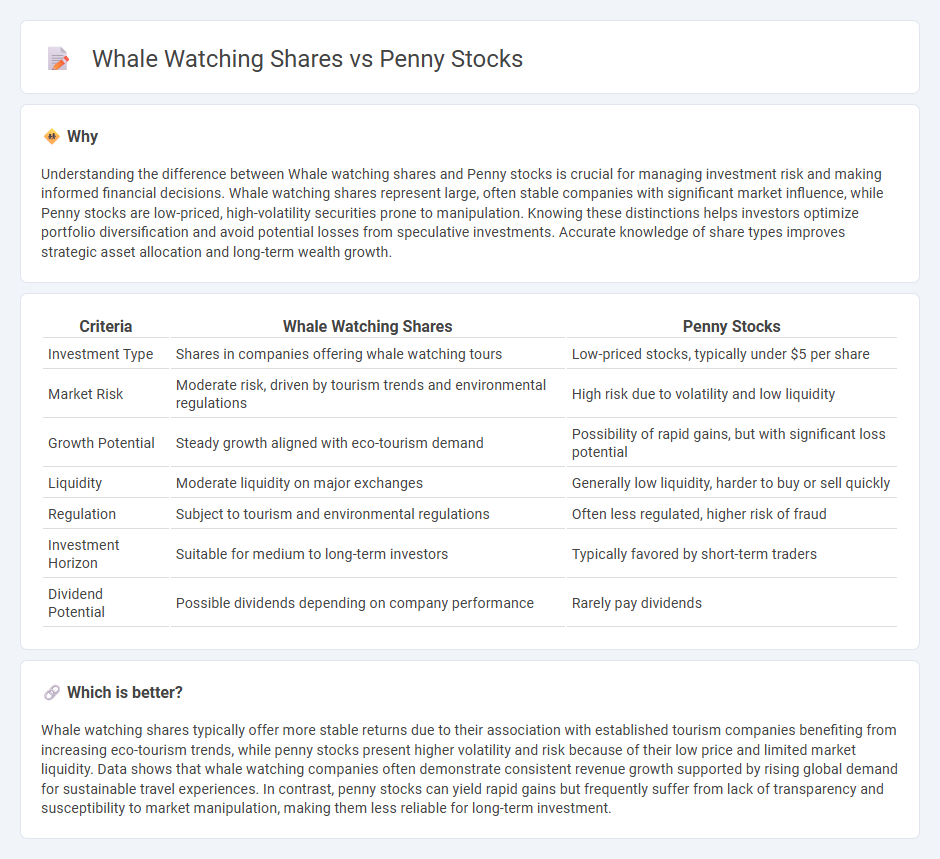

Understanding the difference between Whale watching shares and Penny stocks is crucial for managing investment risk and making informed financial decisions. Whale watching shares represent large, often stable companies with significant market influence, while Penny stocks are low-priced, high-volatility securities prone to manipulation. Knowing these distinctions helps investors optimize portfolio diversification and avoid potential losses from speculative investments. Accurate knowledge of share types improves strategic asset allocation and long-term wealth growth.

Comparison Table

| Criteria | Whale Watching Shares | Penny Stocks |

|---|---|---|

| Investment Type | Shares in companies offering whale watching tours | Low-priced stocks, typically under $5 per share |

| Market Risk | Moderate risk, driven by tourism trends and environmental regulations | High risk due to volatility and low liquidity |

| Growth Potential | Steady growth aligned with eco-tourism demand | Possibility of rapid gains, but with significant loss potential |

| Liquidity | Moderate liquidity on major exchanges | Generally low liquidity, harder to buy or sell quickly |

| Regulation | Subject to tourism and environmental regulations | Often less regulated, higher risk of fraud |

| Investment Horizon | Suitable for medium to long-term investors | Typically favored by short-term traders |

| Dividend Potential | Possible dividends depending on company performance | Rarely pay dividends |

Which is better?

Whale watching shares typically offer more stable returns due to their association with established tourism companies benefiting from increasing eco-tourism trends, while penny stocks present higher volatility and risk because of their low price and limited market liquidity. Data shows that whale watching companies often demonstrate consistent revenue growth supported by rising global demand for sustainable travel experiences. In contrast, penny stocks can yield rapid gains but frequently suffer from lack of transparency and susceptibility to market manipulation, making them less reliable for long-term investment.

Connection

Whale watching shares and penny stocks are connected by their appeal to niche investors seeking high-risk, high-reward opportunities in underexplored markets. Penny stocks, often undervalued small-cap shares, can include companies operating in specialized sectors like eco-tourism, where whale watching firms may be listed. Investing in these shares requires thorough research due to their volatility and the influence of market speculation on lesser-known industries.

Key Terms

Liquidity

Penny stocks typically exhibit low liquidity, resulting in wider bid-ask spreads and increased price volatility, while whale watching shares, often part of established tourism companies, generally offer higher liquidity with more stable trading volumes. Investors in penny stocks face greater challenges executing trades without impacting prices, contrasting with the relatively easier market entry and exit for whale watching shares. Explore detailed liquidity metrics and trading strategies to optimize your investment decisions in these distinct market segments.

Volatility

Penny stocks exhibit extreme volatility, often with rapid price swings exceeding 20% intraday, driven by low trading volumes and speculative interest. Whale watching shares typically experience more stable price movements due to niche market demand and limited supply, reducing abrupt fluctuations. Explore the dynamics of market volatility in these contrasting sectors to enhance your investment strategy.

Market Influence

Penny stocks often exhibit high volatility with low market capitalization, attracting speculative traders looking for rapid gains, while whale watching shares tend to be held by influential institutional investors whose transactions can sway market trends significantly. The disparity in market influence is evident as whale watching shares usually have substantial liquidity and broader market impact compared to the speculative nature of penny stocks. Explore the dynamics of penny stocks versus whale watching shares to understand their contrasting roles in market behavior.

Source and External Links

Penny stock - Wikipedia - Penny stocks are shares of small public companies trading for less than five dollars per share, often representing a high-risk investment category regulated by the U.S. SEC to prevent listing on major exchanges below $5.

Penny Stocks - Missouri Secretary of State - Penny stocks typically trade at or below $5 per share, often on OTC markets, and usually belong to companies with limited assets and operating history, marking them as speculative investments.

Hot Penny Stocks on The Move - Barchart.com - Penny stocks, often referred to as OTC stocks costing less than $5, carry extremely high risk but also the potential for high returns, requiring careful investor due diligence.

dowidth.com

dowidth.com