Social token investment offers a decentralized approach where investors gain access to community-driven projects and exclusive benefits, differing from equity investment that provides ownership stakes and voting rights in traditional companies. Social tokens leverage blockchain technology to enable real-time liquidity and direct engagement with creators, while equity investments typically involve regulated markets with fixed returns and legal protections. Explore deeper insights into how these investment models shape modern finance and personal wealth strategies.

Why it is important

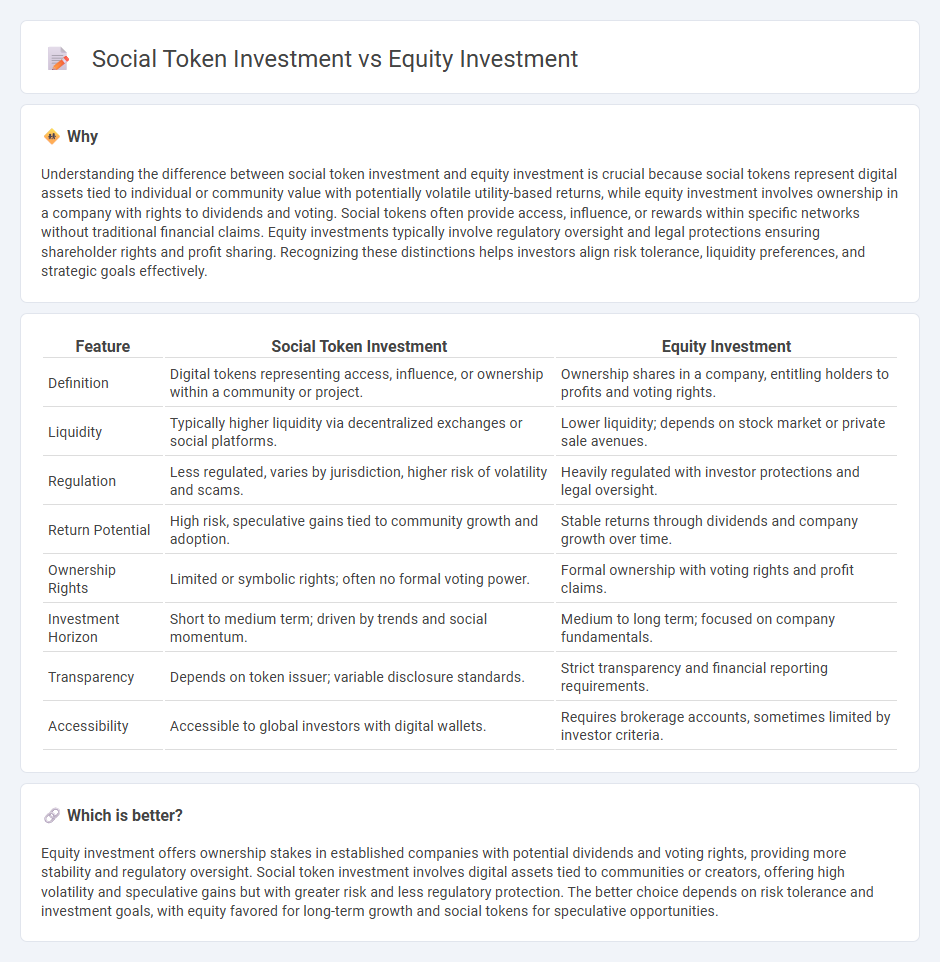

Understanding the difference between social token investment and equity investment is crucial because social tokens represent digital assets tied to individual or community value with potentially volatile utility-based returns, while equity investment involves ownership in a company with rights to dividends and voting. Social tokens often provide access, influence, or rewards within specific networks without traditional financial claims. Equity investments typically involve regulatory oversight and legal protections ensuring shareholder rights and profit sharing. Recognizing these distinctions helps investors align risk tolerance, liquidity preferences, and strategic goals effectively.

Comparison Table

| Feature | Social Token Investment | Equity Investment |

|---|---|---|

| Definition | Digital tokens representing access, influence, or ownership within a community or project. | Ownership shares in a company, entitling holders to profits and voting rights. |

| Liquidity | Typically higher liquidity via decentralized exchanges or social platforms. | Lower liquidity; depends on stock market or private sale avenues. |

| Regulation | Less regulated, varies by jurisdiction, higher risk of volatility and scams. | Heavily regulated with investor protections and legal oversight. |

| Return Potential | High risk, speculative gains tied to community growth and adoption. | Stable returns through dividends and company growth over time. |

| Ownership Rights | Limited or symbolic rights; often no formal voting power. | Formal ownership with voting rights and profit claims. |

| Investment Horizon | Short to medium term; driven by trends and social momentum. | Medium to long term; focused on company fundamentals. |

| Transparency | Depends on token issuer; variable disclosure standards. | Strict transparency and financial reporting requirements. |

| Accessibility | Accessible to global investors with digital wallets. | Requires brokerage accounts, sometimes limited by investor criteria. |

Which is better?

Equity investment offers ownership stakes in established companies with potential dividends and voting rights, providing more stability and regulatory oversight. Social token investment involves digital assets tied to communities or creators, offering high volatility and speculative gains but with greater risk and less regulatory protection. The better choice depends on risk tolerance and investment goals, with equity favored for long-term growth and social tokens for speculative opportunities.

Connection

Social token investment and equity investment intersect through their underlying value representation of ownership and influence within a community or business. Social tokens function as digital assets that confer voting rights or profit-sharing, similar to equity stakes that provide ownership and dividend entitlements in companies. Both investment types enable stakeholders to participate in decision-making processes and share in the growth and success of the issued entity.

Key Terms

Ownership (Equity vs. Access/Utility)

Equity investment grants shareholders partial ownership and voting rights in a company, representing a legal claim to assets and profits through stock shares. Social token investment, in contrast, offers access or utility within a community without granting traditional ownership, often providing benefits such as exclusive content or participation opportunities. Discover how these investment types differ in value and control to make informed decisions.

Dividends (Profit Sharing) vs. Community Incentives

Equity investment provides shareholders with dividends representing a share of company profits, creating a direct financial return based on corporate earnings. Social token investment, by contrast, offers community incentives such as access, influence, or rewards within a digital ecosystem but rarely guarantees traditional profit sharing. Explore the unique benefits and financial implications of both investment types to determine which aligns with your goals.

Regulatory Compliance vs. Decentralization

Equity investment involves purchasing company shares, subject to stringent regulatory compliance such as SEC rules and investor protections ensuring transparency and legal accountability. Social token investment, based on blockchain technology, emphasizes decentralization, enabling community-driven ownership and bypassing traditional regulatory frameworks while raising concerns about legal clarity and investor risk. Explore deeper insights into balancing regulatory challenges and decentralized innovation in these investment models.

Source and External Links

What is equity investment? (A guide to understanding it) - Equity investment means purchasing shares of a company to obtain ownership stakes, with potential returns coming from capital gains and dividends, offering benefits like liquidity, limited liability, participation in company decisions, and the ability to diversify investments.

What Are Equities or Equity Investments? - Equities are stocks representing ownership in companies, providing investors opportunities for dividends, growth potential, portfolio diversification, and easy market access.

Equity Investments | International Finance Corporation (IFC) - Equity investments involve providing long-term growth capital by purchasing 5-20% stakes in companies, typically to support private enterprises and develop capital markets.

dowidth.com

dowidth.com