Farmland funds invest in agricultural land and related assets, offering stable, inflation-resistant returns driven by global food demand and land scarcity. Hedge funds employ diverse strategies, including equities, derivatives, and leverage, aiming for high-risk, high-reward gains with extensive market exposure. Explore the differences in risk, return, and asset diversification to determine which fund suits your investment goals.

Why it is important

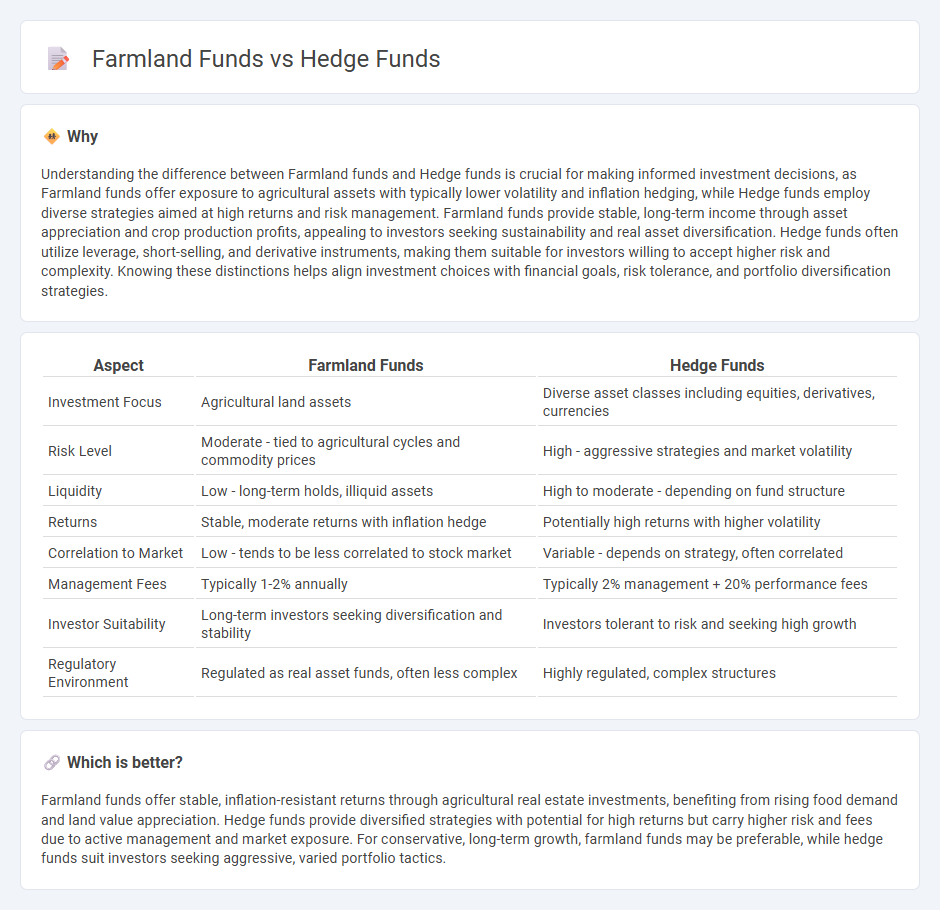

Understanding the difference between Farmland funds and Hedge funds is crucial for making informed investment decisions, as Farmland funds offer exposure to agricultural assets with typically lower volatility and inflation hedging, while Hedge funds employ diverse strategies aimed at high returns and risk management. Farmland funds provide stable, long-term income through asset appreciation and crop production profits, appealing to investors seeking sustainability and real asset diversification. Hedge funds often utilize leverage, short-selling, and derivative instruments, making them suitable for investors willing to accept higher risk and complexity. Knowing these distinctions helps align investment choices with financial goals, risk tolerance, and portfolio diversification strategies.

Comparison Table

| Aspect | Farmland Funds | Hedge Funds |

|---|---|---|

| Investment Focus | Agricultural land assets | Diverse asset classes including equities, derivatives, currencies |

| Risk Level | Moderate - tied to agricultural cycles and commodity prices | High - aggressive strategies and market volatility |

| Liquidity | Low - long-term holds, illiquid assets | High to moderate - depending on fund structure |

| Returns | Stable, moderate returns with inflation hedge | Potentially high returns with higher volatility |

| Correlation to Market | Low - tends to be less correlated to stock market | Variable - depends on strategy, often correlated |

| Management Fees | Typically 1-2% annually | Typically 2% management + 20% performance fees |

| Investor Suitability | Long-term investors seeking diversification and stability | Investors tolerant to risk and seeking high growth |

| Regulatory Environment | Regulated as real asset funds, often less complex | Highly regulated, complex structures |

Which is better?

Farmland funds offer stable, inflation-resistant returns through agricultural real estate investments, benefiting from rising food demand and land value appreciation. Hedge funds provide diversified strategies with potential for high returns but carry higher risk and fees due to active management and market exposure. For conservative, long-term growth, farmland funds may be preferable, while hedge funds suit investors seeking aggressive, varied portfolio tactics.

Connection

Farmland funds and hedge funds intersect through diversified investment strategies aimed at balancing risk and return. Hedge funds increasingly allocate capital to farmland funds due to farmland's potential for stable, inflation-resistant cash flows and asset appreciation. This connection enhances portfolio diversification by integrating real asset exposure within traditional hedge fund frameworks.

Key Terms

Leverage

Hedge funds typically employ high leverage to amplify returns, often using complex derivatives and borrowed capital, whereas farmland funds rely on modest leverage, prioritizing asset stability and long-term appreciation. Leverage ratios in hedge funds can exceed 5:1, contrasting with farmland funds that generally maintain leverage below 2:1 to mitigate risk exposure. Explore deeper insights on the impact of leverage in these fund strategies to optimize your investment decisions.

Diversification

Hedge funds offer broad diversification across asset classes, including equities, fixed income, derivatives, and commodities, aimed at reducing portfolio risk and enhancing returns. Farmland funds provide diversification through tangible real estate assets with inflation-hedging properties and consistent income from agricultural leases. Explore detailed comparisons to determine how these fund types can balance risk and growth in your investment portfolio.

Liquidity

Hedge funds typically offer higher liquidity with daily or quarterly redemption options, while farmland funds generally have longer lock-up periods due to the illiquid nature of agricultural assets. The limited secondary market for farmland investments makes them less accessible for investors needing quick asset liquidation. Explore more about how liquidity differences impact investment strategies in hedge funds versus farmland funds.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - A hedge fund is an investment firm that pools capital from institutional and accredited investors to pursue alternative strategies--such as short selling, derivatives, and event-driven investing--aiming for absolute returns rather than simply beating a market index.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment pools that use flexible and often high-risk strategies, are typically restricted to sophisticated investors, and are subject to fewer regulatory protections than mutual funds or ETFs.

Hedge fund - Wikipedia - Hedge funds employ complex trading and risk management techniques, charge both management and performance fees, and--despite their name--often take on significant risk with the potential to contribute to systemic financial instability due to leverage and interconnectedness with major banks.

dowidth.com

dowidth.com