Livestock investment platforms enable investors to fund animal farming projects, providing returns through livestock sales and agricultural profits. Peer-to-peer lending connects borrowers directly with individual lenders, offering fixed interest income and diversified credit risk exposure. Explore these distinct investment avenues to identify which strategy aligns best with your financial goals.

Why it is important

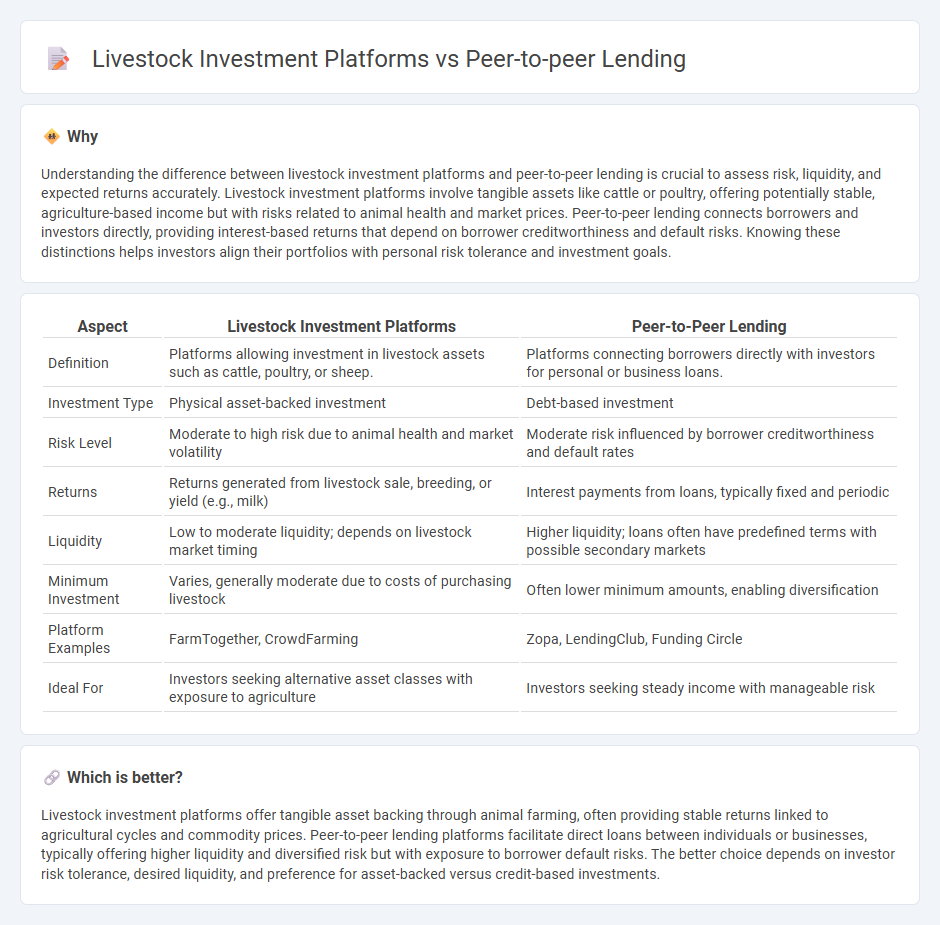

Understanding the difference between livestock investment platforms and peer-to-peer lending is crucial to assess risk, liquidity, and expected returns accurately. Livestock investment platforms involve tangible assets like cattle or poultry, offering potentially stable, agriculture-based income but with risks related to animal health and market prices. Peer-to-peer lending connects borrowers and investors directly, providing interest-based returns that depend on borrower creditworthiness and default risks. Knowing these distinctions helps investors align their portfolios with personal risk tolerance and investment goals.

Comparison Table

| Aspect | Livestock Investment Platforms | Peer-to-Peer Lending |

|---|---|---|

| Definition | Platforms allowing investment in livestock assets such as cattle, poultry, or sheep. | Platforms connecting borrowers directly with investors for personal or business loans. |

| Investment Type | Physical asset-backed investment | Debt-based investment |

| Risk Level | Moderate to high risk due to animal health and market volatility | Moderate risk influenced by borrower creditworthiness and default rates |

| Returns | Returns generated from livestock sale, breeding, or yield (e.g., milk) | Interest payments from loans, typically fixed and periodic |

| Liquidity | Low to moderate liquidity; depends on livestock market timing | Higher liquidity; loans often have predefined terms with possible secondary markets |

| Minimum Investment | Varies, generally moderate due to costs of purchasing livestock | Often lower minimum amounts, enabling diversification |

| Platform Examples | FarmTogether, CrowdFarming | Zopa, LendingClub, Funding Circle |

| Ideal For | Investors seeking alternative asset classes with exposure to agriculture | Investors seeking steady income with manageable risk |

Which is better?

Livestock investment platforms offer tangible asset backing through animal farming, often providing stable returns linked to agricultural cycles and commodity prices. Peer-to-peer lending platforms facilitate direct loans between individuals or businesses, typically offering higher liquidity and diversified risk but with exposure to borrower default risks. The better choice depends on investor risk tolerance, desired liquidity, and preference for asset-backed versus credit-based investments.

Connection

Livestock investment platforms and peer-to-peer lending are connected through their shared model of enabling investors to directly fund agricultural entrepreneurs or projects, reducing reliance on traditional financial institutions. Both platforms leverage technology to facilitate transparent transactions, risk assessment, and returns distribution, attracting investors seeking alternative, impact-driven investment opportunities. By combining asset-backed livestock projects with peer-to-peer lending mechanisms, these platforms maximize capital efficiency and foster community-driven rural development.

Key Terms

Risk assessment

Peer-to-peer lending platforms assess risk by evaluating borrower credit scores, repayment history, and loan purpose, utilizing algorithms and manual underwriting for default prediction. Livestock investment platforms measure risk through animal health monitoring, veterinary assessments, and market demand analysis, accounting for biological and environmental factors affecting livestock productivity. Explore detailed comparisons to understand which risk assessment method aligns with your investment goals.

Return on investment (ROI)

Peer-to-peer lending platforms typically offer average annual returns ranging from 5% to 12%, depending on borrower creditworthiness and platform fees. Livestock investment platforms present variable ROI influenced by factors like animal health, market demand, and operational costs, often yielding between 8% and 15% annually. Explore detailed analyses to determine which investment aligns best with your financial goals.

Platform regulation

Peer-to-peer lending platforms operate under stringent financial regulations such as the Securities and Exchange Commission (SEC) oversight in the U.S., ensuring investor protection and transparency. Livestock investment platforms often face less comprehensive regulation, with varying standards depending on the country, which can impact risk levels and legal safeguards for investors. Explore in-depth comparisons of regulatory frameworks between these investment options to make informed decisions.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work - Peer-to-peer (P2P) lending enables individuals to borrow and lend money directly through specialized websites without involving banks, offering borrowers easier eligibility and lenders potentially higher returns but with added risks.

Peer-to-peer lending - Wikipedia - P2P lending is an online practice matching lenders and borrowers without traditional financial intermediaries, involving unsecured or secured loans that can be traded, with platforms providing credit checks, payment processing, and servicing.

Peer to peer lending: what you need to know - P2P lending marketplaces connect lenders with borrowers, allowing lenders to earn interest, often at higher rates than savings accounts, though with increased risk, and loans can be diversified across multiple borrowers or selected individually.

dowidth.com

dowidth.com