Royalty streams provide investors with a percentage of revenue generated from intellectual property, offering steady cash flow without ownership dilution. Preferred stock grants shareholders priority dividend payments and asset claims but may carry less income predictability compared to royalty streams. Explore the advantages and risks of each investment to determine the best fit for your portfolio.

Why it is important

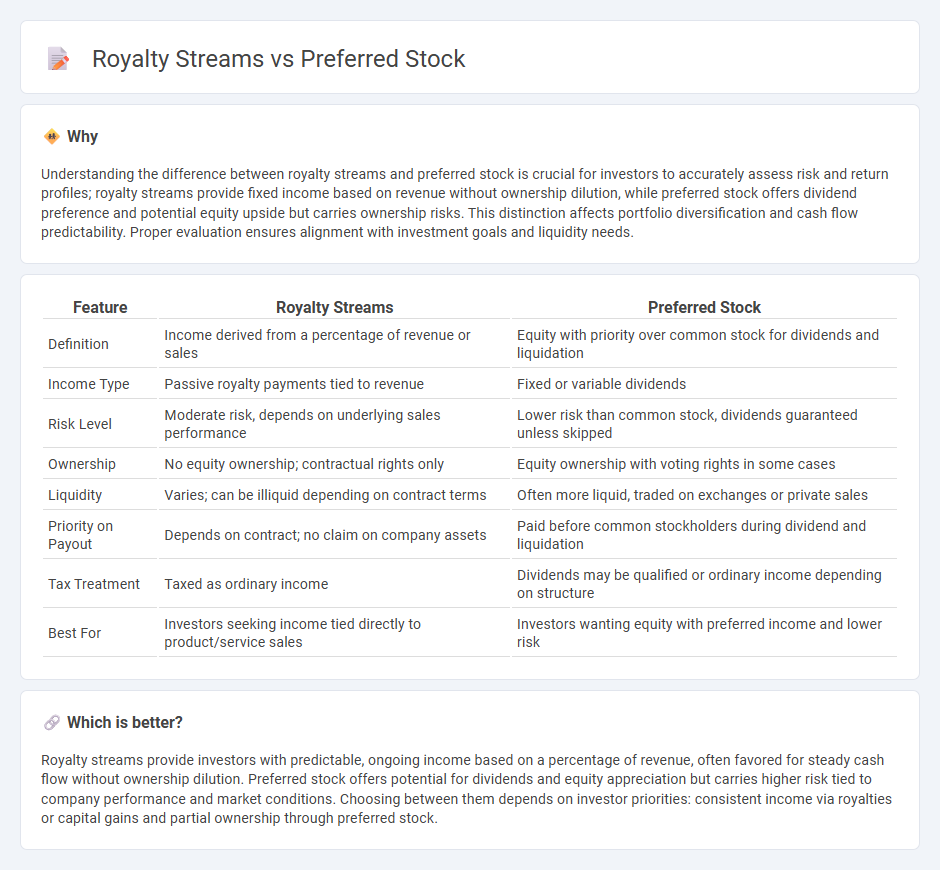

Understanding the difference between royalty streams and preferred stock is crucial for investors to accurately assess risk and return profiles; royalty streams provide fixed income based on revenue without ownership dilution, while preferred stock offers dividend preference and potential equity upside but carries ownership risks. This distinction affects portfolio diversification and cash flow predictability. Proper evaluation ensures alignment with investment goals and liquidity needs.

Comparison Table

| Feature | Royalty Streams | Preferred Stock |

|---|---|---|

| Definition | Income derived from a percentage of revenue or sales | Equity with priority over common stock for dividends and liquidation |

| Income Type | Passive royalty payments tied to revenue | Fixed or variable dividends |

| Risk Level | Moderate risk, depends on underlying sales performance | Lower risk than common stock, dividends guaranteed unless skipped |

| Ownership | No equity ownership; contractual rights only | Equity ownership with voting rights in some cases |

| Liquidity | Varies; can be illiquid depending on contract terms | Often more liquid, traded on exchanges or private sales |

| Priority on Payout | Depends on contract; no claim on company assets | Paid before common stockholders during dividend and liquidation |

| Tax Treatment | Taxed as ordinary income | Dividends may be qualified or ordinary income depending on structure |

| Best For | Investors seeking income tied directly to product/service sales | Investors wanting equity with preferred income and lower risk |

Which is better?

Royalty streams provide investors with predictable, ongoing income based on a percentage of revenue, often favored for steady cash flow without ownership dilution. Preferred stock offers potential for dividends and equity appreciation but carries higher risk tied to company performance and market conditions. Choosing between them depends on investor priorities: consistent income via royalties or capital gains and partial ownership through preferred stock.

Connection

Royalty streams and preferred stock are connected as both provide investors with steady income and risk mitigation in investment portfolios. Royalty streams generate consistent cash flow from intellectual property or natural resource rights, while preferred stock offers prioritized dividend payments and liquidation preferences over common stock. Combining these instruments enhances portfolio diversification by balancing income stability with potential equity appreciation.

Key Terms

Dividend

Preferred stock offers fixed dividend payments, providing investors with a predictable income stream often prioritized over common stock dividends. Royalty streams generate income based on a percentage of revenue or production, creating variable returns tied directly to the underlying asset's performance. Explore deeper insights into dividend structures and income stability by understanding the nuances between preferred stock dividends and royalty stream payments.

Ownership

Preferred stock grants investors ownership stakes with priority on dividends and asset claims, offering a blend of equity control and fixed-income benefits. Royalty streams provide investors with rights to a percentage of revenue without ownership or voting rights, ensuring predictable cash flow tied to the asset's performance. Explore the nuances of ownership structures and financial benefits to determine the best investment strategy.

Income Rights

Preferred stock offers investors fixed dividends and priority in income distribution over common stockholders, ensuring steady income rights. Royalty streams grant holders a percentage of revenue or profits from specific assets, often providing ongoing income tied directly to asset performance. Explore the nuances of income rights to determine which investment aligns best with your portfolio goals.

Source and External Links

What is Preferred Stock? | Preferred stock vs common stock | Fidelity - This webpage provides an overview of preferred stock, comparing it to common stock and bonds, highlighting its predictable income and lower volatility.

What is Preferred Stock? Understanding Types & Benefits - VanEck - This article explains the unique characteristics of preferred stock as a hybrid security, offering fixed dividends and priority over common stockholders in asset distribution.

Preferred Stock | Wex | US Law | LII / Legal Information Institute - This webpage outlines the legal and financial aspects of preferred stock, including its priority in dividend payments and the lack of voting rights for shareholders.

dowidth.com

dowidth.com