Collectible sneakers and rare coins both represent unique investment opportunities with distinct market dynamics and potential returns. Sneakers offer growth driven by trends, brand collaborations, and limited editions, while rare coins rely heavily on historical significance, rarity, and condition. Explore the key differences and benefits of investing in these alternative assets to diversify your portfolio effectively.

Why it is important

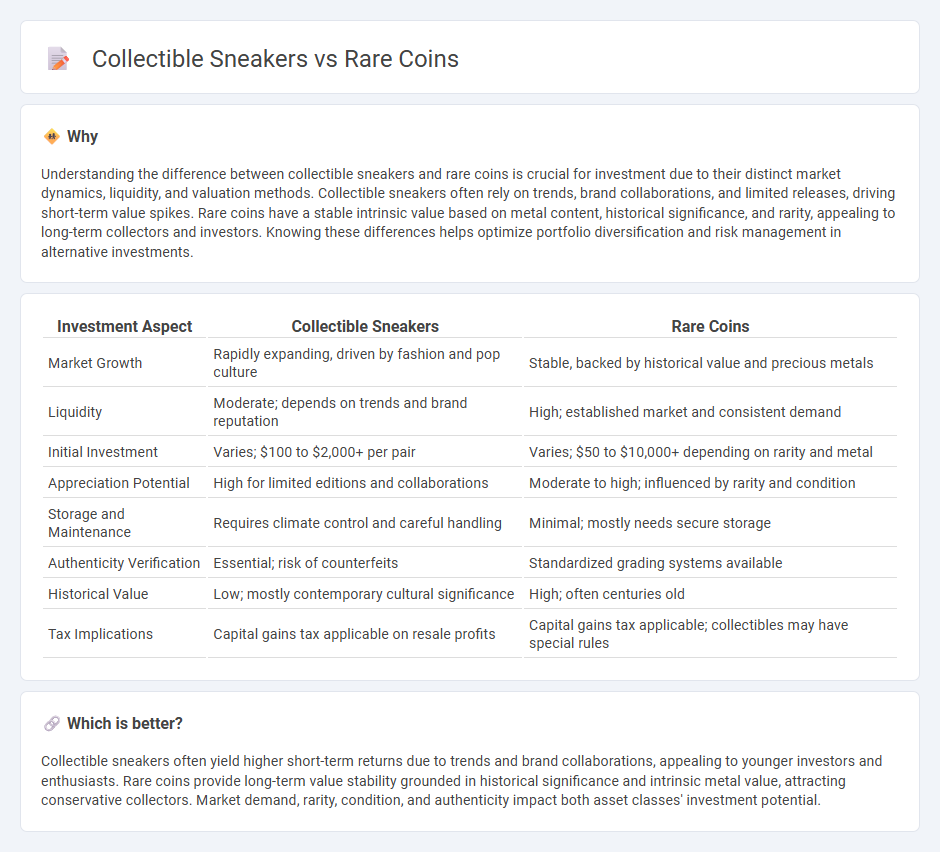

Understanding the difference between collectible sneakers and rare coins is crucial for investment due to their distinct market dynamics, liquidity, and valuation methods. Collectible sneakers often rely on trends, brand collaborations, and limited releases, driving short-term value spikes. Rare coins have a stable intrinsic value based on metal content, historical significance, and rarity, appealing to long-term collectors and investors. Knowing these differences helps optimize portfolio diversification and risk management in alternative investments.

Comparison Table

| Investment Aspect | Collectible Sneakers | Rare Coins |

|---|---|---|

| Market Growth | Rapidly expanding, driven by fashion and pop culture | Stable, backed by historical value and precious metals |

| Liquidity | Moderate; depends on trends and brand reputation | High; established market and consistent demand |

| Initial Investment | Varies; $100 to $2,000+ per pair | Varies; $50 to $10,000+ depending on rarity and metal |

| Appreciation Potential | High for limited editions and collaborations | Moderate to high; influenced by rarity and condition |

| Storage and Maintenance | Requires climate control and careful handling | Minimal; mostly needs secure storage |

| Authenticity Verification | Essential; risk of counterfeits | Standardized grading systems available |

| Historical Value | Low; mostly contemporary cultural significance | High; often centuries old |

| Tax Implications | Capital gains tax applicable on resale profits | Capital gains tax applicable; collectibles may have special rules |

Which is better?

Collectible sneakers often yield higher short-term returns due to trends and brand collaborations, appealing to younger investors and enthusiasts. Rare coins provide long-term value stability grounded in historical significance and intrinsic metal value, attracting conservative collectors. Market demand, rarity, condition, and authenticity impact both asset classes' investment potential.

Connection

Collectible sneakers and rare coins share a strong investment appeal due to their limited supply and high demand, which drives significant value appreciation over time. Both asset classes attract niche collectors and investors who leverage market trends, rarity, and condition to maximize returns. The growing interest in alternative investments highlights the role of these tangible assets in portfolio diversification and hedge against inflation.

Key Terms

Rarity

Rare coins derive their value primarily from limited minting numbers, historical significance, and unique physical characteristics, making scarcity a key factor in their market price. Collectible sneakers gain rarity through limited edition releases, brand collaborations, and cultural trends, often with production runs intentionally kept low to drive exclusivity. Explore deeper insights on how rarity shapes the demand and investment potential in both rare coins and collectible sneakers.

Authentication

Authentication of rare coins relies heavily on expert grading services such as PCGS and NGC, which assess factors like minting quality, condition, and rarity to certify genuineness and provenance. Collectible sneakers utilize advanced technologies including RFID tags, holograms, and blockchain verification, alongside professional authenticators from platforms like StockX and GOAT, to combat counterfeiting and ensure originality. Explore how evolving authentication methods safeguard investments in both rare coins and collectible sneakers.

Market demand

Rare coins maintain steady market demand driven by historical value, scarcity, and numismatic significance, attracting collectors and investors seeking tangible assets. Collectible sneakers experience fluctuating demand influenced by brand collaborations, limited editions, and cultural trends, often appealing to younger demographics and fashion enthusiasts. Explore how market demand shapes investment strategies in both rare coins and collectible sneakers for deeper insights.

Source and External Links

9 Of The World's Most Valuable Coins - Bankrate - This article lists extremely rare coins like the 1794 Flowing Hair Silver Dollar and the 1787 Brasher Doubloon, with some fetching over $10 million at auction.

Rare U.S. Coins | Most Valuable American Coins - APMEX - This page features rare U.S. coins such as the 1794 Flowing Hair Dollar, 1804 Draped Bust Dollar, and 1933 Double Eagle, highlighting their historical and numismatic value.

Rare Coins for Sale | Rare Gold & Silver Coins - Finest Known - Here, collectors can browse a curated selection of rare gold and silver coins, including world rarities and early American issues like the 1799 $10 Heraldic Eagle Draped Bust and 1820 Bust Dime.

dowidth.com

dowidth.com