Whisky cask investment offers unique advantages such as aging value appreciation, low maintenance costs, and a growing global market driven by increasing demand for rare spirits. Classic car investment features tangible assets with historical significance, potential for high appreciation, and passion-driven collector communities, but requires regular upkeep and storage. Explore the comparative benefits and risks of whisky cask versus classic car investment to make an informed financial decision.

Why it is important

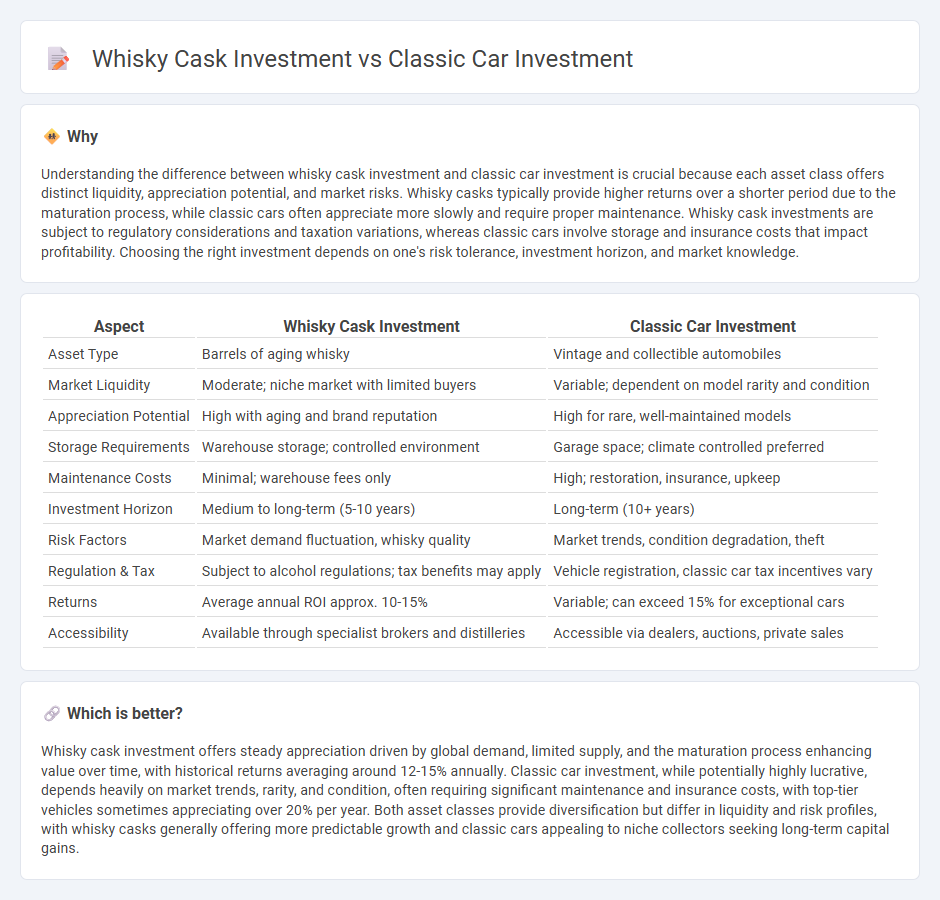

Understanding the difference between whisky cask investment and classic car investment is crucial because each asset class offers distinct liquidity, appreciation potential, and market risks. Whisky casks typically provide higher returns over a shorter period due to the maturation process, while classic cars often appreciate more slowly and require proper maintenance. Whisky cask investments are subject to regulatory considerations and taxation variations, whereas classic cars involve storage and insurance costs that impact profitability. Choosing the right investment depends on one's risk tolerance, investment horizon, and market knowledge.

Comparison Table

| Aspect | Whisky Cask Investment | Classic Car Investment |

|---|---|---|

| Asset Type | Barrels of aging whisky | Vintage and collectible automobiles |

| Market Liquidity | Moderate; niche market with limited buyers | Variable; dependent on model rarity and condition |

| Appreciation Potential | High with aging and brand reputation | High for rare, well-maintained models |

| Storage Requirements | Warehouse storage; controlled environment | Garage space; climate controlled preferred |

| Maintenance Costs | Minimal; warehouse fees only | High; restoration, insurance, upkeep |

| Investment Horizon | Medium to long-term (5-10 years) | Long-term (10+ years) |

| Risk Factors | Market demand fluctuation, whisky quality | Market trends, condition degradation, theft |

| Regulation & Tax | Subject to alcohol regulations; tax benefits may apply | Vehicle registration, classic car tax incentives vary |

| Returns | Average annual ROI approx. 10-15% | Variable; can exceed 15% for exceptional cars |

| Accessibility | Available through specialist brokers and distilleries | Accessible via dealers, auctions, private sales |

Which is better?

Whisky cask investment offers steady appreciation driven by global demand, limited supply, and the maturation process enhancing value over time, with historical returns averaging around 12-15% annually. Classic car investment, while potentially highly lucrative, depends heavily on market trends, rarity, and condition, often requiring significant maintenance and insurance costs, with top-tier vehicles sometimes appreciating over 20% per year. Both asset classes provide diversification but differ in liquidity and risk profiles, with whisky casks generally offering more predictable growth and classic cars appealing to niche collectors seeking long-term capital gains.

Connection

Whisky cask investment and classic car investment both operate as alternative assets that offer diversification beyond traditional stocks and bonds, often appreciating due to rarity and collector demand. Both markets rely heavily on provenance, condition, and limited availability, driving value increases over time through scarcity and historical significance. Investors are attracted to these tangible assets for their potential to hedge against inflation and global economic uncertainties.

Key Terms

Classic car investment:

Classic car investment offers high potential returns driven by rarity, historical significance, and market demand for vintage models, with values often appreciating faster than traditional assets. Collectors benefit from the increasing global interest in iconic vehicles and events that enhance provenance and desirability, making it a tangible, passion-driven investment. Explore detailed insights on how classic car investment can diversify your portfolio and build long-term wealth.

Provenance

Classic car investment relies heavily on detailed provenance records, including original ownership, service history, and restoration documentation which significantly impact market value and authenticity. Whisky cask investment is equally dependent on provenance, with emphasis on distillery origin, cask type, aging duration, and bottling history to ensure legitimacy and potential appreciation. Discover more about how provenance shapes the financial outcomes in these unique investment opportunities.

Mileage

Classic car investment value often correlates directly with mileage, as lower mileage typically enhances rarity, performance, and desirability among collectors. Whisky cask investment, meanwhile, is unaffected by usage but depends on age, provenance, and storage conditions for value appreciation. Explore detailed comparisons to understand how mileage impacts investment potential in classic cars versus whisky casks.

Source and External Links

Cars | Rally | Alternative Asset Investment - The global classic car market has grown to over $30 billion by 2020 and offers a history of stable returns and low volatility, making classic cars attractive for diversification; for example, a 1955 Porsche 356 Speedster appreciated about 568.5% from 2002 to 2021.

Investing in Classic Cars - Classic cars, usually at least 15-25 years old with unique or rare features, can be purchased in a range starting from $20,000-$30,000, and have seen significant value growth, such as a 500% increase between 2004 and 2014, but careful research is essential before investing.

How to Invest in Classic Cars - Investing in classic cars requires thorough research on historical significance and market trends, understanding maintenance and storage costs, and a long-term perspective; while potentially rewarding financially and emotionally, risks include market fluctuations and high upkeep.

dowidth.com

dowidth.com