Forestry investment offers sustainable growth through long-term asset appreciation and carbon credit opportunities, while infrastructure investment focuses on tangible assets like transportation, energy, and utilities with steady cash flows and economic impact. Both sectors provide diversification benefits and risk mitigation but differ in liquidity, regulatory environments, and capital requirements. Explore detailed comparisons to determine which investment aligns best with your financial goals and values.

Why it is important

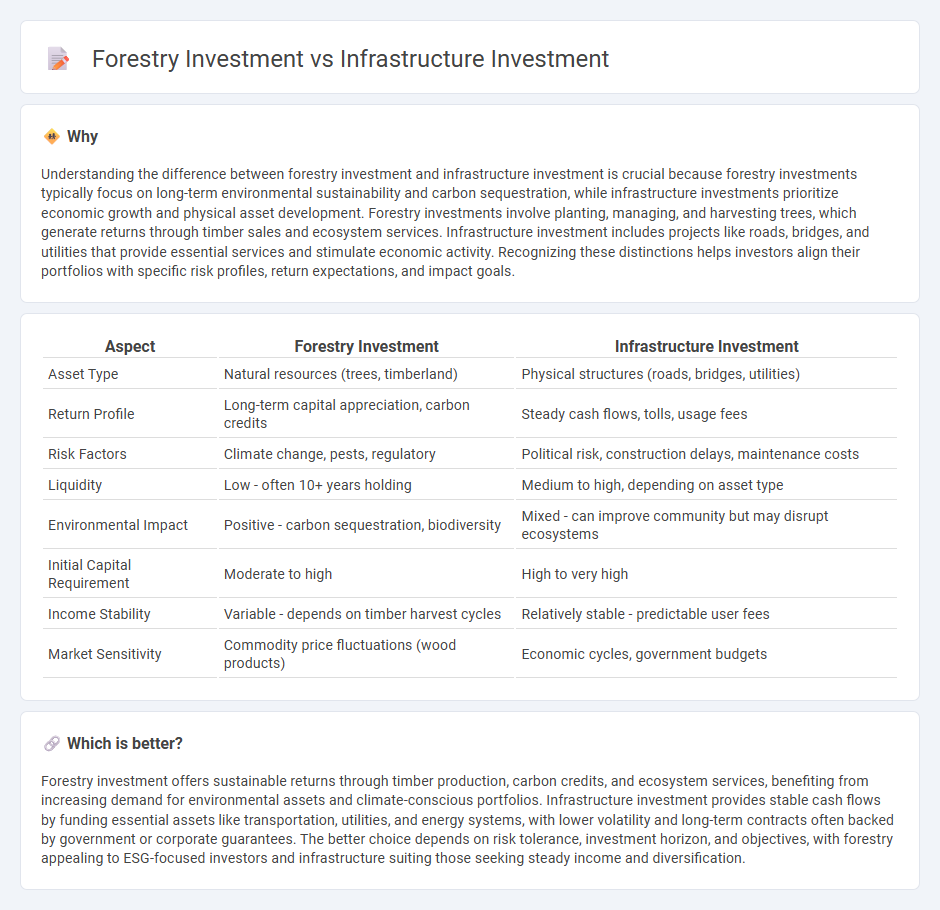

Understanding the difference between forestry investment and infrastructure investment is crucial because forestry investments typically focus on long-term environmental sustainability and carbon sequestration, while infrastructure investments prioritize economic growth and physical asset development. Forestry investments involve planting, managing, and harvesting trees, which generate returns through timber sales and ecosystem services. Infrastructure investment includes projects like roads, bridges, and utilities that provide essential services and stimulate economic activity. Recognizing these distinctions helps investors align their portfolios with specific risk profiles, return expectations, and impact goals.

Comparison Table

| Aspect | Forestry Investment | Infrastructure Investment |

|---|---|---|

| Asset Type | Natural resources (trees, timberland) | Physical structures (roads, bridges, utilities) |

| Return Profile | Long-term capital appreciation, carbon credits | Steady cash flows, tolls, usage fees |

| Risk Factors | Climate change, pests, regulatory | Political risk, construction delays, maintenance costs |

| Liquidity | Low - often 10+ years holding | Medium to high, depending on asset type |

| Environmental Impact | Positive - carbon sequestration, biodiversity | Mixed - can improve community but may disrupt ecosystems |

| Initial Capital Requirement | Moderate to high | High to very high |

| Income Stability | Variable - depends on timber harvest cycles | Relatively stable - predictable user fees |

| Market Sensitivity | Commodity price fluctuations (wood products) | Economic cycles, government budgets |

Which is better?

Forestry investment offers sustainable returns through timber production, carbon credits, and ecosystem services, benefiting from increasing demand for environmental assets and climate-conscious portfolios. Infrastructure investment provides stable cash flows by funding essential assets like transportation, utilities, and energy systems, with lower volatility and long-term contracts often backed by government or corporate guarantees. The better choice depends on risk tolerance, investment horizon, and objectives, with forestry appealing to ESG-focused investors and infrastructure suiting those seeking steady income and diversification.

Connection

Forestry investment and infrastructure investment are interconnected through their mutual impact on sustainable development and economic growth. Investment in forestry supports infrastructure by providing raw materials such as timber for construction, while infrastructure investments enhance access to forest areas, improving resource management and transportation. Both sectors contribute significantly to job creation, environmental conservation, and long-term financial returns by integrating natural resource management with built environment development.

Key Terms

Asset Lifespan

Infrastructure investments often involve assets with lifespans ranging from 30 to 100 years, such as bridges, highways, and utilities, providing long-term value and steady returns. Forestry investments typically focus on biological growth cycles, with rotation periods spanning 20 to 60 years depending on tree species and management practices, offering renewable asset appreciation and carbon sequestration benefits. Explore detailed analyses to understand how the lifespan of these assets impacts risk, return, and sustainability in diverse portfolios.

Revenue Streams

Infrastructure investments generate revenue primarily through tolls, utilities fees, and government contracts, offering relatively predictable cash flows backed by long-term contracts. Forestry investments rely on timber sales, carbon credits, and land appreciation, with revenue influenced by market demand, growth cycles, and environmental regulations. Explore detailed comparisons to understand which investment aligns with your financial goals and risk tolerance.

Regulatory Environment

Infrastructure investment demands navigating complex regulatory frameworks including zoning laws, environmental impact assessments, and public procurement rules, which vary significantly by region and can affect project timelines and costs. Forestry investment is influenced by forestry management policies, land use regulations, and sustainability certifications such as FSC or PEFC, essential for ensuring long-term ecological balance and market access. Explore deeper insights into how regulatory environments shape investment risks and returns in these sectors.

Source and External Links

Investment Pays - ASCE's 2025 Infrastructure Report Card - The American Society of Civil Engineers estimates the U.S. needs $9.1 trillion in infrastructure investment by 2033 across 18 categories, revealing funding gaps in roads, bridges, energy, drinking water, and more totaling $3.7 trillion under current federal investment levels.

Infrastructure investment - OECD - Infrastructure investment includes spending on new transport construction and improvements, encompassing roads, rail, ports, and airports, and is vital for economic growth, regional development, and social connectivity.

The basics of infrastructure investing | abrdn - Long-term infrastructure investment focuses on structural themes like energy transition, demographic changes, and urbanization, driving opportunities in renewable energy, transport modernization, and digital infrastructure expansion.

dowidth.com

dowidth.com