Alternative data analytics leverages unconventional datasets such as satellite images, social media trends, and transaction records to uncover unique investment insights beyond traditional financial metrics. Big data analytics processes vast volumes of structured and unstructured data to identify patterns, correlations, and trends that drive informed decision-making in investment strategies. Discover how integrating these approaches can enhance portfolio performance and risk management.

Why it is important

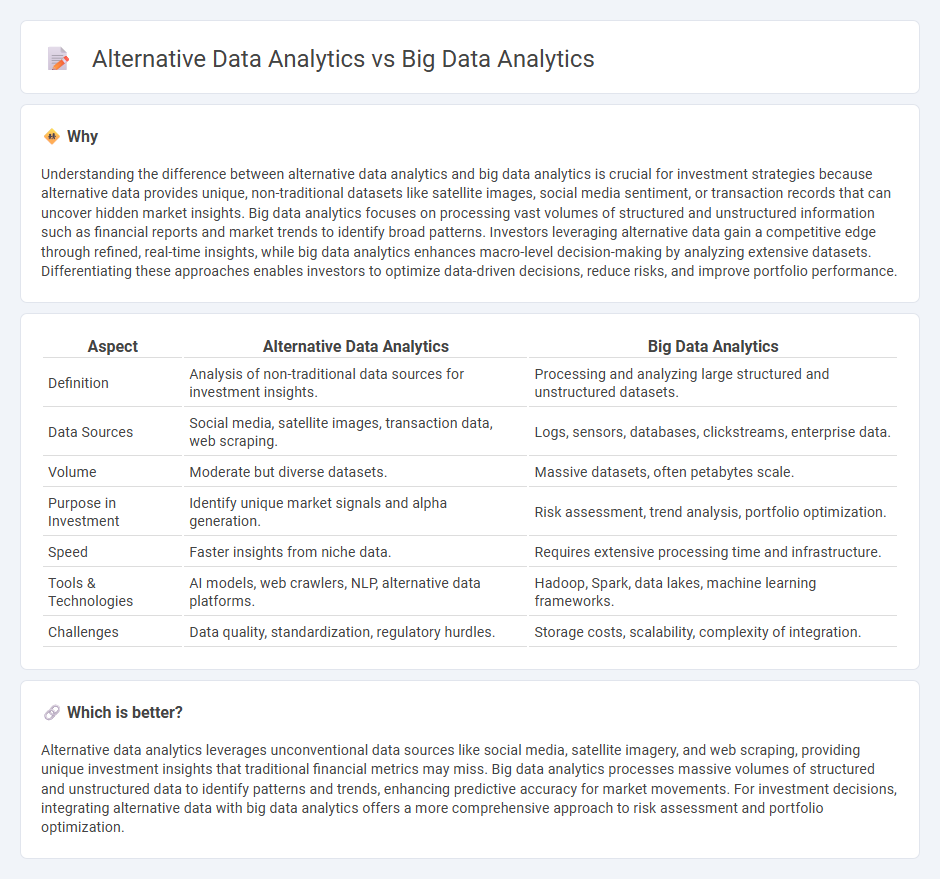

Understanding the difference between alternative data analytics and big data analytics is crucial for investment strategies because alternative data provides unique, non-traditional datasets like satellite images, social media sentiment, or transaction records that can uncover hidden market insights. Big data analytics focuses on processing vast volumes of structured and unstructured information such as financial reports and market trends to identify broad patterns. Investors leveraging alternative data gain a competitive edge through refined, real-time insights, while big data analytics enhances macro-level decision-making by analyzing extensive datasets. Differentiating these approaches enables investors to optimize data-driven decisions, reduce risks, and improve portfolio performance.

Comparison Table

| Aspect | Alternative Data Analytics | Big Data Analytics |

|---|---|---|

| Definition | Analysis of non-traditional data sources for investment insights. | Processing and analyzing large structured and unstructured datasets. |

| Data Sources | Social media, satellite images, transaction data, web scraping. | Logs, sensors, databases, clickstreams, enterprise data. |

| Volume | Moderate but diverse datasets. | Massive datasets, often petabytes scale. |

| Purpose in Investment | Identify unique market signals and alpha generation. | Risk assessment, trend analysis, portfolio optimization. |

| Speed | Faster insights from niche data. | Requires extensive processing time and infrastructure. |

| Tools & Technologies | AI models, web crawlers, NLP, alternative data platforms. | Hadoop, Spark, data lakes, machine learning frameworks. |

| Challenges | Data quality, standardization, regulatory hurdles. | Storage costs, scalability, complexity of integration. |

Which is better?

Alternative data analytics leverages unconventional data sources like social media, satellite imagery, and web scraping, providing unique investment insights that traditional financial metrics may miss. Big data analytics processes massive volumes of structured and unstructured data to identify patterns and trends, enhancing predictive accuracy for market movements. For investment decisions, integrating alternative data with big data analytics offers a more comprehensive approach to risk assessment and portfolio optimization.

Connection

Alternative data analytics leverages unconventional data sources such as social media, satellite images, and transaction records to provide deeper investment insights. Big data analytics processes and analyzes these vast and diverse datasets at scale, enabling investors to identify patterns, trends, and market signals that traditional data may overlook. The integration of alternative data with big data analytics enhances predictive accuracy and decision-making in investment strategies.

Key Terms

Data sources

Big data analytics primarily leverages vast, structured, and unstructured datasets from traditional sources such as social media, transactional records, and sensor data to uncover patterns and insights. Alternative data analytics focuses on non-traditional sources like satellite imagery, web scraping, geolocation data, and consumer behavior signals to gain a competitive edge and deeper market understanding. Explore more to understand how integrating these diverse data sources can enhance decision-making and predictive capabilities.

Predictive modeling

Big data analytics leverages vast volumes of structured and unstructured data from diverse sources to build predictive models that identify patterns and forecast future trends with high accuracy. Alternative data analytics focuses on unconventional datasets such as social media signals, satellite imagery, and sensor data to enhance predictive modeling by providing unique insights not captured by traditional big data. Explore these innovative approaches to predictive modeling and discover how they transform decision-making processes across industries.

Market signals

Big data analytics leverages structured and unstructured datasets from various sources such as social media, transaction records, and sensor data to identify broad market trends and consumer behavior patterns. Alternative data analytics focuses on non-traditional data sources like satellite imagery, credit card transactions, and web scraping to uncover nuanced market signals often overlooked by conventional methods. Explore how these analytics approaches transform market intelligence by diving deeper into their methodologies and applications.

Source and External Links

What is Big Data Analytics? - IBM - Big data analytics is the systematic processing and analysis of large, complex datasets to uncover trends, patterns, and insights that inform decision-making across organizations.

Big Data Analytics: What It Is, How It Works, Benefits, And Challenges - Big data analytics involves collecting, processing, cleaning, and analyzing massive datasets from diverse sources to help organizations operationalize their data and gain actionable intelligence.

What is Big Data Analytics? - Microsoft Azure - Big data analytics uses advanced tools and methods to collect, store, organize, clean, and analyze high-volume, high-velocity data from multiple sources, enabling the prediction of outcomes and discovery of patterns through technologies like AI and machine learning.

dowidth.com

dowidth.com