Fine art micro-shares offer investors the chance to own fractions of valuable artworks, making high-end art more accessible and potentially yielding significant appreciation. Classic car fractional ownership allows enthusiasts to invest in iconic automobiles, combining asset enjoyment with possible value growth due to rarity and collector demand. Explore the dynamics and advantages of both investment options to make informed decisions tailored to your portfolio goals.

Why it is important

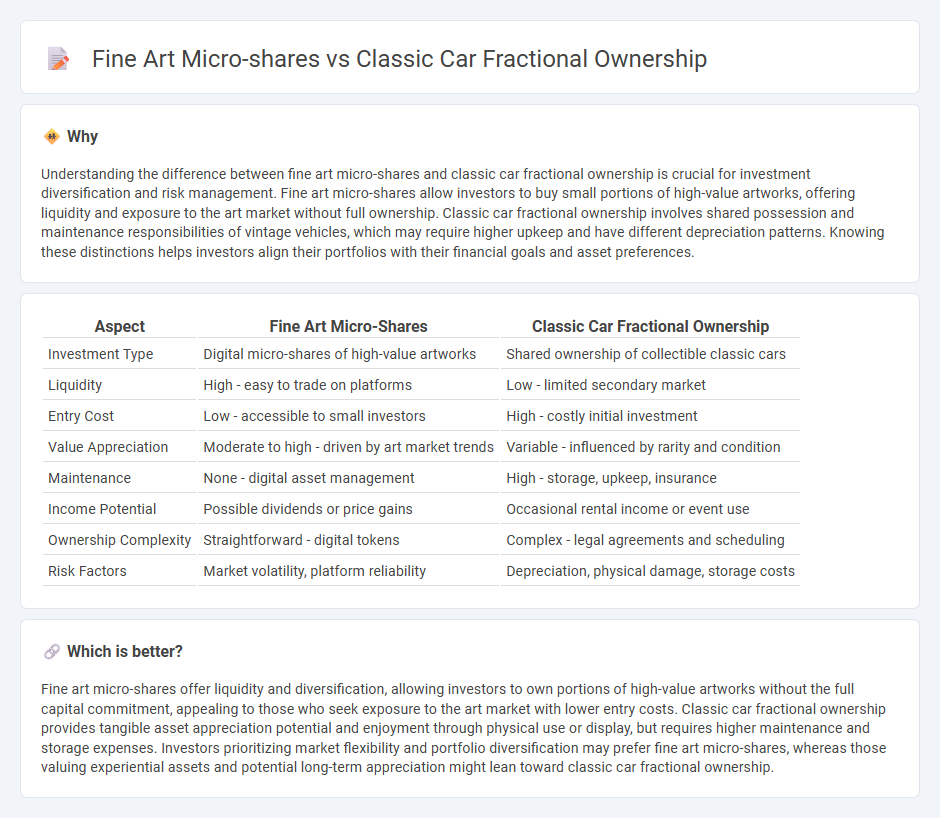

Understanding the difference between fine art micro-shares and classic car fractional ownership is crucial for investment diversification and risk management. Fine art micro-shares allow investors to buy small portions of high-value artworks, offering liquidity and exposure to the art market without full ownership. Classic car fractional ownership involves shared possession and maintenance responsibilities of vintage vehicles, which may require higher upkeep and have different depreciation patterns. Knowing these distinctions helps investors align their portfolios with their financial goals and asset preferences.

Comparison Table

| Aspect | Fine Art Micro-Shares | Classic Car Fractional Ownership |

|---|---|---|

| Investment Type | Digital micro-shares of high-value artworks | Shared ownership of collectible classic cars |

| Liquidity | High - easy to trade on platforms | Low - limited secondary market |

| Entry Cost | Low - accessible to small investors | High - costly initial investment |

| Value Appreciation | Moderate to high - driven by art market trends | Variable - influenced by rarity and condition |

| Maintenance | None - digital asset management | High - storage, upkeep, insurance |

| Income Potential | Possible dividends or price gains | Occasional rental income or event use |

| Ownership Complexity | Straightforward - digital tokens | Complex - legal agreements and scheduling |

| Risk Factors | Market volatility, platform reliability | Depreciation, physical damage, storage costs |

Which is better?

Fine art micro-shares offer liquidity and diversification, allowing investors to own portions of high-value artworks without the full capital commitment, appealing to those who seek exposure to the art market with lower entry costs. Classic car fractional ownership provides tangible asset appreciation potential and enjoyment through physical use or display, but requires higher maintenance and storage expenses. Investors prioritizing market flexibility and portfolio diversification may prefer fine art micro-shares, whereas those valuing experiential assets and potential long-term appreciation might lean toward classic car fractional ownership.

Connection

Investment in fine art micro-shares and classic car fractional ownership both leverage asset tokenization to enable smaller investors to access high-value collectibles. These platforms fractionalize ownership, allowing diversification and liquidity in traditionally illiquid markets like fine art and vintage automobiles. Blockchain technology underpins secure transactions and transparent record-keeping, enhancing trust and efficiency in both investment models.

Key Terms

Asset Valuation

Classic car fractional ownership offers tangible asset valuation based on historical auction prices, rarity, and condition, with market trends influenced by collector demand and provenance. Fine art micro-shares derive their value from artist reputation, exhibition history, and auction records, often subject to volatile market sentiment and cultural relevance. Explore deeper insights on asset valuation metrics in these niche investment markets to make informed decisions.

Liquidity

Classic car fractional ownership offers limited liquidity due to niche market demand and longer transaction times, often requiring buyers to wait for specific events or auctions. Fine art micro-shares provide enhanced liquidity through digital platforms enabling quicker buying and selling, supported by a broader investor base and fractionalized ownership models. Explore deeper insights into how liquidity dynamics vary between these asset classes.

Provenance

Classic car fractional ownership offers tangible provenance through documented maintenance records, historical significance, and verifiable mileage, enhancing asset authenticity. Fine art micro-shares emphasize provenance by tracing artwork authenticity via certified galleries, artist documentation, and blockchain technology, ensuring transparency and ownership clarity. Explore the nuances of provenance in alternative investments to make informed decisions.

Source and External Links

Fraction test: Does investing in a share of a car work for you? - Fractional ownership of classic cars allows investors to buy shares in a vehicle, making ownership more affordable while benefiting from potential appreciation, with cars held in a limited company structure and generally not driven by shareholders to preserve value.

Why Classic Cars? - Fraction Motors - Fraction Motors uses blockchain technology for classic car fractional ownership, where the custodian manages all upkeep costs, allowing minority owners to enjoy ownership without ongoing expenses related to storage, maintenance, or insurance.

Classic Car Fund - FalconCo - Fractional ownership of classic cars offers portfolio diversification, professional management, liquidity advantages, and access to prestigious vehicles, enabling investors to enjoy classic car ownership benefits with reduced financial and management burdens.

dowidth.com

dowidth.com