Wine investing platforms offer access to rare vintages and fine wines with potential for appreciation based on provenance and market trends, while collectible car investment platforms provide opportunities to invest in classic and exotic automobiles valued for rarity and historical significance. Both asset types require expert valuation and storage solutions to preserve value and maximize returns. Explore the unique benefits and risks of wine and collectible car investments to make informed decisions.

Why it is important

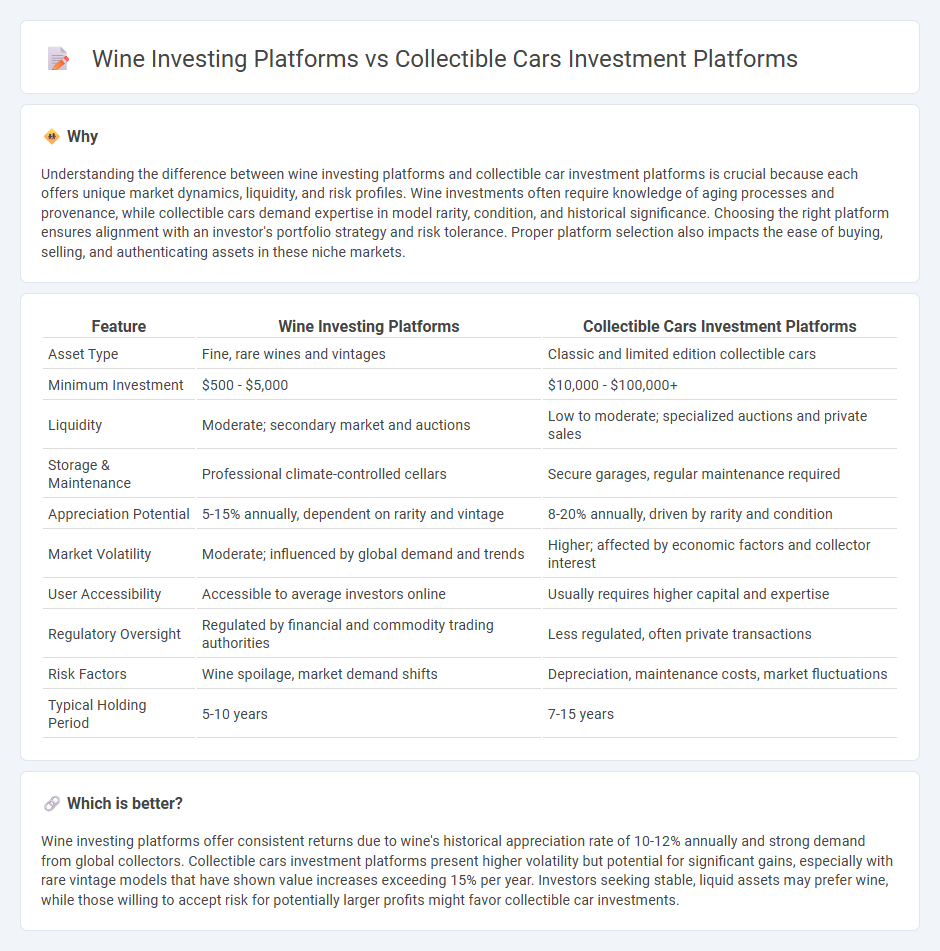

Understanding the difference between wine investing platforms and collectible car investment platforms is crucial because each offers unique market dynamics, liquidity, and risk profiles. Wine investments often require knowledge of aging processes and provenance, while collectible cars demand expertise in model rarity, condition, and historical significance. Choosing the right platform ensures alignment with an investor's portfolio strategy and risk tolerance. Proper platform selection also impacts the ease of buying, selling, and authenticating assets in these niche markets.

Comparison Table

| Feature | Wine Investing Platforms | Collectible Cars Investment Platforms |

|---|---|---|

| Asset Type | Fine, rare wines and vintages | Classic and limited edition collectible cars |

| Minimum Investment | $500 - $5,000 | $10,000 - $100,000+ |

| Liquidity | Moderate; secondary market and auctions | Low to moderate; specialized auctions and private sales |

| Storage & Maintenance | Professional climate-controlled cellars | Secure garages, regular maintenance required |

| Appreciation Potential | 5-15% annually, dependent on rarity and vintage | 8-20% annually, driven by rarity and condition |

| Market Volatility | Moderate; influenced by global demand and trends | Higher; affected by economic factors and collector interest |

| User Accessibility | Accessible to average investors online | Usually requires higher capital and expertise |

| Regulatory Oversight | Regulated by financial and commodity trading authorities | Less regulated, often private transactions |

| Risk Factors | Wine spoilage, market demand shifts | Depreciation, maintenance costs, market fluctuations |

| Typical Holding Period | 5-10 years | 7-15 years |

Which is better?

Wine investing platforms offer consistent returns due to wine's historical appreciation rate of 10-12% annually and strong demand from global collectors. Collectible cars investment platforms present higher volatility but potential for significant gains, especially with rare vintage models that have shown value increases exceeding 15% per year. Investors seeking stable, liquid assets may prefer wine, while those willing to accept risk for potentially larger profits might favor collectible car investments.

Connection

Wine investing platforms and collectible car investment platforms both appeal to alternative asset investors seeking portfolio diversification through tangible assets with historical appreciation trends. Both markets leverage scarcity, provenance, and condition grading to determine asset value, attracting enthusiasts and collectors who benefit from rotating global demand and auction house dynamics. Technological advancements in digital marketplaces and blockchain authentication further enhance transparency and liquidity in these niche investment sectors.

Key Terms

**Collectible Cars Investment Platforms:**

Collectible cars investment platforms offer a unique opportunity to invest in rare and appreciating vehicles, combining passion with asset diversification. These platforms provide detailed market analytics, historical price trends, and expert valuations that help investors make informed decisions in a niche yet growing collector car market. Explore more about how collectible cars can drive your investment portfolio's value.

Title/Ownership Verification

Collectible car investment platforms prioritize blockchain-based title and ownership verification to ensure authenticity and reduce fraud risks, enhancing investor confidence. Wine investing platforms rely heavily on provenance documentation and third-party certification to confirm the origins and storage conditions of the wine, maintaining its value over time. Explore how these industries utilize technology and documentation standards to secure your investment portfolio.

Vehicle Provenance

Vehicle provenance is a critical factor in collectible car investment platforms, ensuring authenticity, maintenance history, and ownership records that enhance the vehicle's market value. Wine investing platforms emphasize vintage, vineyard origin, and storage conditions, but lack the detailed provenance documentation typical in car investments. Explore the nuances of vehicle provenance to make informed decisions in collectible car investments.

Source and External Links

Crowdfunding for Cars: Revving Up Car Investments - LenderKit - TheCarCrowd platform offers fractional ownership of rare classic cars through limited liability companies, handling maintenance, storage, and insurance while letting investors vote on resale decisions over a 5-year period, primarily for high-net-worth individuals in the UK and internationally verified investors.

MCQ Markets - Fractional Ownership in Luxury Assets - MCQ Markets allows investors to start fractional ownership in investment-grade collectible cars from as low as $100, highlighting the asset class's historic outperformance compared to traditional investments and alternative assets like fine art and wine.

How To Invest in Collectible and Vintage Cars - The Accredited Investor - Various platforms and funds like TheCarCrowd, Inspira Classic Car Fund, and Rally provide options for fractional ownership and investment in collectible cars, with benefits such as lifestyle perks, easy share trading, and curated car selections forming limited companies to facilitate investment.

dowidth.com

dowidth.com