Investing in viticulture land offers long-term value through vineyard development and premium wine production potential, contrasting with infrastructure investments focused on immediate returns from urban or industrial projects. Viticulture land acquisition requires understanding soil quality, climate conditions, and regional wine market trends, while infrastructure investments demand analysis of location accessibility, regulatory environment, and economic growth prospects. Explore more about the comparative benefits and strategic considerations of these investment options.

Why it is important

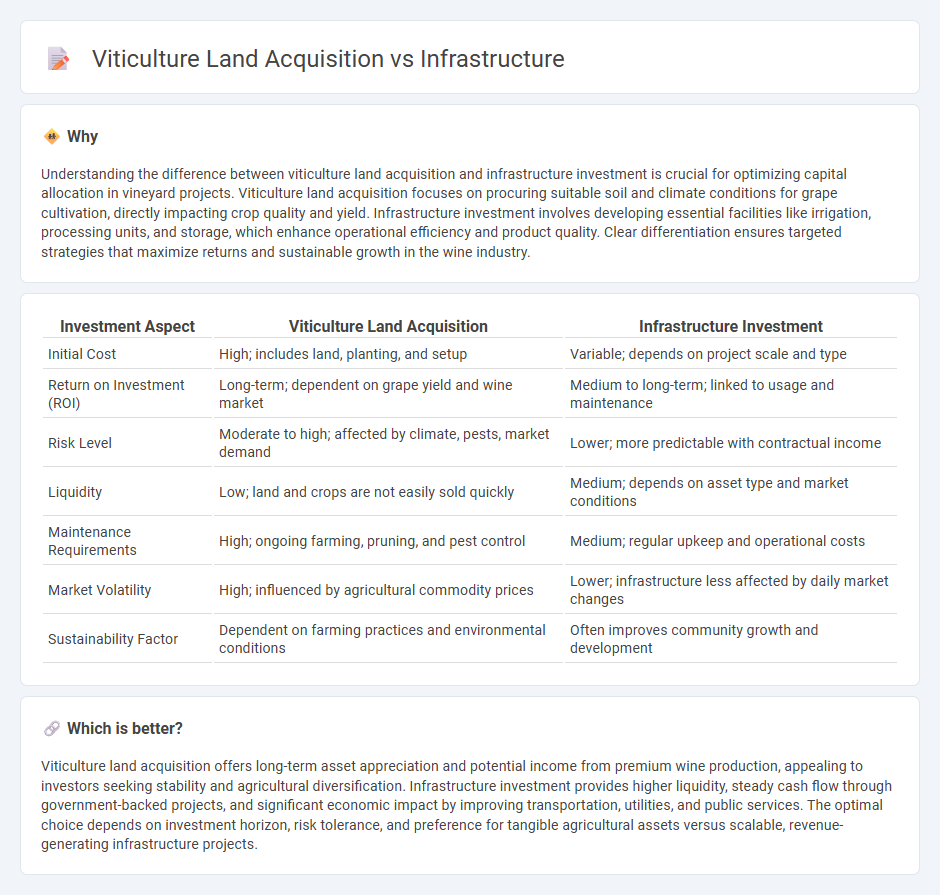

Understanding the difference between viticulture land acquisition and infrastructure investment is crucial for optimizing capital allocation in vineyard projects. Viticulture land acquisition focuses on procuring suitable soil and climate conditions for grape cultivation, directly impacting crop quality and yield. Infrastructure investment involves developing essential facilities like irrigation, processing units, and storage, which enhance operational efficiency and product quality. Clear differentiation ensures targeted strategies that maximize returns and sustainable growth in the wine industry.

Comparison Table

| Investment Aspect | Viticulture Land Acquisition | Infrastructure Investment |

|---|---|---|

| Initial Cost | High; includes land, planting, and setup | Variable; depends on project scale and type |

| Return on Investment (ROI) | Long-term; dependent on grape yield and wine market | Medium to long-term; linked to usage and maintenance |

| Risk Level | Moderate to high; affected by climate, pests, market demand | Lower; more predictable with contractual income |

| Liquidity | Low; land and crops are not easily sold quickly | Medium; depends on asset type and market conditions |

| Maintenance Requirements | High; ongoing farming, pruning, and pest control | Medium; regular upkeep and operational costs |

| Market Volatility | High; influenced by agricultural commodity prices | Lower; infrastructure less affected by daily market changes |

| Sustainability Factor | Dependent on farming practices and environmental conditions | Often improves community growth and development |

Which is better?

Viticulture land acquisition offers long-term asset appreciation and potential income from premium wine production, appealing to investors seeking stability and agricultural diversification. Infrastructure investment provides higher liquidity, steady cash flow through government-backed projects, and significant economic impact by improving transportation, utilities, and public services. The optimal choice depends on investment horizon, risk tolerance, and preference for tangible agricultural assets versus scalable, revenue-generating infrastructure projects.

Connection

Viticulture land acquisition directly influences investment potential by determining the quality and scale of vineyard development, which impacts long-term revenue generation. Infrastructure such as irrigation systems, access roads, and processing facilities enhances the productivity and operational efficiency of acquired viticulture land. Strategic investment in both land acquisition and infrastructure is essential for optimizing grape yield and wine production profitability.

Key Terms

Due Diligence

Due diligence in infrastructure land acquisition prioritizes environmental impact assessments, zoning regulations, and easements, ensuring compliance with government mandates and future development plans. In viticulture land acquisition, due diligence emphasizes soil quality analysis, microclimate evaluation, and water rights to optimize grape production and vineyard sustainability. Explore detailed due diligence processes tailored for both sectors to secure informed land investments and mitigate risks.

Zoning Regulations

Zoning regulations play a critical role in distinguishing infrastructure development from viticulture land acquisition by designating specific land uses and controlling permissible activities within those zones. Infrastructure projects often require land zoned for commercial or industrial purposes, whereas viticulture land acquisition demands agricultural or rural zoning to support vineyard cultivation and comply with environmental protections. Explore detailed zoning classification impacts and legal considerations to master land acquisition strategies in these sectors.

Return on Investment (ROI)

Infrastructure land acquisition typically requires significant upfront capital but yields higher long-term returns through increased property value and economic activity, driven by urban expansion and commercial development. Viticulture land acquisition involves specialized investments in soil preparation, vineyard establishment, and ongoing maintenance, with ROI influenced by grape quality, wine market demand, and seasonal variability. Explore comprehensive analyses on optimizing ROI for infrastructure versus viticulture land acquisitions to guide strategic investment decisions.

Source and External Links

Infrastructure - Infrastructure consists of essential public and private systems such as roads, railways, airports, water supply, and utilities, with funding sources ranging from government spending and private investment to international aid, depending on the sector and country.

H.R.3684 - 117th Congress (2021-2022): Infrastructure ... - The U.S. Infrastructure Investment and Jobs Act allocates funding for roads, bridges, rail, public transit, broadband, airports, water systems, power grids, electric vehicle charging, and environmental cleanup projects.

Infrastructure - Public infrastructure in the U.S. includes roads, bridges, transit, dams, ports, airports, water and wastewater systems, electrical grids, telecommunications, and buildings, all vital for daily life and economic activity.

dowidth.com

dowidth.com