Sports team ownership shares offer investors a unique opportunity to participate in the growth of high-profile franchises with potential for significant appreciation and revenue from media rights, merchandise, and ticket sales. Infrastructure funds focus on long-term, stable returns by investing in essential public assets like transportation, energy, and utilities, providing steady cash flows and lower volatility. Explore the distinct advantages and risks of sports team ownership shares versus infrastructure funds to make informed investment decisions.

Why it is important

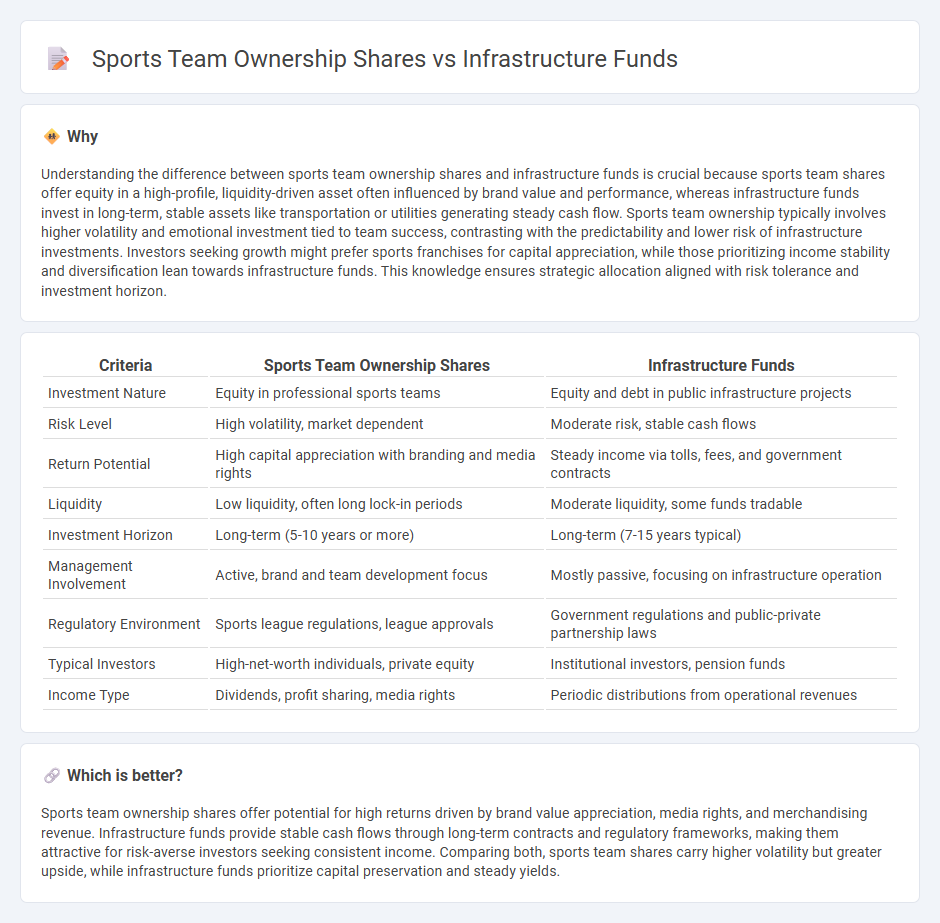

Understanding the difference between sports team ownership shares and infrastructure funds is crucial because sports team shares offer equity in a high-profile, liquidity-driven asset often influenced by brand value and performance, whereas infrastructure funds invest in long-term, stable assets like transportation or utilities generating steady cash flow. Sports team ownership typically involves higher volatility and emotional investment tied to team success, contrasting with the predictability and lower risk of infrastructure investments. Investors seeking growth might prefer sports franchises for capital appreciation, while those prioritizing income stability and diversification lean towards infrastructure funds. This knowledge ensures strategic allocation aligned with risk tolerance and investment horizon.

Comparison Table

| Criteria | Sports Team Ownership Shares | Infrastructure Funds |

|---|---|---|

| Investment Nature | Equity in professional sports teams | Equity and debt in public infrastructure projects |

| Risk Level | High volatility, market dependent | Moderate risk, stable cash flows |

| Return Potential | High capital appreciation with branding and media rights | Steady income via tolls, fees, and government contracts |

| Liquidity | Low liquidity, often long lock-in periods | Moderate liquidity, some funds tradable |

| Investment Horizon | Long-term (5-10 years or more) | Long-term (7-15 years typical) |

| Management Involvement | Active, brand and team development focus | Mostly passive, focusing on infrastructure operation |

| Regulatory Environment | Sports league regulations, league approvals | Government regulations and public-private partnership laws |

| Typical Investors | High-net-worth individuals, private equity | Institutional investors, pension funds |

| Income Type | Dividends, profit sharing, media rights | Periodic distributions from operational revenues |

Which is better?

Sports team ownership shares offer potential for high returns driven by brand value appreciation, media rights, and merchandising revenue. Infrastructure funds provide stable cash flows through long-term contracts and regulatory frameworks, making them attractive for risk-averse investors seeking consistent income. Comparing both, sports team shares carry higher volatility but greater upside, while infrastructure funds prioritize capital preservation and steady yields.

Connection

Sports team ownership shares and infrastructure funds are connected through their shared emphasis on long-term asset appreciation and stable revenue streams. Infrastructure funds often invest in stadiums, training facilities, and transportation networks that enhance the value and profitability of sports teams. This strategic link allows investors to benefit from both direct team performance and the broader economic impact of supporting infrastructure.

Key Terms

**Infrastructure funds:**

Infrastructure funds provide investors with exposure to essential public assets such as transportation, energy, and utilities, offering stable, long-term cash flows backed by government contracts or regulated entities. These funds typically focus on low-risk, inflation-linked revenue streams, making them attractive for risk-averse investors seeking consistent income. Explore the benefits and risks of infrastructure funds to determine if they align with your portfolio goals.

Asset allocation

Infrastructure funds provide investors with stable, long-term returns through investments in essential physical assets like transportation, energy, and utilities, often appealing for portfolio diversification and risk mitigation. In contrast, sports team ownership shares tend to offer higher volatility with potential for significant appreciation tied to team performance, brand value, and revenue streams such as media rights and merchandising. Explore detailed comparisons to optimize your asset allocation strategy effectively.

Yield

Infrastructure funds typically offer stable, long-term yields derived from investments in essential assets such as highways, utilities, and renewable energy projects, benefiting from steady cash flows and inflation-linked revenue. Sports team ownership shares, on the other hand, present more volatile returns driven by team performance, franchise valuation growth, and media rights, often with potential for significant capital appreciation but less predictable income streams. Explore in-depth comparisons of yield profiles and risk factors to determine the optimal investment strategy.

Source and External Links

Infrastructure Fund - Wikipedia - An infrastructure fund is a privately offered or publicly listed fund that invests in infrastructure and associated industries, including power plants, transportation systems, and healthcare facilities.

Infrastructure Fund - Cohen & Steers - This fund focuses on total return with an emphasis on income through investments in securities issued by infrastructure companies.

Largest Infrastructure Fund Managers | Infrastructure Investor 100 - Lists the top 100 global infrastructure fund managers, providing insights into major players like Brookfield and Global Infrastructure Partners.

dowidth.com

dowidth.com