Whale watching shares offer investors a unique opportunity to engage in eco-tourism ventures with potential for sustainable growth, focusing on natural conservation and tourism revenue. Private equity involves pooling capital to invest in private companies, aiming for high returns through active management and strategic business transformations. Explore the key differences and advantages of whale watching shares versus private equity investments to make informed financial decisions.

Why it is important

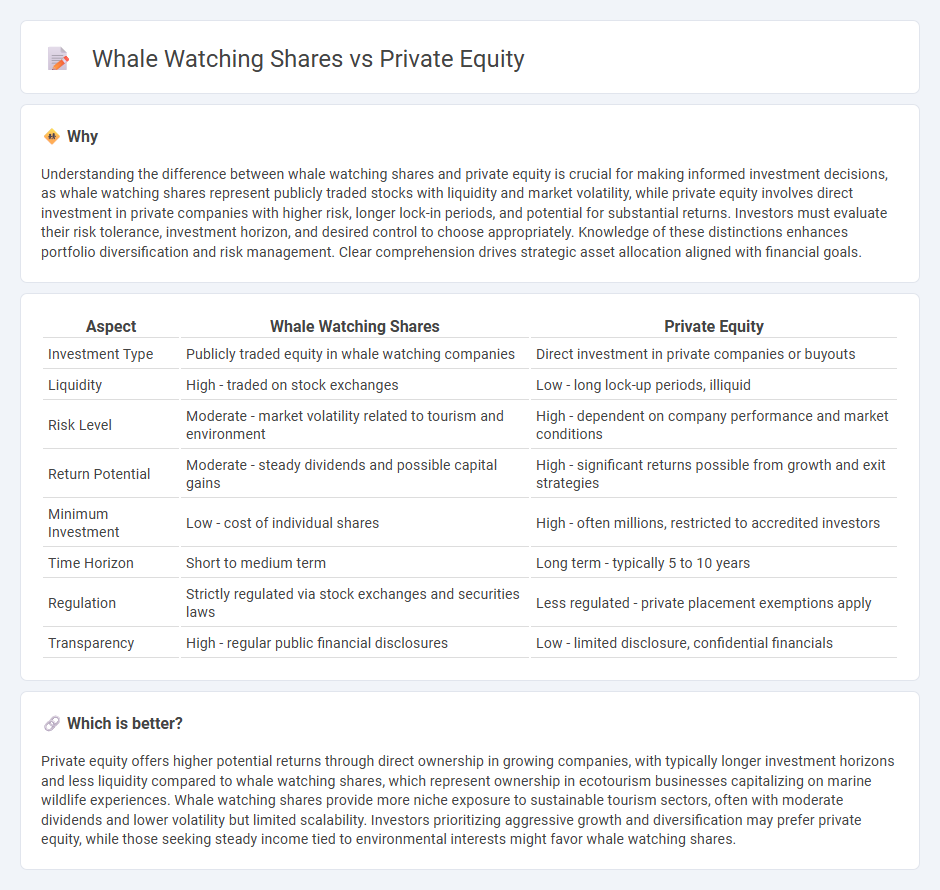

Understanding the difference between whale watching shares and private equity is crucial for making informed investment decisions, as whale watching shares represent publicly traded stocks with liquidity and market volatility, while private equity involves direct investment in private companies with higher risk, longer lock-in periods, and potential for substantial returns. Investors must evaluate their risk tolerance, investment horizon, and desired control to choose appropriately. Knowledge of these distinctions enhances portfolio diversification and risk management. Clear comprehension drives strategic asset allocation aligned with financial goals.

Comparison Table

| Aspect | Whale Watching Shares | Private Equity |

|---|---|---|

| Investment Type | Publicly traded equity in whale watching companies | Direct investment in private companies or buyouts |

| Liquidity | High - traded on stock exchanges | Low - long lock-up periods, illiquid |

| Risk Level | Moderate - market volatility related to tourism and environment | High - dependent on company performance and market conditions |

| Return Potential | Moderate - steady dividends and possible capital gains | High - significant returns possible from growth and exit strategies |

| Minimum Investment | Low - cost of individual shares | High - often millions, restricted to accredited investors |

| Time Horizon | Short to medium term | Long term - typically 5 to 10 years |

| Regulation | Strictly regulated via stock exchanges and securities laws | Less regulated - private placement exemptions apply |

| Transparency | High - regular public financial disclosures | Low - limited disclosure, confidential financials |

Which is better?

Private equity offers higher potential returns through direct ownership in growing companies, with typically longer investment horizons and less liquidity compared to whale watching shares, which represent ownership in ecotourism businesses capitalizing on marine wildlife experiences. Whale watching shares provide more niche exposure to sustainable tourism sectors, often with moderate dividends and lower volatility but limited scalability. Investors prioritizing aggressive growth and diversification may prefer private equity, while those seeking steady income tied to environmental interests might favor whale watching shares.

Connection

Whale watching shares represent a niche investment sector focused on eco-tourism companies that capitalize on the growing interest in marine wildlife experiences. Private equity firms target these shares by acquiring significant stakes in whale watching businesses to drive growth, improve operations, and potentially exit with high returns. This connection highlights private equity's role in scaling sustainable tourism ventures through strategic capital infusion and market expertise.

Key Terms

Capital Commitment

Capital commitment in private equity involves investors pledging substantial funds for long-term investments, typically locked in for several years to fuel company growth and generate high returns. Whale watching shares, by contrast, represent public market investments characterized by liquidity and the potential for more immediate trading but with less predictable capital allocation. Discover more about how capital commitment shapes investment strategies across these distinct asset classes.

Ownership Structure

Private equity involves ownership in privately-held companies, typically through direct investments by funds or limited partners, allowing for significant control and influence over management decisions. Whale watching shares refer to publicly traded stocks in companies operating whale watching tours, where ownership is distributed among numerous shareholders with limited individual control. Explore in-depth insights on how ownership structures shape investment strategies and risk profiles.

Market Liquidity

Market liquidity in private equity is typically low due to long holding periods and limited secondary markets, making it difficult to quickly buy or sell shares without affecting the price. In contrast, whale watching company shares, traded on public exchanges, offer higher liquidity with real-time pricing and ease of transaction for investors. Explore further to understand how liquidity impacts investment strategies across these sectors.

Source and External Links

Private equity - Wikipedia - Private equity involves investment managers raising funds from institutional investors to buy equity stakes in private companies, aiming to generate returns through revenue growth, margin expansion, and operational improvements over a typical 4-7 year horizon.

What is Private Equity? - BVCA - Private equity is medium- to long-term finance provided for equity stakes in high-growth unquoted companies, involving close collaboration with management to drive business growth and operational efficiency, usually holding investments for 4-7 years before exiting.

Private Equity: What You Need to Know - KKR - Private equity funds invest in non-publicly traded companies, enhancing value through strategies like strengthening management, expanding markets, improving operations, and optimizing capital structure to achieve strong returns.

dowidth.com

dowidth.com