Investment in viticulture land offers tangible assets and potential long-term appreciation through vineyard profitability and wine production, contrasting with private equity's higher liquidity and diversified portfolio exposure. Viticulture land acquisition provides unique agricultural tax benefits, while private equity focuses on strategic business growth and exit opportunities. Explore the distinct advantages and risks of these investment avenues to enhance your financial strategy.

Why it is important

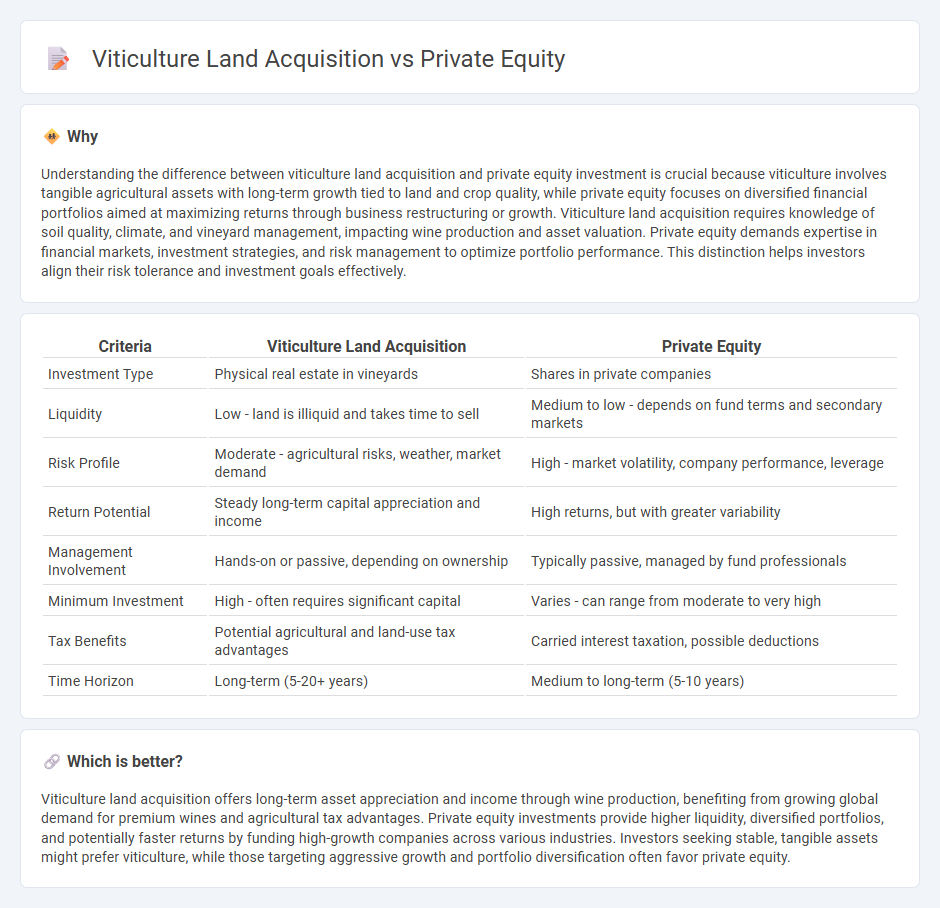

Understanding the difference between viticulture land acquisition and private equity investment is crucial because viticulture involves tangible agricultural assets with long-term growth tied to land and crop quality, while private equity focuses on diversified financial portfolios aimed at maximizing returns through business restructuring or growth. Viticulture land acquisition requires knowledge of soil quality, climate, and vineyard management, impacting wine production and asset valuation. Private equity demands expertise in financial markets, investment strategies, and risk management to optimize portfolio performance. This distinction helps investors align their risk tolerance and investment goals effectively.

Comparison Table

| Criteria | Viticulture Land Acquisition | Private Equity |

|---|---|---|

| Investment Type | Physical real estate in vineyards | Shares in private companies |

| Liquidity | Low - land is illiquid and takes time to sell | Medium to low - depends on fund terms and secondary markets |

| Risk Profile | Moderate - agricultural risks, weather, market demand | High - market volatility, company performance, leverage |

| Return Potential | Steady long-term capital appreciation and income | High returns, but with greater variability |

| Management Involvement | Hands-on or passive, depending on ownership | Typically passive, managed by fund professionals |

| Minimum Investment | High - often requires significant capital | Varies - can range from moderate to very high |

| Tax Benefits | Potential agricultural and land-use tax advantages | Carried interest taxation, possible deductions |

| Time Horizon | Long-term (5-20+ years) | Medium to long-term (5-10 years) |

Which is better?

Viticulture land acquisition offers long-term asset appreciation and income through wine production, benefiting from growing global demand for premium wines and agricultural tax advantages. Private equity investments provide higher liquidity, diversified portfolios, and potentially faster returns by funding high-growth companies across various industries. Investors seeking stable, tangible assets might prefer viticulture, while those targeting aggressive growth and portfolio diversification often favor private equity.

Connection

Viticulture land acquisition attracts private equity due to its potential for high returns through premium wine production and land appreciation. Private equity firms leverage substantial capital to invest in vineyards, optimizing operations and scaling production for market growth. This synergy enhances asset value and generates lucrative exit opportunities in the growing global wine industry.

Key Terms

Due Diligence

Due diligence in private equity involves comprehensive financial analysis, legal review, and market evaluation to assess investment risks and potential returns. In viticulture land acquisition, due diligence emphasizes soil quality, climate conditions, water rights, and vineyard history to ensure long-term agricultural viability and wine production potential. Explore expert strategies and key considerations to master due diligence in both sectors.

Exit Strategy

Private equity investors prioritize exit strategies that maximize returns through timely sales, IPOs, or secondary buyouts, leveraging market conditions and operational improvements in acquired companies. Viticulture land acquisition emphasizes long-term value appreciation and cash flow generation from grape production and wine sales, with exit options including land resale or vineyard operations transfer. Explore the strategic nuances of exit planning in these distinct investment landscapes to optimize your portfolio.

Asset Valuation

Private equity asset valuation relies heavily on cash flow projections, market multiples, and exit strategy potential, emphasizing financial return metrics and risk assessments. In contrast, viticulture land acquisition valuation incorporates soil quality, terroir uniqueness, agricultural productivity, and long-term vineyard development prospects, reflecting both intrinsic environmental factors and market trends in premium wine demand. Explore deeper insights into how valuation methodologies differ across these investment types for optimized portfolio decisions.

Source and External Links

Private equity - Wikipedia - Private equity involves investment managers raising funds from institutional investors to acquire equity stakes in private companies, aiming to generate returns through strategies like revenue growth, margin expansion, cash flow generation, and valuation multiple expansion over a 4-7 year horizon.

What is Private Equity? - BVCA - Private equity provides medium to long-term finance in exchange for equity stakes in mature companies, supporting management buyouts and working closely with management to drive sustainable growth through operational improvements and active ownership.

The Strategic Secret of Private Equity - Harvard Business Review - Private equity buyouts have grown dramatically, with firms acquiring and managing companies with a focus on large-scale deals and generating substantial returns despite increased market challenges.

dowidth.com

dowidth.com