Royalty streams offer investors a share of revenue generated by projects or intellectual property, providing ongoing income without assuming debt obligations. Debt investments involve lending capital to entities with fixed repayment schedules and interest, offering predictable returns but requiring principal repayment. Explore the differences in risk, return, and cash flow characteristics between royalty streams and debt to optimize your investment strategy.

Why it is important

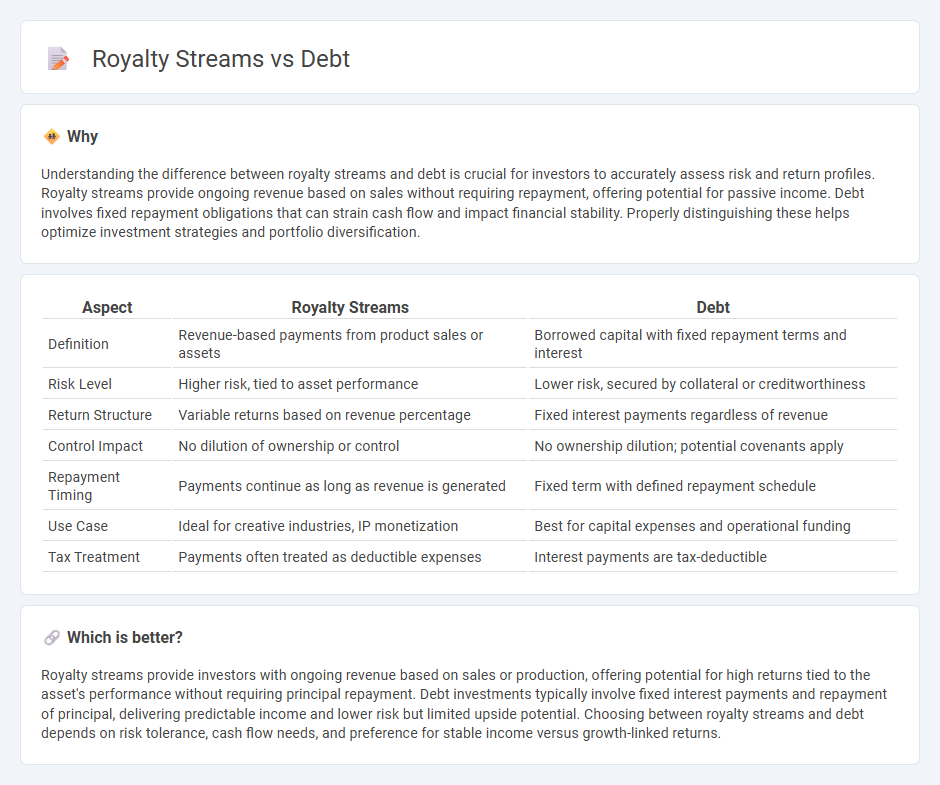

Understanding the difference between royalty streams and debt is crucial for investors to accurately assess risk and return profiles. Royalty streams provide ongoing revenue based on sales without requiring repayment, offering potential for passive income. Debt involves fixed repayment obligations that can strain cash flow and impact financial stability. Properly distinguishing these helps optimize investment strategies and portfolio diversification.

Comparison Table

| Aspect | Royalty Streams | Debt |

|---|---|---|

| Definition | Revenue-based payments from product sales or assets | Borrowed capital with fixed repayment terms and interest |

| Risk Level | Higher risk, tied to asset performance | Lower risk, secured by collateral or creditworthiness |

| Return Structure | Variable returns based on revenue percentage | Fixed interest payments regardless of revenue |

| Control Impact | No dilution of ownership or control | No ownership dilution; potential covenants apply |

| Repayment Timing | Payments continue as long as revenue is generated | Fixed term with defined repayment schedule |

| Use Case | Ideal for creative industries, IP monetization | Best for capital expenses and operational funding |

| Tax Treatment | Payments often treated as deductible expenses | Interest payments are tax-deductible |

Which is better?

Royalty streams provide investors with ongoing revenue based on sales or production, offering potential for high returns tied to the asset's performance without requiring principal repayment. Debt investments typically involve fixed interest payments and repayment of principal, delivering predictable income and lower risk but limited upside potential. Choosing between royalty streams and debt depends on risk tolerance, cash flow needs, and preference for stable income versus growth-linked returns.

Connection

Royalty streams provide a predictable cash flow that can be securitized or used as collateral for debt financing, enhancing a borrower's credit profile. Lenders assess the stability of royalty income when structuring debt agreements, influencing loan terms and interest rates. This connection allows investors to leverage royalty-based assets to obtain capital while mitigating risk through consistent revenue streams.

Key Terms

Principal Repayment

Debt instruments require scheduled principal repayments that reduce the outstanding loan balance over time, impacting issuer cash flow and credit metrics. Royalty streams often forgo fixed principal repayment, instead delivering returns based on revenue or production levels, offering flexible cash flow but variable total return. Explore further distinctions to optimize financing strategies for your business model.

Royalty Rate

Royalty streams involve a percentage of revenue paid to an investor based on sales performance, with the royalty rate determining the share earned; unlike fixed debt repayments, royalties fluctuate with business success. Typical royalty rates range from 5% to 15%, varying by industry and deal structure, impacting both investor returns and company cash flow flexibility. Explore deeper insights into optimizing royalty rates for balanced financial growth and investor alignment.

Maturity Date

Debt financing typically involves a fixed maturity date by which the principal must be repaid, providing borrowers with a clear timeline for debt clearance. Royalty streams, on the other hand, often lack a defined maturity date, as payments continue based on revenue generation or usage agreements, aligning investor returns with business performance. Explore the detailed differences and strategic implications of maturity dates in debt vs royalty financing.

Source and External Links

debt | Wex | US Law | LII / Legal Information Institute - Debt is a financial liability owed by a debtor to a creditor, typically composed of principal and interest, and can be issued by individuals, corporations, or governments in forms like loans, bonds, or notes.

Debt - Wikipedia - Debt is an obligation requiring one party (the debtor) to pay money borrowed or withheld from another (the creditor), with repayment terms and structures varying by agreement and often involving principal, interest, and potential collateral.

Debt Explained | consumer.gov - Debt occurs when you owe money to someone, such as from a loan or credit card, and managing or repaying debt responsibly can impact your credit history and financial health.

dowidth.com

dowidth.com