Whiskey cask investment offers potential high returns through asset appreciation and rarity, driven by aging processes and limited production, while jewelry investment is valued for its intrinsic beauty, craftsmanship, and market demand for precious metals and gemstones. Whiskey casks provide a liquid asset that can appreciate significantly over time, whereas jewelry often serves as a tangible store of value with strong resale markets. Explore the advantages and risks of each to determine the best option for your investment portfolio.

Why it is important

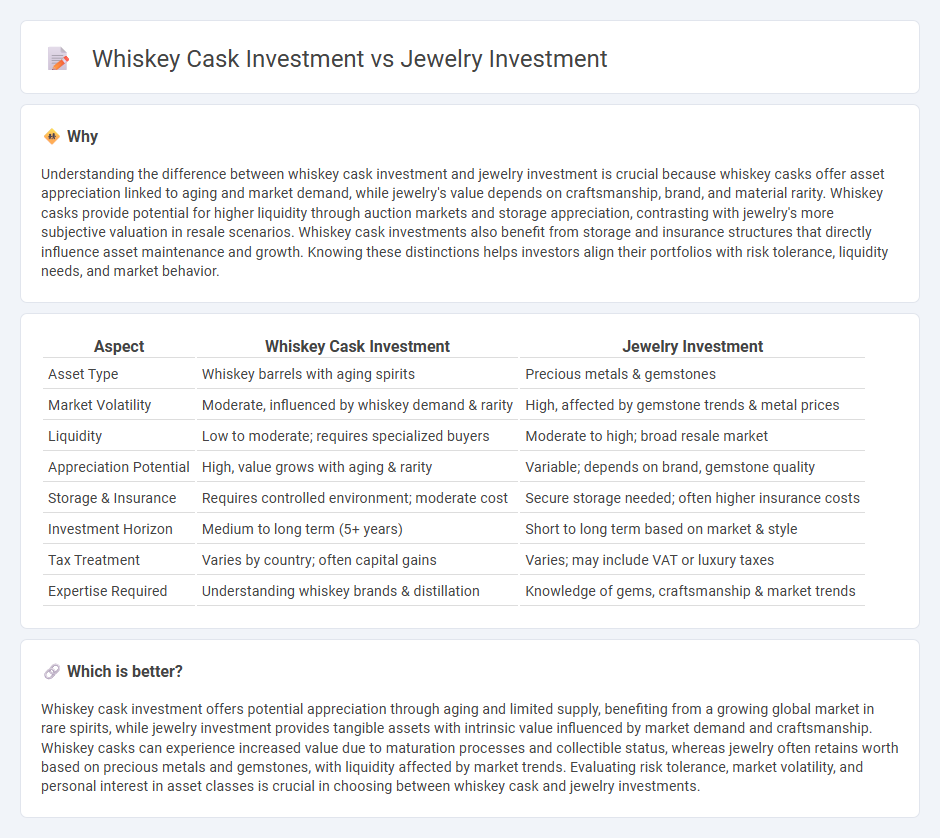

Understanding the difference between whiskey cask investment and jewelry investment is crucial because whiskey casks offer asset appreciation linked to aging and market demand, while jewelry's value depends on craftsmanship, brand, and material rarity. Whiskey casks provide potential for higher liquidity through auction markets and storage appreciation, contrasting with jewelry's more subjective valuation in resale scenarios. Whiskey cask investments also benefit from storage and insurance structures that directly influence asset maintenance and growth. Knowing these distinctions helps investors align their portfolios with risk tolerance, liquidity needs, and market behavior.

Comparison Table

| Aspect | Whiskey Cask Investment | Jewelry Investment |

|---|---|---|

| Asset Type | Whiskey barrels with aging spirits | Precious metals & gemstones |

| Market Volatility | Moderate, influenced by whiskey demand & rarity | High, affected by gemstone trends & metal prices |

| Liquidity | Low to moderate; requires specialized buyers | Moderate to high; broad resale market |

| Appreciation Potential | High, value grows with aging & rarity | Variable; depends on brand, gemstone quality |

| Storage & Insurance | Requires controlled environment; moderate cost | Secure storage needed; often higher insurance costs |

| Investment Horizon | Medium to long term (5+ years) | Short to long term based on market & style |

| Tax Treatment | Varies by country; often capital gains | Varies; may include VAT or luxury taxes |

| Expertise Required | Understanding whiskey brands & distillation | Knowledge of gems, craftsmanship & market trends |

Which is better?

Whiskey cask investment offers potential appreciation through aging and limited supply, benefiting from a growing global market in rare spirits, while jewelry investment provides tangible assets with intrinsic value influenced by market demand and craftsmanship. Whiskey casks can experience increased value due to maturation processes and collectible status, whereas jewelry often retains worth based on precious metals and gemstones, with liquidity affected by market trends. Evaluating risk tolerance, market volatility, and personal interest in asset classes is crucial in choosing between whiskey cask and jewelry investments.

Connection

Whiskey cask investment and jewelry investment both represent tangible asset classes that appeal to investors seeking diversification beyond traditional stocks and bonds. Each asset benefits from rarity and craftsmanship, with whiskey casks appreciating as aged spirits mature and jewelry gaining value through precious metals and gemstones. The intersection lies in their shared potential for long-term value growth driven by market demand, scarcity, and collector interest.

Key Terms

Liquidity

Jewelry investment offers moderate liquidity as pieces can be sold relatively quickly through auctions, dealers, or private sales, but prices may fluctuate significantly based on market trends and gem quality. Whiskey cask investment typically involves longer holding periods with limited buyers, making it less liquid, though some specialized online marketplaces provide emerging liquidity options. Discover detailed comparisons on liquidity and market potential to make informed investment choices.

Provenance

Provenance plays a crucial role in assessing the value of both jewelry and whiskey cask investments, as verified origin enhances authenticity and market appeal. Jewelry with documented history from renowned designers or royal collections often commands a premium, while whiskey casks tied to specific distilleries and vintage years attract collectors and investors seeking rare spirits. Explore the nuances of provenance to make informed decisions in these specialized asset markets.

Storage

Jewelry investment requires secure, climate-controlled storage to prevent tarnishing and damage, often necessitating specialized safes or professional vault services. Whiskey cask investment storage involves maintaining optimal environmental conditions, like consistent temperature and humidity, typically through bonded warehouses regulated for aging and legal compliance. Explore the best storage solutions to maximize the value and safety of your investments.

Source and External Links

The Best Jewelry Investment Pieces: What to Buy for Long-Term Value - High-quality diamond engagement rings and rare gemstones are top choices for jewelry investment, offering both timeless appeal and potential appreciation in value over time.

Jewelry as an Investment: 10 Key Factors to Consider - Focus on jewelry made from gold, platinum, or featuring high-quality, rare colored gemstones like sapphires, rubies, and emeralds, as their scarcity and quality drive long-term value.

Top Jewelry Investment Ideas for 2025 - Natural saltwater pearls, colored fancy diamonds, and rare collection-grade pieces are highlighted as promising jewelry investments for 2025, but thorough education and trusted connections are essential before buying.

dowidth.com

dowidth.com