Farmland funds offer investors exposure to agricultural land assets, delivering stable long-term returns through crop production and land appreciation. Infrastructure funds focus on investing in physical assets such as transportation, utilities, and energy facilities, providing steady income streams and inflation protection. Discover the key differences and benefits of each fund type to optimize your investment strategy.

Why it is important

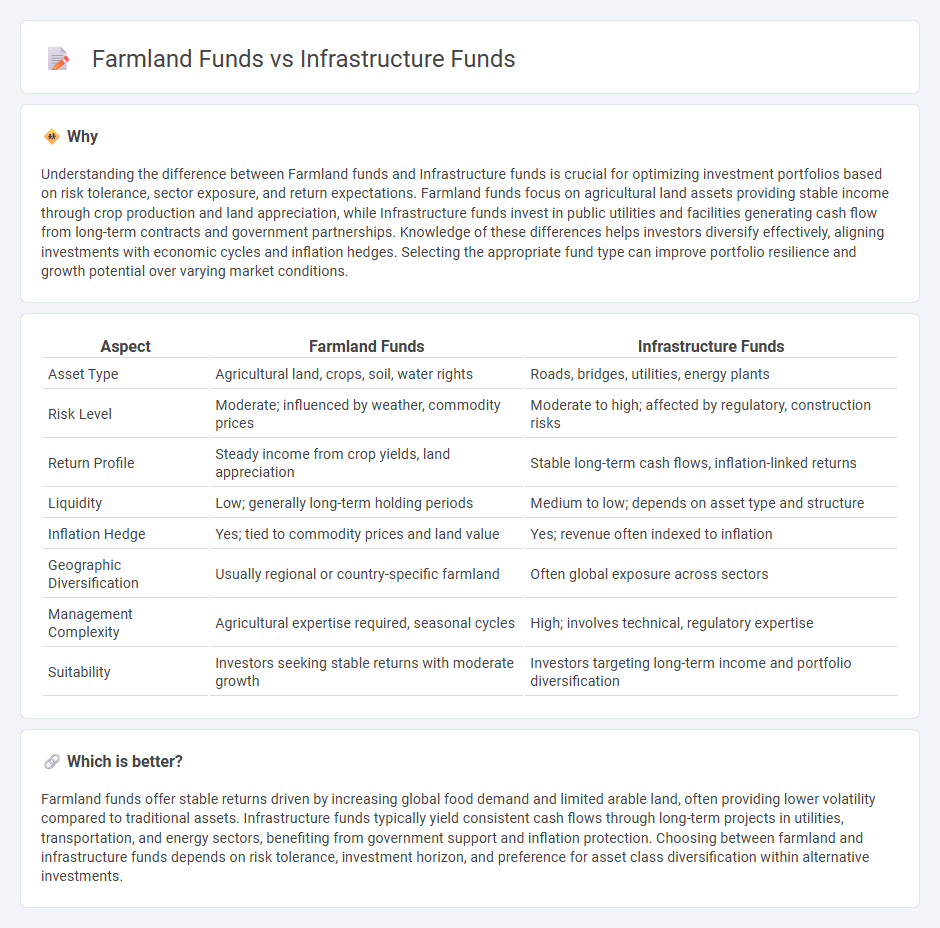

Understanding the difference between Farmland funds and Infrastructure funds is crucial for optimizing investment portfolios based on risk tolerance, sector exposure, and return expectations. Farmland funds focus on agricultural land assets providing stable income through crop production and land appreciation, while Infrastructure funds invest in public utilities and facilities generating cash flow from long-term contracts and government partnerships. Knowledge of these differences helps investors diversify effectively, aligning investments with economic cycles and inflation hedges. Selecting the appropriate fund type can improve portfolio resilience and growth potential over varying market conditions.

Comparison Table

| Aspect | Farmland Funds | Infrastructure Funds |

|---|---|---|

| Asset Type | Agricultural land, crops, soil, water rights | Roads, bridges, utilities, energy plants |

| Risk Level | Moderate; influenced by weather, commodity prices | Moderate to high; affected by regulatory, construction risks |

| Return Profile | Steady income from crop yields, land appreciation | Stable long-term cash flows, inflation-linked returns |

| Liquidity | Low; generally long-term holding periods | Medium to low; depends on asset type and structure |

| Inflation Hedge | Yes; tied to commodity prices and land value | Yes; revenue often indexed to inflation |

| Geographic Diversification | Usually regional or country-specific farmland | Often global exposure across sectors |

| Management Complexity | Agricultural expertise required, seasonal cycles | High; involves technical, regulatory expertise |

| Suitability | Investors seeking stable returns with moderate growth | Investors targeting long-term income and portfolio diversification |

Which is better?

Farmland funds offer stable returns driven by increasing global food demand and limited arable land, often providing lower volatility compared to traditional assets. Infrastructure funds typically yield consistent cash flows through long-term projects in utilities, transportation, and energy sectors, benefiting from government support and inflation protection. Choosing between farmland and infrastructure funds depends on risk tolerance, investment horizon, and preference for asset class diversification within alternative investments.

Connection

Farmland funds and infrastructure funds are interconnected through their shared emphasis on long-term, tangible asset investments that generate stable cash flows and hedge against inflation. Both fund types attract institutional investors seeking diversification by allocating capital into physical assets like agricultural land and essential infrastructure projects, including transportation and utilities. Their complementary roles in sustainable economic development enhance portfolio resilience while addressing global demands for food security and modern infrastructure.

Key Terms

**Infrastructure funds:**

Infrastructure funds invest in physical assets like transportation, energy, and utilities that provide stable, long-term cash flows and inflation protection. These funds attract investors seeking diversification through essential services and assets with government-backed revenues or long-term contracts. Explore the benefits and risk profiles of infrastructure funds to determine their role in a balanced investment portfolio.

Public-Private Partnership (PPP)

Infrastructure funds often prioritize large-scale projects such as highways, airports, and energy facilities developed through Public-Private Partnerships (PPP) that leverage both governmental support and private sector efficiency to deliver critical public assets. Farmland funds, by contrast, invest in agricultural land assets, benefiting from stable long-term returns linked to food demand but rarely engage directly in PPP structures. Explore how PPP models shape investment strategies and risk profiles in infrastructure versus farmland funds for a comprehensive understanding of these emerging asset classes.

Yield

Infrastructure funds offer steady income streams generated from assets like toll roads, utilities, and renewable energy projects, typically providing reliable and inflation-linked yields. Farmland funds generate returns primarily through agricultural production and land appreciation, often yielding moderate income with potential for capital growth influenced by commodity prices and land demand. Explore the distinct yield profiles and risk factors of infrastructure and farmland funds to make informed investment decisions.

Source and External Links

Infrastructure fund - Wikipedia - An infrastructure fund is a privately offered or publicly listed investment vehicle that invests directly or indirectly in infrastructure assets and related industries, such as transportation, energy, water, and communications systems.

Brookfield Global Listed Infrastructure Fund - This fund seeks total return through capital growth and current income by primarily investing in publicly traded infrastructure companies, while facing risks such as market volatility, economic cycles, and regulatory changes.

Infrastructure Fund - Cohen & Steers - The fund's primary objective is total return with an emphasis on income, achieved by investing in securities issued by infrastructure companies, and aims for potentially higher returns and lower volatility compared to global equities.

dowidth.com

dowidth.com