Investment in sports card fractionalization involves dividing ownership of valuable sports memorabilia into smaller, tradable shares, enabling broader participation with lower capital. In contrast, art fractionalization focuses on splitting ownership of high-value artworks, leveraging the growing market for fine art as an alternative asset class. Explore the nuances and benefits of each fractionalization method to diversify your investment portfolio effectively.

Why it is important

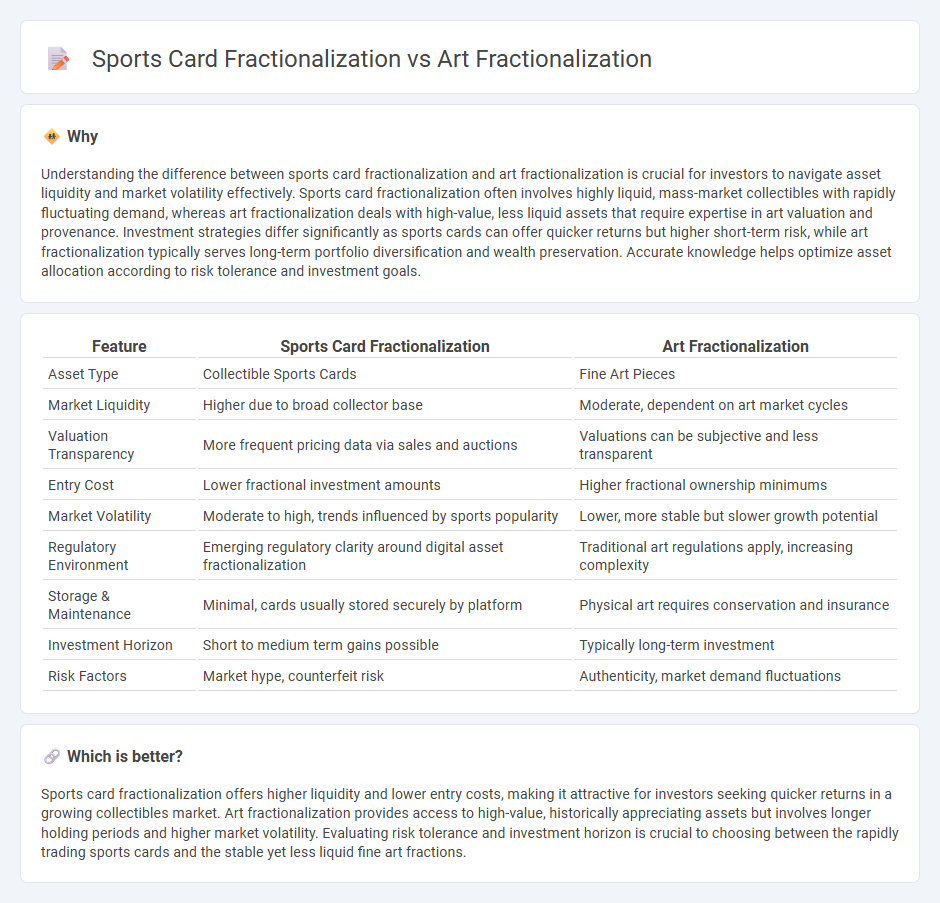

Understanding the difference between sports card fractionalization and art fractionalization is crucial for investors to navigate asset liquidity and market volatility effectively. Sports card fractionalization often involves highly liquid, mass-market collectibles with rapidly fluctuating demand, whereas art fractionalization deals with high-value, less liquid assets that require expertise in art valuation and provenance. Investment strategies differ significantly as sports cards can offer quicker returns but higher short-term risk, while art fractionalization typically serves long-term portfolio diversification and wealth preservation. Accurate knowledge helps optimize asset allocation according to risk tolerance and investment goals.

Comparison Table

| Feature | Sports Card Fractionalization | Art Fractionalization |

|---|---|---|

| Asset Type | Collectible Sports Cards | Fine Art Pieces |

| Market Liquidity | Higher due to broad collector base | Moderate, dependent on art market cycles |

| Valuation Transparency | More frequent pricing data via sales and auctions | Valuations can be subjective and less transparent |

| Entry Cost | Lower fractional investment amounts | Higher fractional ownership minimums |

| Market Volatility | Moderate to high, trends influenced by sports popularity | Lower, more stable but slower growth potential |

| Regulatory Environment | Emerging regulatory clarity around digital asset fractionalization | Traditional art regulations apply, increasing complexity |

| Storage & Maintenance | Minimal, cards usually stored securely by platform | Physical art requires conservation and insurance |

| Investment Horizon | Short to medium term gains possible | Typically long-term investment |

| Risk Factors | Market hype, counterfeit risk | Authenticity, market demand fluctuations |

Which is better?

Sports card fractionalization offers higher liquidity and lower entry costs, making it attractive for investors seeking quicker returns in a growing collectibles market. Art fractionalization provides access to high-value, historically appreciating assets but involves longer holding periods and higher market volatility. Evaluating risk tolerance and investment horizon is crucial to choosing between the rapidly trading sports cards and the stable yet less liquid fine art fractions.

Connection

Sports card fractionalization and art fractionalization both leverage blockchain technology to enable shared ownership of high-value collectibles, increasing liquidity and accessibility for investors. By dividing a single asset into smaller, tradable shares, these markets attract diverse investors who benefit from fractional profits without full ownership risks. This parallel approach transforms traditionally illiquid assets into dynamic investment opportunities, expanding participation beyond wealthy collectors.

Key Terms

Provenance

Art fractionalization relies heavily on provenance to authenticate the artwork and establish its historical ownership, providing transparency and boosting investor confidence. Sports card fractionalization emphasizes player achievements and card condition but often lacks the depth of provenance found in art, affecting its valuation and market trust. Explore how provenance impacts the value and trust in fractionalized assets across these markets.

Liquidity

Art fractionalization provides liquidity by enabling multiple investors to own a share of high-value artworks, often resulting in longer holding periods and less frequent trading due to the niche market. Sports card fractionalization enhances liquidity through a larger, more active marketplace where collectibles are regularly bought and sold, allowing for quicker asset turnover. Discover more about how these fractional ownership models impact investment opportunities and market dynamics.

Valuation

Art fractionalization and sports card fractionalization differ primarily in valuation dynamics, where art tends to derive value from historical significance and artist reputation, whereas sports cards gain value through player performance and rarity. Art fractional shares often experience slower liquidity but maintain steadier valuation over time, while sports card fractions can exhibit rapid price fluctuations influenced by market trends and player careers. Explore insightful comparisons and market analyses to understand the nuanced valuation of fractionalized assets.

Source and External Links

What is Art Fractionalization? - M&A Arts Sarl - Art fractionalization is the process of dividing an artwork into shares that investors can buy, enabling access to art investments with smaller capital and greater diversification.

Fractional Art Ownership and New Investment Models - MoMAA - Fractional art ownership involves purchasing shares in high-value artworks through legal entities, reducing entry barriers and offering professional management, liquidity, and portfolio diversification.

Guide to Fractional Art Investing - SoFi - Fractional art investing lets individuals buy shares in expensive artworks (without physical possession) via specialized platforms, with costs and fees varying by provider and investment amount.

dowidth.com

dowidth.com