Investing in music royalties offers a unique revenue stream through the collection of royalties generated by songs, providing consistent cash flow tied directly to music consumption patterns and intellectual property rights. Venture capital investing focuses on high-risk, high-reward allocations into startups and early-stage companies with potential for exponential growth but uncertain returns. Explore the comparative advantages and risk profiles of music royalties versus venture capital to optimize your investment portfolio.

Why it is important

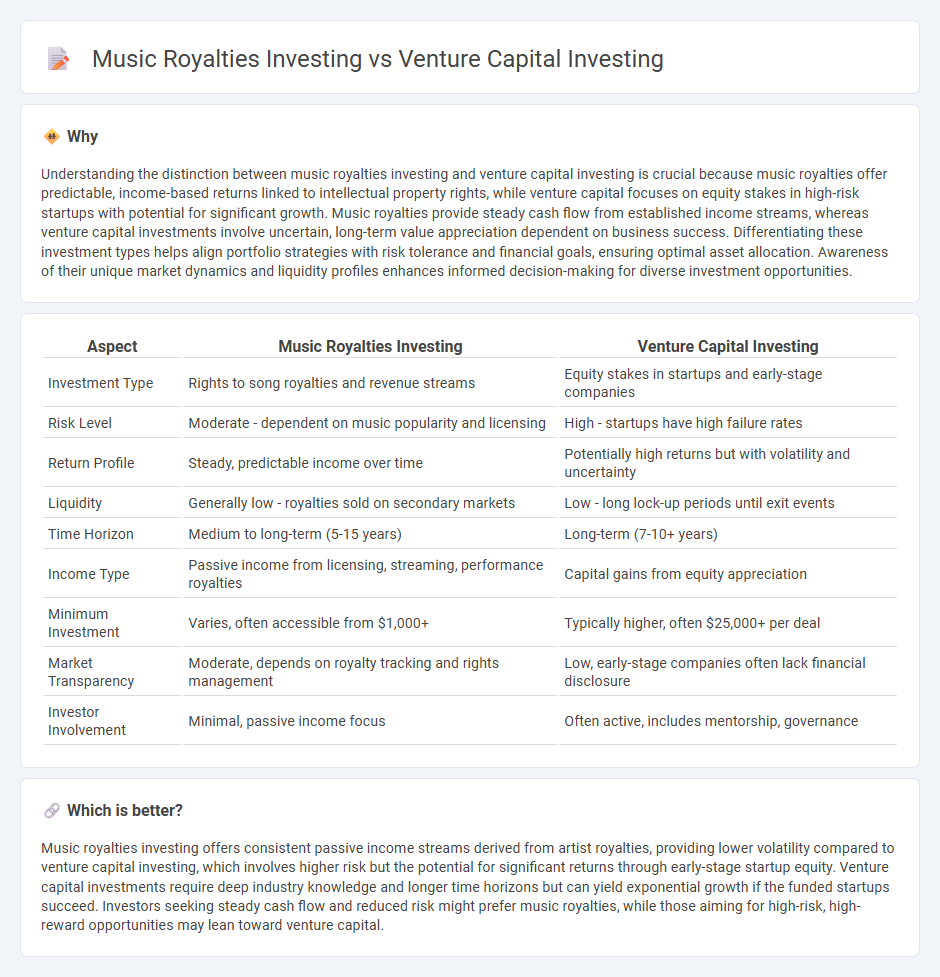

Understanding the distinction between music royalties investing and venture capital investing is crucial because music royalties offer predictable, income-based returns linked to intellectual property rights, while venture capital focuses on equity stakes in high-risk startups with potential for significant growth. Music royalties provide steady cash flow from established income streams, whereas venture capital investments involve uncertain, long-term value appreciation dependent on business success. Differentiating these investment types helps align portfolio strategies with risk tolerance and financial goals, ensuring optimal asset allocation. Awareness of their unique market dynamics and liquidity profiles enhances informed decision-making for diverse investment opportunities.

Comparison Table

| Aspect | Music Royalties Investing | Venture Capital Investing |

|---|---|---|

| Investment Type | Rights to song royalties and revenue streams | Equity stakes in startups and early-stage companies |

| Risk Level | Moderate - dependent on music popularity and licensing | High - startups have high failure rates |

| Return Profile | Steady, predictable income over time | Potentially high returns but with volatility and uncertainty |

| Liquidity | Generally low - royalties sold on secondary markets | Low - long lock-up periods until exit events |

| Time Horizon | Medium to long-term (5-15 years) | Long-term (7-10+ years) |

| Income Type | Passive income from licensing, streaming, performance royalties | Capital gains from equity appreciation |

| Minimum Investment | Varies, often accessible from $1,000+ | Typically higher, often $25,000+ per deal |

| Market Transparency | Moderate, depends on royalty tracking and rights management | Low, early-stage companies often lack financial disclosure |

| Investor Involvement | Minimal, passive income focus | Often active, includes mentorship, governance |

Which is better?

Music royalties investing offers consistent passive income streams derived from artist royalties, providing lower volatility compared to venture capital investing, which involves higher risk but the potential for significant returns through early-stage startup equity. Venture capital investments require deep industry knowledge and longer time horizons but can yield exponential growth if the funded startups succeed. Investors seeking steady cash flow and reduced risk might prefer music royalties, while those aiming for high-risk, high-reward opportunities may lean toward venture capital.

Connection

Music royalties investing and venture capital investing intersect through their shared focus on asset-backed growth opportunities and portfolio diversification. Music royalties offer steady, predictable cash flows derived from intellectual property rights, aligning with venture capital's emphasis on high-potential returns, especially when investing in music tech startups or entertainment ventures. This synergy allows investors to balance risk by combining the stability of royalty income with the growth potential of early-stage companies.

Key Terms

**Venture Capital Investing:**

Venture capital investing involves allocating funds to startups and early-stage companies with high growth potential, often in technology, healthcare, and fintech sectors, aiming for significant equity stakes and potentially high returns. It requires thorough due diligence, risk tolerance, and a long-term investment horizon, as liquidity is usually limited until exit events like IPOs or acquisitions occur. Explore detailed strategies and risk profiles to understand how venture capital can fit into your diversified investment portfolio.

Equity

Venture capital investing primarily involves acquiring equity stakes in early-stage companies with high growth potential, providing investors substantial control and future profit participation. Music royalties investing, while offering a form of equity through revenue-sharing rights, typically lacks direct ownership or control over the underlying intellectual property. Explore the distinct advantages and considerations of equity-focused investing in these sectors to make informed decisions.

Startup Valuation

Venture capital investing in startups involves analyzing financial metrics, market potential, and competitive landscape to determine startup valuation, often resulting in equity stakes with high growth potential but significant risk. Music royalties investing depends on the valuation of intellectual property rights, historical revenue streams, and artist popularity, offering steady cash flow but limited scalability compared to startups. Explore how these distinct valuation methods impact investment strategies and risk profiles.

Source and External Links

Venture Capital Funds: What they are & how to invest in them - Venture capital funds pool investor money to finance early-stage startups with high growth potential, providing both capital and active management support, and aim to exit through IPOs or acquisitions to generate returns.

What is venture capital? - Venture capital is private equity funding given to startups and early-stage companies in exchange for equity, with investors accepting high risk for the chance of substantial returns if the company succeeds or goes public.

Venture Capital: An Introduction - Venture capital investing offers portfolio diversification and exposure to innovation for investors, while providing startups with growth capital, expert guidance, and industry credibility.

dowidth.com

dowidth.com