Viticulture land acquisition offers tangible asset appreciation and the potential for high returns through wine production and land value increase, contrasting with bonds that provide fixed income and lower risk via interest payments. Investing in vineyard properties ties capital to agricultural cycles and market demand for premium wines, while bonds focus on steady cash flow and capital preservation. Explore the advantages of each investment type to determine the best fit for your financial goals.

Why it is important

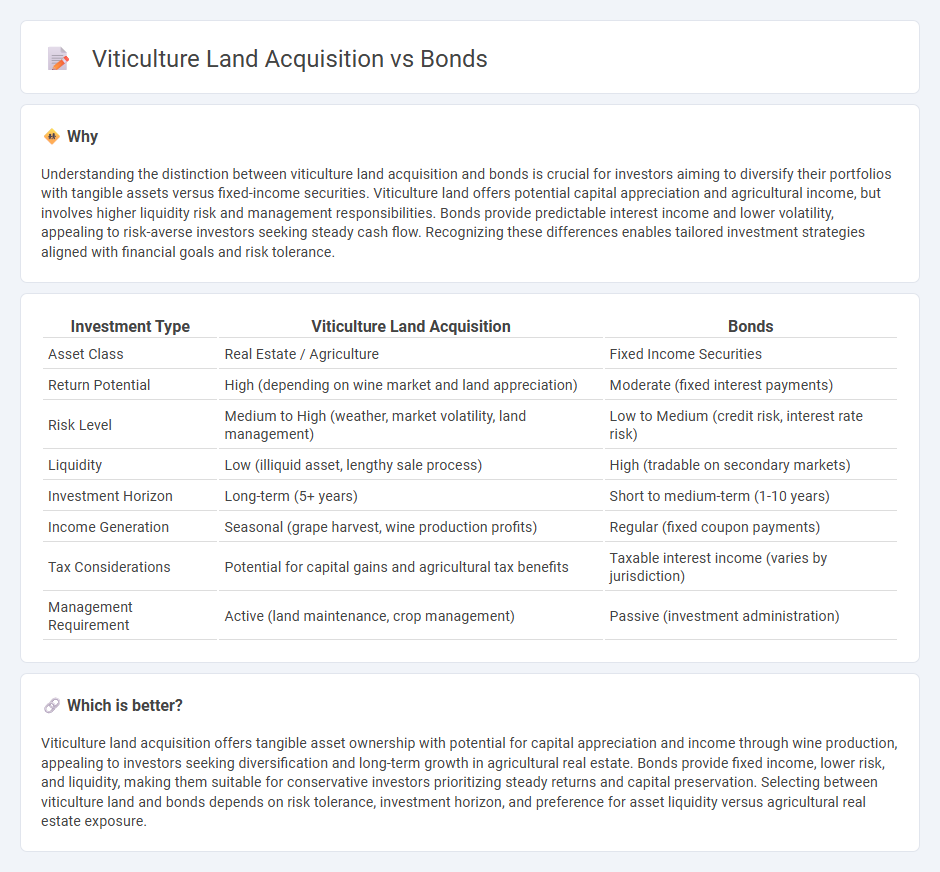

Understanding the distinction between viticulture land acquisition and bonds is crucial for investors aiming to diversify their portfolios with tangible assets versus fixed-income securities. Viticulture land offers potential capital appreciation and agricultural income, but involves higher liquidity risk and management responsibilities. Bonds provide predictable interest income and lower volatility, appealing to risk-averse investors seeking steady cash flow. Recognizing these differences enables tailored investment strategies aligned with financial goals and risk tolerance.

Comparison Table

| Investment Type | Viticulture Land Acquisition | Bonds |

|---|---|---|

| Asset Class | Real Estate / Agriculture | Fixed Income Securities |

| Return Potential | High (depending on wine market and land appreciation) | Moderate (fixed interest payments) |

| Risk Level | Medium to High (weather, market volatility, land management) | Low to Medium (credit risk, interest rate risk) |

| Liquidity | Low (illiquid asset, lengthy sale process) | High (tradable on secondary markets) |

| Investment Horizon | Long-term (5+ years) | Short to medium-term (1-10 years) |

| Income Generation | Seasonal (grape harvest, wine production profits) | Regular (fixed coupon payments) |

| Tax Considerations | Potential for capital gains and agricultural tax benefits | Taxable interest income (varies by jurisdiction) |

| Management Requirement | Active (land maintenance, crop management) | Passive (investment administration) |

Which is better?

Viticulture land acquisition offers tangible asset ownership with potential for capital appreciation and income through wine production, appealing to investors seeking diversification and long-term growth in agricultural real estate. Bonds provide fixed income, lower risk, and liquidity, making them suitable for conservative investors prioritizing steady returns and capital preservation. Selecting between viticulture land and bonds depends on risk tolerance, investment horizon, and preference for asset liquidity versus agricultural real estate exposure.

Connection

Investment in viticulture land acquisition offers tangible asset ownership with potential appreciation linked to vineyard productivity and wine market trends. Bonds provide a complementary strategy by delivering fixed-income returns that balance the higher risk and liquidity constraints of agricultural investments. Combining viticulture land with bond portfolios enhances diversification, stabilizing overall investment performance through exposure to both real estate and debt instruments.

Key Terms

Yield

Bonds typically offer fixed income yields that range from 2% to 6%, providing predictable returns with lower risk compared to agricultural investments. Viticulture land acquisition can yield substantial returns through grape production and wine sales, with potential annual yields varying from 4% to over 10% depending on climate, grape variety, and market demand. Explore detailed comparisons of bond yields versus viticulture land profits to make informed investment decisions.

Liquidity

Bonds offer high liquidity with the ability to buy or sell quickly on financial markets, providing easy access to cash compared to viticulture land acquisition, which is a long-term investment with limited resale opportunities and higher transaction costs. Viticulture land requires substantial capital and involves slower liquidity processes due to the specialized nature and location constraints of vineyards. Explore how liquidity considerations impact your investment strategy between bonds and viticulture land acquisition.

Appreciation Potential

Bonds offer predictable income and lower volatility but generally provide modest appreciation compared to viticulture land, which benefits from increasing global wine demand and limited arable land availability driving higher asset values. Viticulture land acquisition presents a unique opportunity for long-term appreciation due to strong market trends and the prestige associated with established wine regions, often outperforming traditional fixed-income investments. Explore the dynamics of both investment types to determine which aligns best with your financial goals.

Source and External Links

Bonds | Investor.gov - Bonds are debt securities where investors lend money to issuers like governments or corporations in exchange for interest payments and repayment of principal at maturity, providing predictable income and capital preservation.

Bond (finance) - Wikipedia - Bonds function as loans that finance long-term investments, are less volatile than stocks, are mainly held by institutions, and provide legal protections to bondholders in case of bankruptcy.

What is a Bond and How do they Work? - Vanguard - Bonds offer income through periodic interest and help reduce portfolio volatility, with their market value and interest rates influenced by the issuer's credit quality and bond maturity.

dowidth.com

dowidth.com