Carbon offset investing focuses on reducing carbon emissions through projects like renewable energy or reforestation that generate measurable carbon credits. Nature-based solutions investments prioritize ecosystem restoration and conservation to enhance biodiversity while capturing carbon naturally, offering co-benefits for climate resilience. Explore how these strategies differ in impact and financial potential to make informed investment decisions.

Why it is important

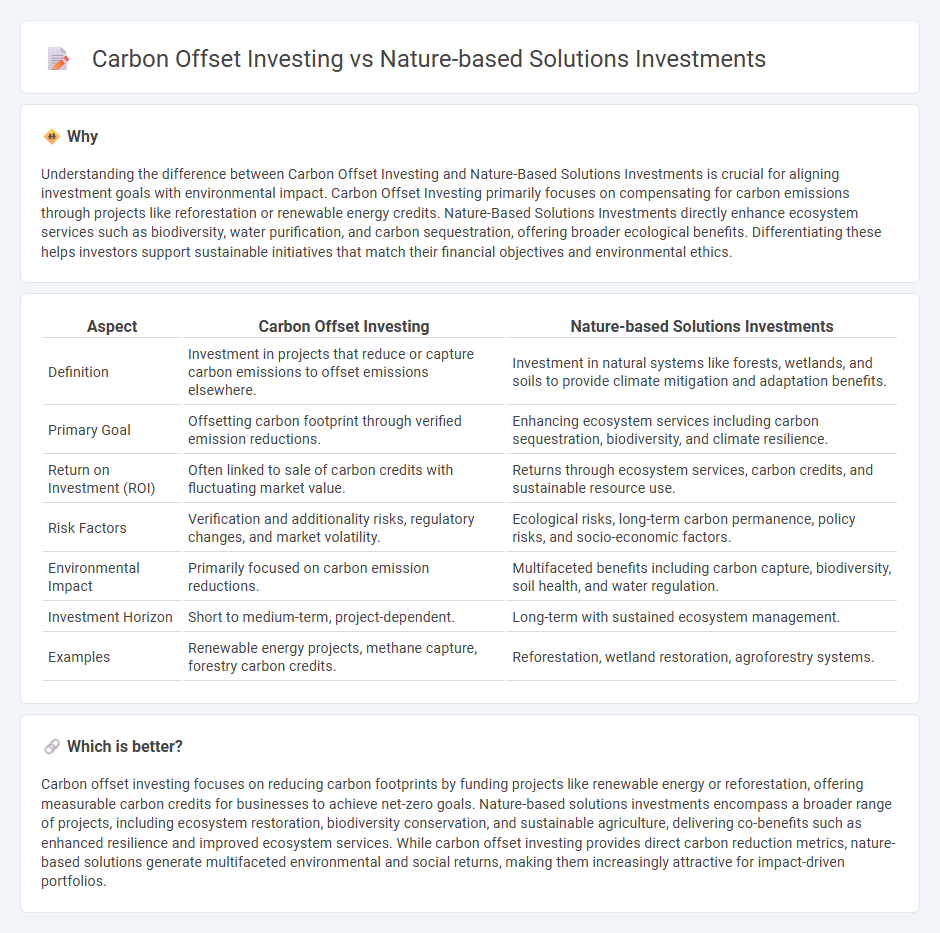

Understanding the difference between Carbon Offset Investing and Nature-Based Solutions Investments is crucial for aligning investment goals with environmental impact. Carbon Offset Investing primarily focuses on compensating for carbon emissions through projects like reforestation or renewable energy credits. Nature-Based Solutions Investments directly enhance ecosystem services such as biodiversity, water purification, and carbon sequestration, offering broader ecological benefits. Differentiating these helps investors support sustainable initiatives that match their financial objectives and environmental ethics.

Comparison Table

| Aspect | Carbon Offset Investing | Nature-based Solutions Investments |

|---|---|---|

| Definition | Investment in projects that reduce or capture carbon emissions to offset emissions elsewhere. | Investment in natural systems like forests, wetlands, and soils to provide climate mitigation and adaptation benefits. |

| Primary Goal | Offsetting carbon footprint through verified emission reductions. | Enhancing ecosystem services including carbon sequestration, biodiversity, and climate resilience. |

| Return on Investment (ROI) | Often linked to sale of carbon credits with fluctuating market value. | Returns through ecosystem services, carbon credits, and sustainable resource use. |

| Risk Factors | Verification and additionality risks, regulatory changes, and market volatility. | Ecological risks, long-term carbon permanence, policy risks, and socio-economic factors. |

| Environmental Impact | Primarily focused on carbon emission reductions. | Multifaceted benefits including carbon capture, biodiversity, soil health, and water regulation. |

| Investment Horizon | Short to medium-term, project-dependent. | Long-term with sustained ecosystem management. |

| Examples | Renewable energy projects, methane capture, forestry carbon credits. | Reforestation, wetland restoration, agroforestry systems. |

Which is better?

Carbon offset investing focuses on reducing carbon footprints by funding projects like renewable energy or reforestation, offering measurable carbon credits for businesses to achieve net-zero goals. Nature-based solutions investments encompass a broader range of projects, including ecosystem restoration, biodiversity conservation, and sustainable agriculture, delivering co-benefits such as enhanced resilience and improved ecosystem services. While carbon offset investing provides direct carbon reduction metrics, nature-based solutions generate multifaceted environmental and social returns, making them increasingly attractive for impact-driven portfolios.

Connection

Carbon offset investing and nature-based solutions investments are interconnected through their shared goal of mitigating climate change by reducing greenhouse gas emissions. Nature-based solutions, such as reforestation, wetland restoration, and soil carbon sequestration, provide measurable carbon offsets by enhancing natural carbon sinks. Investors channel funds into these projects to generate verified carbon credits, aligning environmental impact with financial returns while supporting biodiversity and ecosystem resilience.

Key Terms

Ecosystem Services

Investments in nature-based solutions emphasize enhancing ecosystem services such as biodiversity, water purification, and climate regulation, offering long-term ecological and social benefits beyond carbon sequestration. In contrast, carbon offset investing primarily targets emission reduction through projects like reforestation and renewable energy, often prioritizing carbon credits over broader ecosystem health. Explore the evolving roles of nature-based solutions and carbon offset investments in advancing sustainable environmental impact.

Additionality

Nature-based solutions investments prioritize ecosystem restoration and biodiversity enhancement, generating tangible environmental benefits beyond carbon sequestration. Carbon offset investing often centers on compensating emissions, with additionality requiring projects to demonstrate carbon reductions that wouldn't occur without the investment. Explore deeper insights into how additionality impacts the effectiveness and credibility of these sustainable investment approaches.

Carbon Credits

Nature-based solutions investments focus on restoring and conserving ecosystems such as forests, wetlands, and grasslands to enhance carbon sequestration and biodiversity preservation. Carbon offset investing involves purchasing carbon credits generated from projects that reduce greenhouse gas emissions, providing a market-driven way to compensate for unavoidable emissions. Explore more about how these strategies contribute to climate action and sustainable finance.

Source and External Links

Nature-based Solutions: Fostering integrity for ... - BlueOrchard - Nature-based solutions (NbS) are actions that address climate change, food and water security, and disaster risk through the protection, sustainable management, and restoration of ecosystems, offering environmental, social, and financial benefits.

NBS Invest: Accelerating Nature Based Solutions in Least ... - The World Bank's NBS Invest initiative aims to increase funding and mainstream nature-based solutions into climate and adaptation projects in the world's Least Developed Countries, supporting cost-effective climate mitigation, biodiversity conservation, and livelihood development.

Financial Sector Guidebook on Nature-Based Solutions Investment - This guidebook provides a framework for financial institutions to integrate nature-based solutions into their investment strategies, addressing key challenges and showcasing real-world examples of NBS finance.

dowidth.com

dowidth.com