Music royalties platforms offer investors unique opportunities to earn passive income through rights to songs and catalogs, leveraging the growing digital streaming market. Precious metals investment platforms provide a more traditional hedge against inflation and economic instability by facilitating the purchase and storage of gold, silver, and other tangible assets. Explore the advantages and risks of each investment type to determine the best fit for your portfolio strategy.

Why it is important

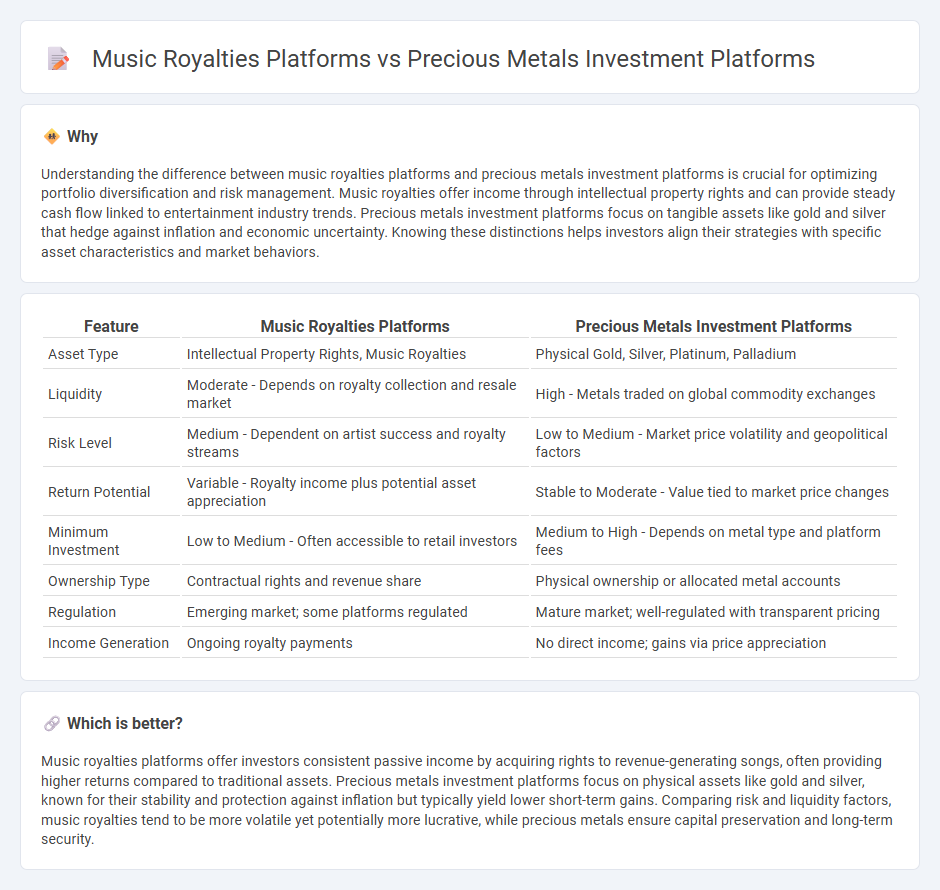

Understanding the difference between music royalties platforms and precious metals investment platforms is crucial for optimizing portfolio diversification and risk management. Music royalties offer income through intellectual property rights and can provide steady cash flow linked to entertainment industry trends. Precious metals investment platforms focus on tangible assets like gold and silver that hedge against inflation and economic uncertainty. Knowing these distinctions helps investors align their strategies with specific asset characteristics and market behaviors.

Comparison Table

| Feature | Music Royalties Platforms | Precious Metals Investment Platforms |

|---|---|---|

| Asset Type | Intellectual Property Rights, Music Royalties | Physical Gold, Silver, Platinum, Palladium |

| Liquidity | Moderate - Depends on royalty collection and resale market | High - Metals traded on global commodity exchanges |

| Risk Level | Medium - Dependent on artist success and royalty streams | Low to Medium - Market price volatility and geopolitical factors |

| Return Potential | Variable - Royalty income plus potential asset appreciation | Stable to Moderate - Value tied to market price changes |

| Minimum Investment | Low to Medium - Often accessible to retail investors | Medium to High - Depends on metal type and platform fees |

| Ownership Type | Contractual rights and revenue share | Physical ownership or allocated metal accounts |

| Regulation | Emerging market; some platforms regulated | Mature market; well-regulated with transparent pricing |

| Income Generation | Ongoing royalty payments | No direct income; gains via price appreciation |

Which is better?

Music royalties platforms offer investors consistent passive income by acquiring rights to revenue-generating songs, often providing higher returns compared to traditional assets. Precious metals investment platforms focus on physical assets like gold and silver, known for their stability and protection against inflation but typically yield lower short-term gains. Comparing risk and liquidity factors, music royalties tend to be more volatile yet potentially more lucrative, while precious metals ensure capital preservation and long-term security.

Connection

Music royalties platforms and precious metals investment platforms both offer alternative investments that diversify traditional portfolios by providing steady income streams and hedging against market volatility. These platforms utilize digital technology to enable fractional ownership and liquidity in assets typically considered illiquid, such as royalty rights or physical gold and silver. Investors benefit from asset-backed revenue sources while gaining exposure to non-correlated market sectors that enhance long-term financial stability.

Key Terms

**Precious metals investment platforms:**

Precious metals investment platforms offer direct access to gold, silver, platinum, and palladium markets, providing secure storage options and transparent pricing based on real-time market data. These platforms emphasize liquidity, market depth, and regulatory compliance to ensure investor confidence and portfolio diversification. Explore how precious metals platforms compare to alternative asset investments like music royalties by learning more about their unique benefits and risks.

Bullion

Bullion investment platforms specialize in trading physical precious metals such as gold, silver, platinum, and palladium, offering secure storage and verified asset authenticity to protect market value. Music royalties platforms provide investors with rights to earnings from recorded music, which can offer diversified income streams but are influenced by market trends and copyright laws. Explore the advantages and risks of bullion investments to enhance your diversified portfolio strategy.

Vault storage

Precious metals investment platforms offer secure vault storage with insured, climate-controlled facilities designed to protect assets like gold, silver, and platinum from theft and environmental damage. Music royalties platforms, on the other hand, provide digital rights management and revenue tracking without physical storage, focusing on managing intellectual property and income streams. Explore the distinct security and management features that differentiate vault storage in precious metals from digital asset handling in music royalties.

Source and External Links

Best Gold and Silver App: Online Platforms for Precious Metal Investments - American Hartford Gold, Birch Gold Group, and Noble Gold Investments stand out for offering accessible investments, diverse product ranges including gold, silver, platinum, and palladium, with strong customer service and transparent pricing, catering to both new and experienced investors without high minimum amounts.

BullionVault: Buy Gold, Silver and Platinum Bullion Online - BullionVault is the largest online investment gold service globally, providing private investors with low-cost access to professional bullion markets, insured storage in multiple vaults worldwide, easy buying/selling with no penalties, and a risk-free silver offer to start investing.

GBI: Physical Precious Metals for Wealth Management - GBI caters to wealth managers and institutional investors by integrating physical precious metals trading and secure storage directly within trading systems, enabling real-time trading and portfolio diversification with metals like gold and silver under secure vault custody.

dowidth.com

dowidth.com