Art flipping involves buying and selling artwork for profit, capitalizing on trends in the art market and the unique appeal of creative assets. Classic car flipping focuses on acquiring vintage vehicles, restoring them, and reselling at a premium due to their historical value and collector demand. Explore the key differences and potential returns of these investment strategies to determine which suits your portfolio best.

Why it is important

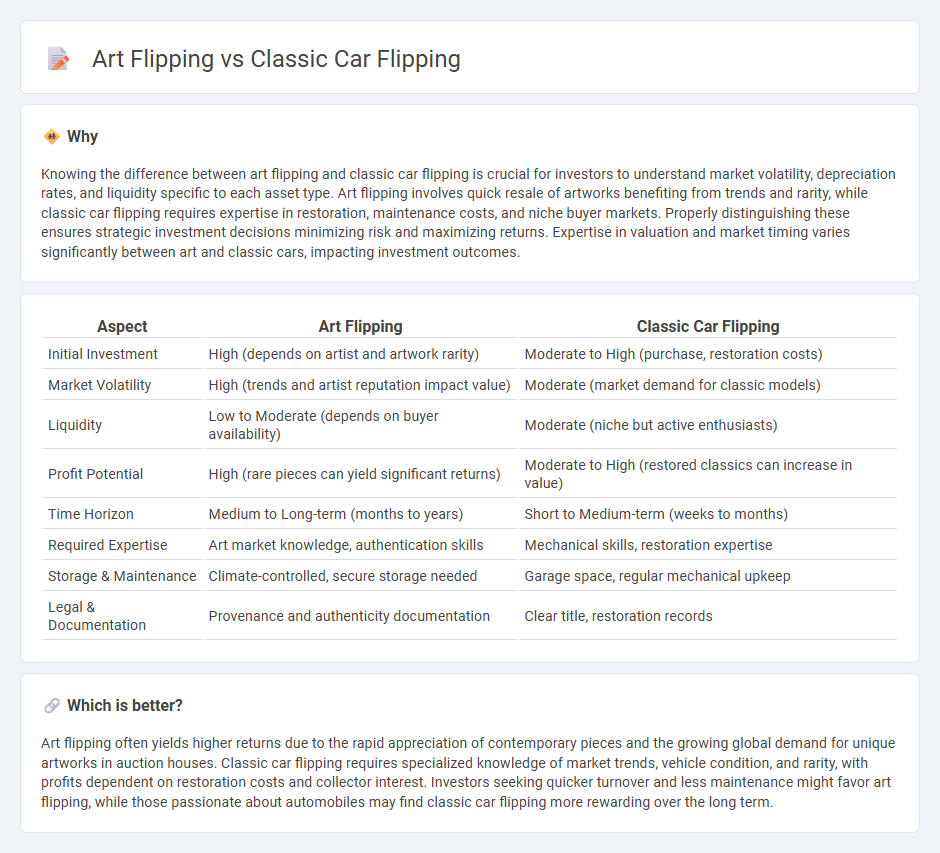

Knowing the difference between art flipping and classic car flipping is crucial for investors to understand market volatility, depreciation rates, and liquidity specific to each asset type. Art flipping involves quick resale of artworks benefiting from trends and rarity, while classic car flipping requires expertise in restoration, maintenance costs, and niche buyer markets. Properly distinguishing these ensures strategic investment decisions minimizing risk and maximizing returns. Expertise in valuation and market timing varies significantly between art and classic cars, impacting investment outcomes.

Comparison Table

| Aspect | Art Flipping | Classic Car Flipping |

|---|---|---|

| Initial Investment | High (depends on artist and artwork rarity) | Moderate to High (purchase, restoration costs) |

| Market Volatility | High (trends and artist reputation impact value) | Moderate (market demand for classic models) |

| Liquidity | Low to Moderate (depends on buyer availability) | Moderate (niche but active enthusiasts) |

| Profit Potential | High (rare pieces can yield significant returns) | Moderate to High (restored classics can increase in value) |

| Time Horizon | Medium to Long-term (months to years) | Short to Medium-term (weeks to months) |

| Required Expertise | Art market knowledge, authentication skills | Mechanical skills, restoration expertise |

| Storage & Maintenance | Climate-controlled, secure storage needed | Garage space, regular mechanical upkeep |

| Legal & Documentation | Provenance and authenticity documentation | Clear title, restoration records |

Which is better?

Art flipping often yields higher returns due to the rapid appreciation of contemporary pieces and the growing global demand for unique artworks in auction houses. Classic car flipping requires specialized knowledge of market trends, vehicle condition, and rarity, with profits dependent on restoration costs and collector interest. Investors seeking quicker turnover and less maintenance might favor art flipping, while those passionate about automobiles may find classic car flipping more rewarding over the long term.

Connection

Art flipping and classic car flipping both rely on identifying undervalued assets with high potential for appreciation in niche markets. Savvy investors apply market knowledge, trend analysis, and restoration skills to maximize resale value and achieve substantial returns. Both types of flipping require understanding provenance, authenticity, and condition to capitalize on investor demand and collector interest.

Key Terms

**Classic Car Flipping:**

Classic car flipping involves purchasing vintage vehicles at undervalued prices, restoring them to enhance both aesthetic appeal and mechanical performance, then reselling at a profit in collectors' markets. Success depends on in-depth knowledge of car models, restoration costs, and market trends to identify undervalued gems and maximize return on investment. Explore the nuances of classic car flipping to unlock profitable investment strategies.

Restoration

Classic car flipping emphasizes meticulous restoration to enhance vehicle value through authentic parts and expert craftsmanship, appealing to collectors and enthusiasts. Art flipping involves restoring artwork to preserve original aesthetics and potentially increase market worth, often requiring specialized conservation techniques. Discover more about the restoration nuances that differentiate classic car flipping from art flipping.

Provenance

Classic car flipping relies heavily on provenance, as well-documented ownership history and original parts verification significantly enhance vehicle value and desirability among collectors. Art flipping also centers on provenance, where authenticated ownership lineage and exhibition history boost artwork credibility and market price. Explore how provenance shapes asset valuation in both markets for deeper insights.

Source and External Links

The most desirable cars to flip for a profit - Andys Auto - Classic car flipping can be profitable, especially with models like GM A-body cars (1964-72) such as Pontiac GTO and Chevrolet Chevelle, which are easier to sell due to their desirable performance and classic look; finding cars to flip often involves networking with collectors, checking classified ads, or visiting salvage yards.

Have People Finally Stopped Flipping Collector Cars? - Hagerty - The trend of flipping collector cars--buying and reselling within a year for quick profit--has slowed as the market is no longer driven by speculation, giving buyers more control, though some quick flips still occur.

Flipping Cars| Off-Topic Discussion forum | Grassroots Motorsports - Car flipping involves buying cheap vehicles, cleaning, or making minor repairs, and reselling them for profit, but the return on investment can be low especially on low-cost cars, and the market shows signs of normalizing after a bubble.

dowidth.com

dowidth.com