Spice trading historically represented a lucrative commodity market driven by global demand for exotic flavors, while precious metals trading focuses on valuable assets like gold and silver that act as a hedge against inflation and currency fluctuations. Both markets offer distinct risk profiles and profit potentials, influenced by geopolitical factors and supply chain dynamics. Explore deeper insights into how these trading avenues can diversify your investment portfolio.

Why it is important

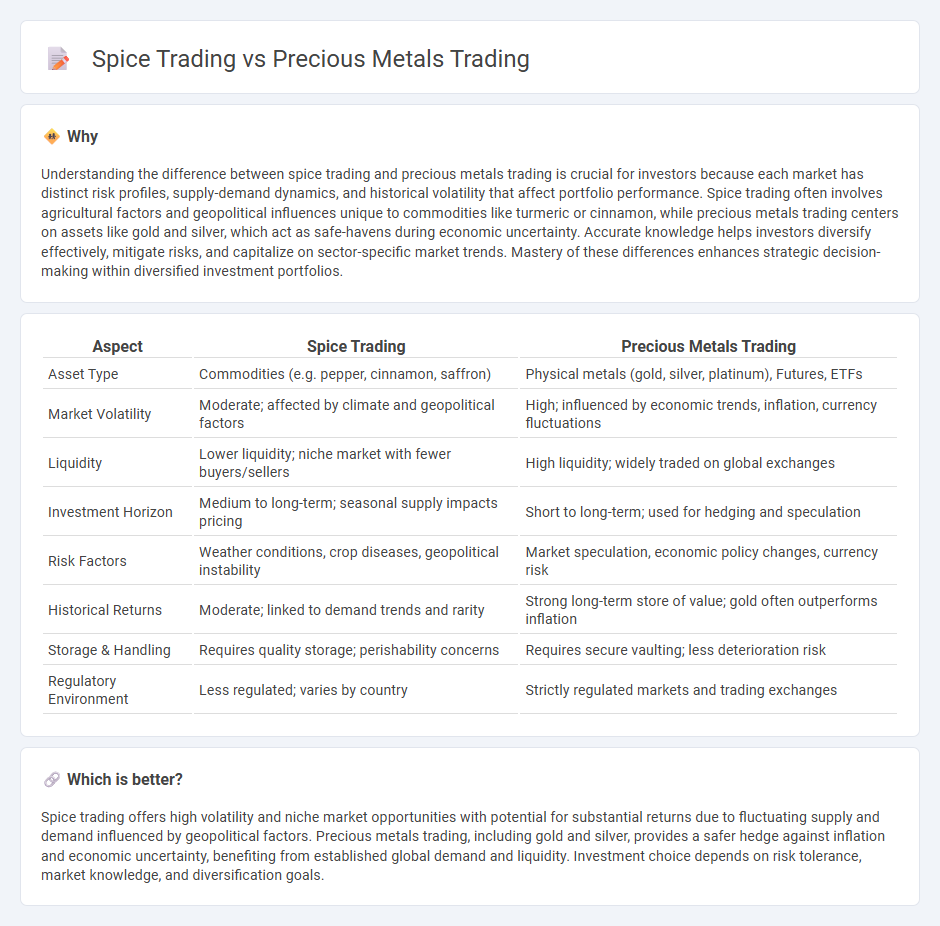

Understanding the difference between spice trading and precious metals trading is crucial for investors because each market has distinct risk profiles, supply-demand dynamics, and historical volatility that affect portfolio performance. Spice trading often involves agricultural factors and geopolitical influences unique to commodities like turmeric or cinnamon, while precious metals trading centers on assets like gold and silver, which act as safe-havens during economic uncertainty. Accurate knowledge helps investors diversify effectively, mitigate risks, and capitalize on sector-specific market trends. Mastery of these differences enhances strategic decision-making within diversified investment portfolios.

Comparison Table

| Aspect | Spice Trading | Precious Metals Trading |

|---|---|---|

| Asset Type | Commodities (e.g. pepper, cinnamon, saffron) | Physical metals (gold, silver, platinum), Futures, ETFs |

| Market Volatility | Moderate; affected by climate and geopolitical factors | High; influenced by economic trends, inflation, currency fluctuations |

| Liquidity | Lower liquidity; niche market with fewer buyers/sellers | High liquidity; widely traded on global exchanges |

| Investment Horizon | Medium to long-term; seasonal supply impacts pricing | Short to long-term; used for hedging and speculation |

| Risk Factors | Weather conditions, crop diseases, geopolitical instability | Market speculation, economic policy changes, currency risk |

| Historical Returns | Moderate; linked to demand trends and rarity | Strong long-term store of value; gold often outperforms inflation |

| Storage & Handling | Requires quality storage; perishability concerns | Requires secure vaulting; less deterioration risk |

| Regulatory Environment | Less regulated; varies by country | Strictly regulated markets and trading exchanges |

Which is better?

Spice trading offers high volatility and niche market opportunities with potential for substantial returns due to fluctuating supply and demand influenced by geopolitical factors. Precious metals trading, including gold and silver, provides a safer hedge against inflation and economic uncertainty, benefiting from established global demand and liquidity. Investment choice depends on risk tolerance, market knowledge, and diversification goals.

Connection

Spice trading and precious metals trading share historical significance as early forms of global commerce, where wealth accumulation often involved exchanging valuable commodities like spices for gold and silver. Both markets rely on supply and demand dynamics influenced by geopolitical events, trade routes, and scarcity, impacting investment strategies. Investing in these sectors highlights diversification opportunities, combining tangible assets with potential inflation hedges.

Key Terms

Hedging

Precious metals trading offers robust hedging opportunities against market volatility and inflation, using instruments like futures and options to secure asset value. Spice trading, while influenced by agricultural and climatic factors, provides hedging primarily through commodity contracts that mitigate risks related to supply fluctuations. Explore our detailed analysis to understand the strategic advantages of hedging in both markets.

Spot price

Precious metals trading, such as gold and silver, relies heavily on spot prices determined by global exchanges like COMEX and LBMA, reflecting immediate supply and demand dynamics. Spice trading spot prices fluctuate based on seasonal harvests, weather conditions, and geopolitical impacts in key producing regions like India and Vietnam. Explore detailed market factors influencing spot price volatility in both sectors for a comprehensive understanding.

Liquidity

Precious metals trading offers high liquidity due to the constant global demand for gold, silver, platinum, and palladium in financial markets and industrial applications. Spice trading, while historically significant, typically experiences lower liquidity because it is subject to seasonal harvests and regional supply chain constraints. Explore detailed market dynamics and liquidity analysis to make informed trading decisions.

Source and External Links

How and Where Precious Metals are Traded - Precious metals like gold, silver, platinum, and palladium are traded globally through futures contracts on exchanges such as COMEX, NYMEX, and Asian markets, with trading volumes far exceeding actual mined production due to private market activity and investment funds.

What Are Precious Metals and How Do You Trade Them? - IG - Trading precious metals typically involves speculating on price movements using derivatives such as CFDs on futures, spot prices, and options without taking physical delivery, focusing on gold, silver, platinum, and palladium as investment and hedging instruments.

Precious metals services- Gold, silver futures trading - StoneX provides a full suite of physical and financial precious metals trading services, including spot and futures trading, margin facilities, options, hedging solutions, and real-time trading platforms enabling global liquidity access and market execution.

dowidth.com

dowidth.com