Royalty stream investing provides steady income through ongoing cash flows derived from intellectual property or natural resources, while growth investing focuses on capital appreciation by targeting companies with high potential for expansion. Royalty streams offer lower risk and predictable returns, contrasting with the higher volatility and potentially greater rewards of growth stocks. Discover how each strategy can fit your portfolio goals by exploring their distinct benefits and risks.

Why it is important

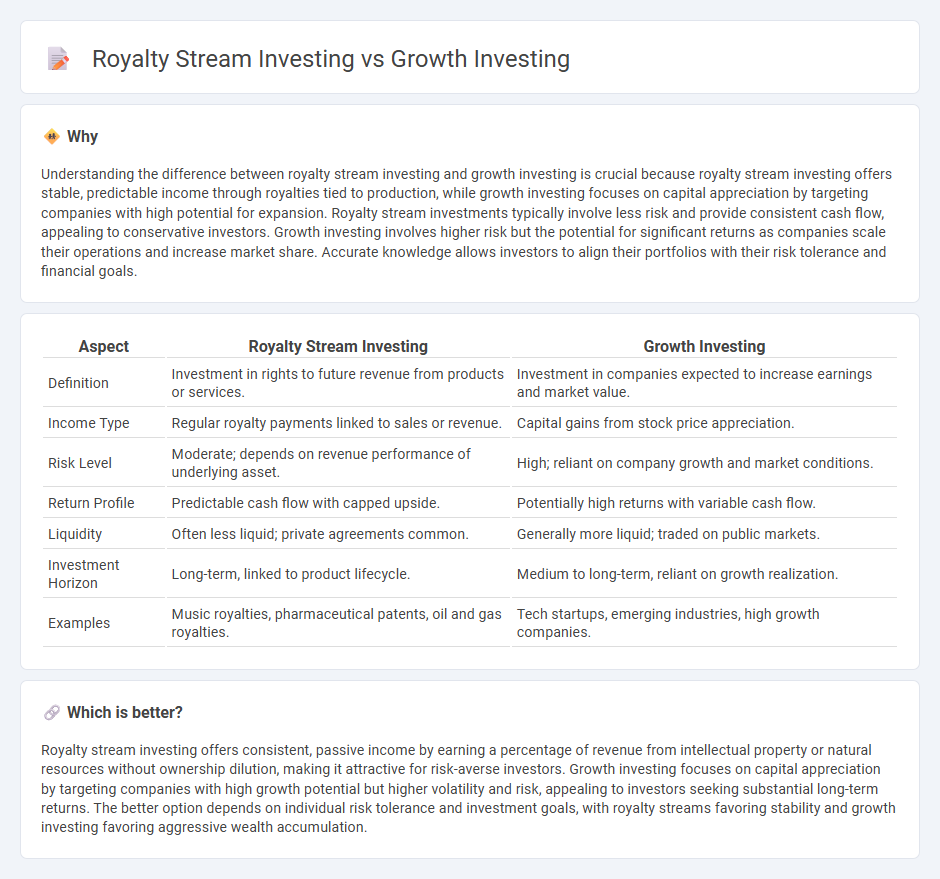

Understanding the difference between royalty stream investing and growth investing is crucial because royalty stream investing offers stable, predictable income through royalties tied to production, while growth investing focuses on capital appreciation by targeting companies with high potential for expansion. Royalty stream investments typically involve less risk and provide consistent cash flow, appealing to conservative investors. Growth investing involves higher risk but the potential for significant returns as companies scale their operations and increase market share. Accurate knowledge allows investors to align their portfolios with their risk tolerance and financial goals.

Comparison Table

| Aspect | Royalty Stream Investing | Growth Investing |

|---|---|---|

| Definition | Investment in rights to future revenue from products or services. | Investment in companies expected to increase earnings and market value. |

| Income Type | Regular royalty payments linked to sales or revenue. | Capital gains from stock price appreciation. |

| Risk Level | Moderate; depends on revenue performance of underlying asset. | High; reliant on company growth and market conditions. |

| Return Profile | Predictable cash flow with capped upside. | Potentially high returns with variable cash flow. |

| Liquidity | Often less liquid; private agreements common. | Generally more liquid; traded on public markets. |

| Investment Horizon | Long-term, linked to product lifecycle. | Medium to long-term, reliant on growth realization. |

| Examples | Music royalties, pharmaceutical patents, oil and gas royalties. | Tech startups, emerging industries, high growth companies. |

Which is better?

Royalty stream investing offers consistent, passive income by earning a percentage of revenue from intellectual property or natural resources without ownership dilution, making it attractive for risk-averse investors. Growth investing focuses on capital appreciation by targeting companies with high growth potential but higher volatility and risk, appealing to investors seeking substantial long-term returns. The better option depends on individual risk tolerance and investment goals, with royalty streams favoring stability and growth investing favoring aggressive wealth accumulation.

Connection

Royalty stream investing and growth investing both focus on maximizing long-term returns by targeting revenue-generating assets with scalable potential. Royalty streams provide consistent income through a percentage of sales or profits, aligning with growth investing's emphasis on companies reinvesting earnings into expansion. Investors leveraging both strategies benefit from diversified cash flow sources while capitalizing on accelerating business growth and market demand.

Key Terms

Capital Appreciation

Growth investing targets companies with high potential for capital appreciation by reinvesting earnings to fuel expansion, often leading to significant share price increases. Royalty stream investing provides steady income through contractual payments tied to revenue or production, offering lower volatility but limited capital growth. Explore how these strategies align with your financial goals for optimal capital appreciation.

Dividend Yield

Growth investing targets companies with high potential for revenue and earnings expansion, often resulting in lower or no dividend yields as profits are reinvested. Royalty stream investing offers steady, predictable income through royalties, typically providing a higher and consistent dividend yield due to contractual revenue sharing. Explore the advantages and considerations of both strategies to optimize your dividend yield-focused portfolio.

Passive Income

Growth investing targets companies with high potential for capital appreciation by investing in stocks poised for significant revenue and earnings expansion, often in emerging sectors like technology and healthcare. Royalty stream investing involves purchasing rights to a share of future revenue from intellectual property, natural resources, or franchises, generating steady passive income with lower market volatility. Explore the detailed benefits and risks of each investment strategy to enhance your passive income portfolio.

Source and External Links

Growth investing: What it is and how to build a high-growth portfolio - Growth investing focuses on companies expected to grow at an above-average rate, benefiting from strong earnings potential, compounding returns, and market innovation in sectors like tech and renewable energy.

Growth investing - Wikipedia - Growth investing is an investment strategy targeting companies with above-average growth signs, often paying premium prices, and was popularized by Thomas Rowe Price Jr., known as the father of growth investing.

3 Ways to Invest for Potential Growth | Morgan Stanley at Work - Growth investing involves picking stocks expected to grow faster than the market, often volatile and without dividends, suitable for investors with a longer time horizon willing to accept higher risk for capital appreciation.

dowidth.com

dowidth.com