Music royalties investment offers steady cash flow through continuous revenue streams generated by song plays across various platforms, providing liquidity and passive income potential. Art investment, while often more volatile, involves acquiring physical or digital artworks with prospects of significant appreciation based on artist reputation and market trends. Discover the key differences and advantages of each investment type to make informed financial decisions.

Why it is important

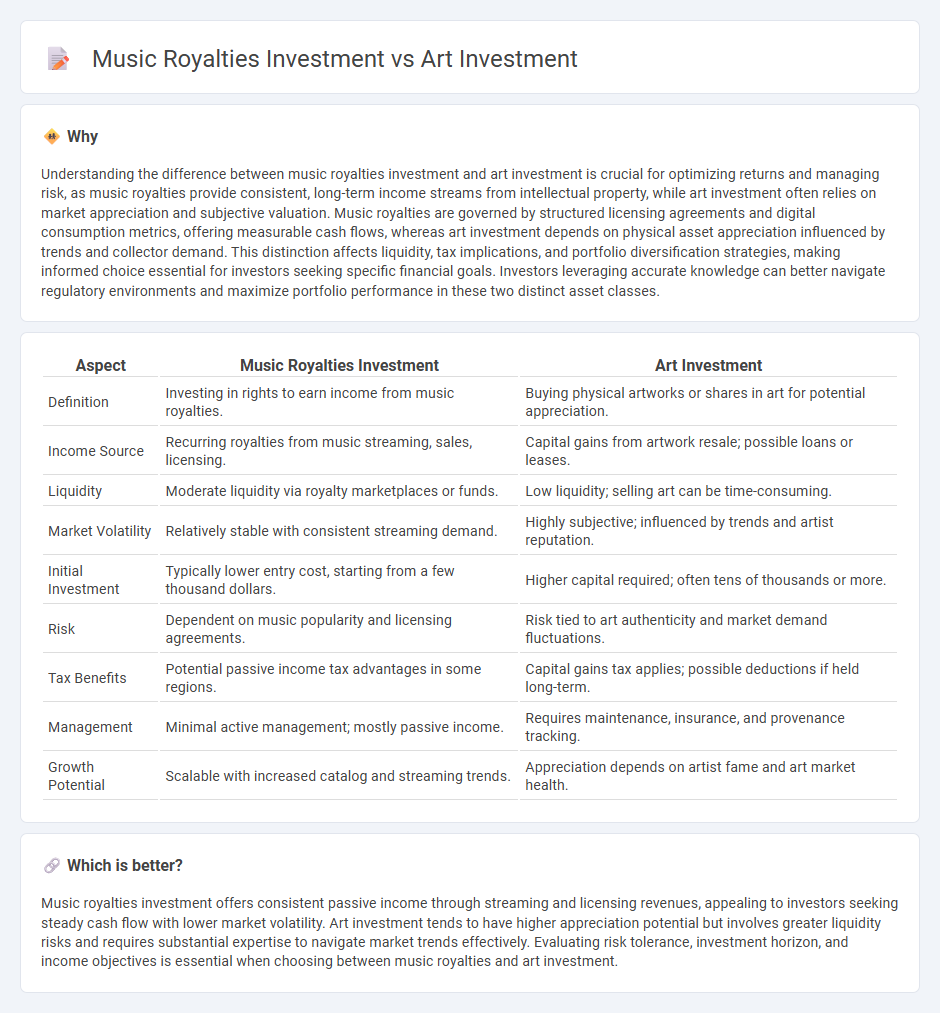

Understanding the difference between music royalties investment and art investment is crucial for optimizing returns and managing risk, as music royalties provide consistent, long-term income streams from intellectual property, while art investment often relies on market appreciation and subjective valuation. Music royalties are governed by structured licensing agreements and digital consumption metrics, offering measurable cash flows, whereas art investment depends on physical asset appreciation influenced by trends and collector demand. This distinction affects liquidity, tax implications, and portfolio diversification strategies, making informed choice essential for investors seeking specific financial goals. Investors leveraging accurate knowledge can better navigate regulatory environments and maximize portfolio performance in these two distinct asset classes.

Comparison Table

| Aspect | Music Royalties Investment | Art Investment |

|---|---|---|

| Definition | Investing in rights to earn income from music royalties. | Buying physical artworks or shares in art for potential appreciation. |

| Income Source | Recurring royalties from music streaming, sales, licensing. | Capital gains from artwork resale; possible loans or leases. |

| Liquidity | Moderate liquidity via royalty marketplaces or funds. | Low liquidity; selling art can be time-consuming. |

| Market Volatility | Relatively stable with consistent streaming demand. | Highly subjective; influenced by trends and artist reputation. |

| Initial Investment | Typically lower entry cost, starting from a few thousand dollars. | Higher capital required; often tens of thousands or more. |

| Risk | Dependent on music popularity and licensing agreements. | Risk tied to art authenticity and market demand fluctuations. |

| Tax Benefits | Potential passive income tax advantages in some regions. | Capital gains tax applies; possible deductions if held long-term. |

| Management | Minimal active management; mostly passive income. | Requires maintenance, insurance, and provenance tracking. |

| Growth Potential | Scalable with increased catalog and streaming trends. | Appreciation depends on artist fame and art market health. |

Which is better?

Music royalties investment offers consistent passive income through streaming and licensing revenues, appealing to investors seeking steady cash flow with lower market volatility. Art investment tends to have higher appreciation potential but involves greater liquidity risks and requires substantial expertise to navigate market trends effectively. Evaluating risk tolerance, investment horizon, and income objectives is essential when choosing between music royalties and art investment.

Connection

Music royalties and art investments are connected through their shared foundation in alternative assets that generate passive income and portfolio diversification. Both asset classes leverage unique intellectual property rights and cultural value, appealing to investors seeking non-traditional, inflation-resistant opportunities. The growth of digital platforms and blockchain technology increasingly facilitates transparent transactions and fractional ownership within these creative economy markets.

Key Terms

Art investment:

Art investment offers a tangible asset that can appreciate significantly over time, often benefiting from the growing global art market valued at over $65 billion annually. Unlike music royalties, which depend on ongoing usage and rights management, art pieces provide physical ownership with potential for long-term capital gains and portfolio diversification. Explore the nuances of art investment strategies to maximize your returns and build a resilient asset base.

Provenance

Art investment relies heavily on provenance, providing a verifiable history that authenticates and often increases the value of a piece, making it a critical factor for collectors and investors. In contrast, music royalties investment depends on the documented ownership and licensing rights of songs, with clear provenance ensuring accurate royalty tracking and legal protection. Explore more about how provenance affects valuation and security in both art and music royalties investments.

Authentication

Authentication plays a critical role in art investment, ensuring the provenance and legitimacy of pieces through certificates, expert evaluations, and blockchain technology. Music royalties investment relies on verifiable rights management systems and digital tracking platforms to authenticate ownership and revenue streams. Explore the nuances of authentication in both sectors to make informed investment decisions.

Source and External Links

Basics of Art Funds and their Managers - Art investment often involves art funds that pursue diverse strategies such as buy and hold, geographic arbitrage, and investing in emerging artists, offering potential inflation protection and portfolio diversification benefits.

Investing in art: What to know about turning a passion into a ... - Art can diversify a portfolio, protect against inflation, and provide potential high returns, but it is illiquid, requires care, and its value depends heavily on trends, provenance, and authenticity.

Invest in Art - Own Shares in Masterpieces - Yieldstreet - Investors can access fractional ownership in diversified art portfolios, benefiting from historical outperformance relative to traditional markets, though investment risks including illiquidity remain significant.

dowidth.com

dowidth.com