Litigation finance involves third-party funding of legal cases, allowing plaintiffs to pursue claims without upfront costs while sharing potential settlements; peer-to-peer lending connects individual borrowers with investors via online platforms, offering alternative financing options beyond traditional banks. Both investment methods diversify portfolios and carry distinct risk profiles influenced by legal outcomes or borrower creditworthiness. Explore further to understand which investment strategy aligns best with your financial goals.

Why it is important

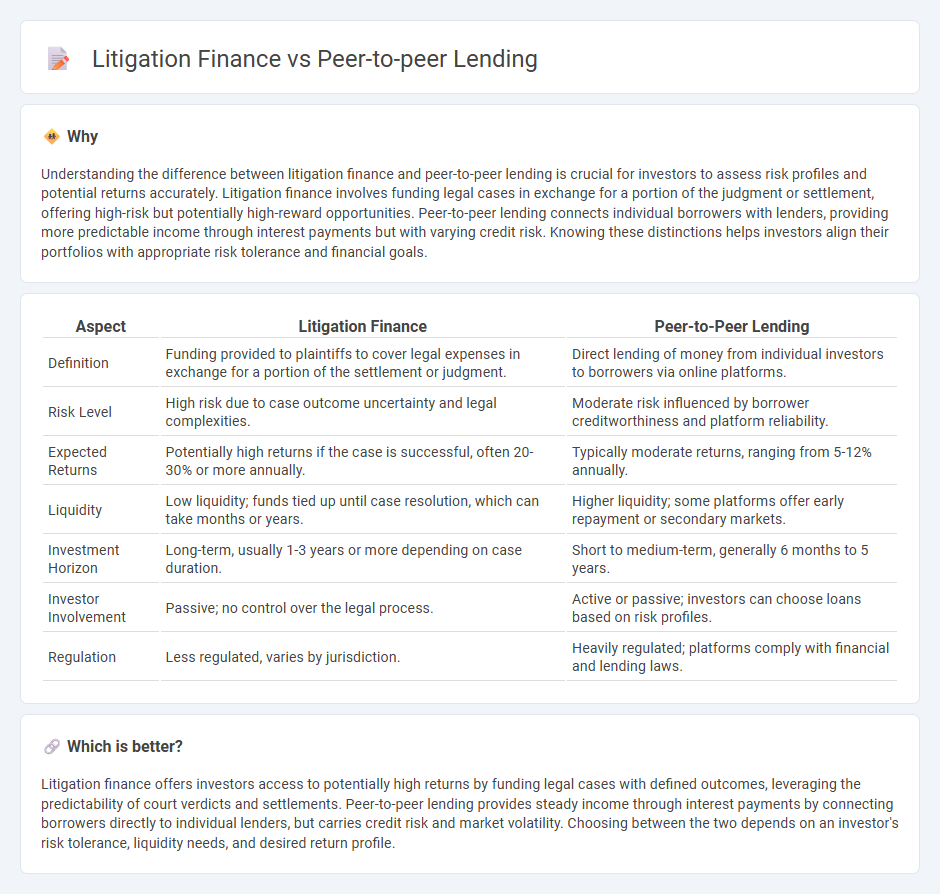

Understanding the difference between litigation finance and peer-to-peer lending is crucial for investors to assess risk profiles and potential returns accurately. Litigation finance involves funding legal cases in exchange for a portion of the judgment or settlement, offering high-risk but potentially high-reward opportunities. Peer-to-peer lending connects individual borrowers with lenders, providing more predictable income through interest payments but with varying credit risk. Knowing these distinctions helps investors align their portfolios with appropriate risk tolerance and financial goals.

Comparison Table

| Aspect | Litigation Finance | Peer-to-Peer Lending |

|---|---|---|

| Definition | Funding provided to plaintiffs to cover legal expenses in exchange for a portion of the settlement or judgment. | Direct lending of money from individual investors to borrowers via online platforms. |

| Risk Level | High risk due to case outcome uncertainty and legal complexities. | Moderate risk influenced by borrower creditworthiness and platform reliability. |

| Expected Returns | Potentially high returns if the case is successful, often 20-30% or more annually. | Typically moderate returns, ranging from 5-12% annually. |

| Liquidity | Low liquidity; funds tied up until case resolution, which can take months or years. | Higher liquidity; some platforms offer early repayment or secondary markets. |

| Investment Horizon | Long-term, usually 1-3 years or more depending on case duration. | Short to medium-term, generally 6 months to 5 years. |

| Investor Involvement | Passive; no control over the legal process. | Active or passive; investors can choose loans based on risk profiles. |

| Regulation | Less regulated, varies by jurisdiction. | Heavily regulated; platforms comply with financial and lending laws. |

Which is better?

Litigation finance offers investors access to potentially high returns by funding legal cases with defined outcomes, leveraging the predictability of court verdicts and settlements. Peer-to-peer lending provides steady income through interest payments by connecting borrowers directly to individual lenders, but carries credit risk and market volatility. Choosing between the two depends on an investor's risk tolerance, liquidity needs, and desired return profile.

Connection

Litigation finance and peer-to-peer lending intersect as alternative investment models that democratize access to capital by connecting individual investors with unique funding opportunities. Both rely on leveraging private capital to support ventures--litigation finance funds legal claims while peer-to-peer lending provides loans to borrowers without traditional banking intermediaries. These innovative financing methods share a reliance on risk assessment, investor returns, and technology platforms to facilitate transparent and efficient capital allocation.

Key Terms

Credit Risk (Peer-to-peer lending)

Peer-to-peer lending involves direct borrowing and lending between individuals or businesses through online platforms, where credit risk is primarily borne by individual lenders due to borrower default probability. Credit risk assessment in P2P lending relies heavily on borrower credit scores, income verification, and platform-driven risk models that predict default likelihood. Explore detailed comparisons of credit risk metrics and mitigation strategies between peer-to-peer lending and litigation finance to enhance your financial decision-making.

Case Merits (Litigation finance)

Litigation finance evaluates case merits by funding lawsuits with strong potential for success, ensuring capital is allocated to legally viable claims with high likelihood of favorable judgments. Peer-to-peer lending bypasses case merit assessment by focusing on borrowers' credit profiles and repayment ability, without evaluating legal case strength. Discover more about how case merits impact litigation finance decisions and investor risks.

Returns Structure

Peer-to-peer lending typically offers fixed interest returns based on borrower creditworthiness and loan terms, providing predictable cash flows. Litigation finance returns are contingent on case outcomes, often involving a share of the judgment or settlement, resulting in higher risk but potentially superior returns. Explore detailed comparisons to assess which returns structure aligns with your investment goals.

Source and External Links

Peer-to-peer lending - Wikipedia - Peer-to-peer lending (P2P lending) is an online financial service where individuals or businesses borrow money directly from other individuals via a P2P platform that intermediates and matches lenders with borrowers, offering unsecured or secured loans outside traditional financial institutions.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending lets people lend money through online marketplaces to individuals or businesses, typically offering higher interest rates than savings accounts but with higher risk, and requires checking regulatory approval by the Financial Conduct Authority (FCA) before lending.

PEER-TO-PEER LENDING - North American Securities Administrators Association (NASAA) - P2P lending uses the internet to connect borrowers, often seeking loans difficult to get from banks, with lenders funding unsecured loans generally between $1,000 and $25,000, creating an alternative online marketplace for personal and small business loans.

dowidth.com

dowidth.com