Art tokenization offers fractional ownership of valuable artworks through blockchain technology, enabling smaller investments and increased liquidity compared to traditional mutual funds, which pool capital to invest in diversified portfolios managed by professional fund managers. Unlike mutual funds that are regulated and provide steady returns through diverse asset classes, art tokenization introduces unique market dynamics with potential for high appreciation but less regulatory oversight. Explore the evolving landscape of investment options to decide which aligns best with your financial goals.

Why it is important

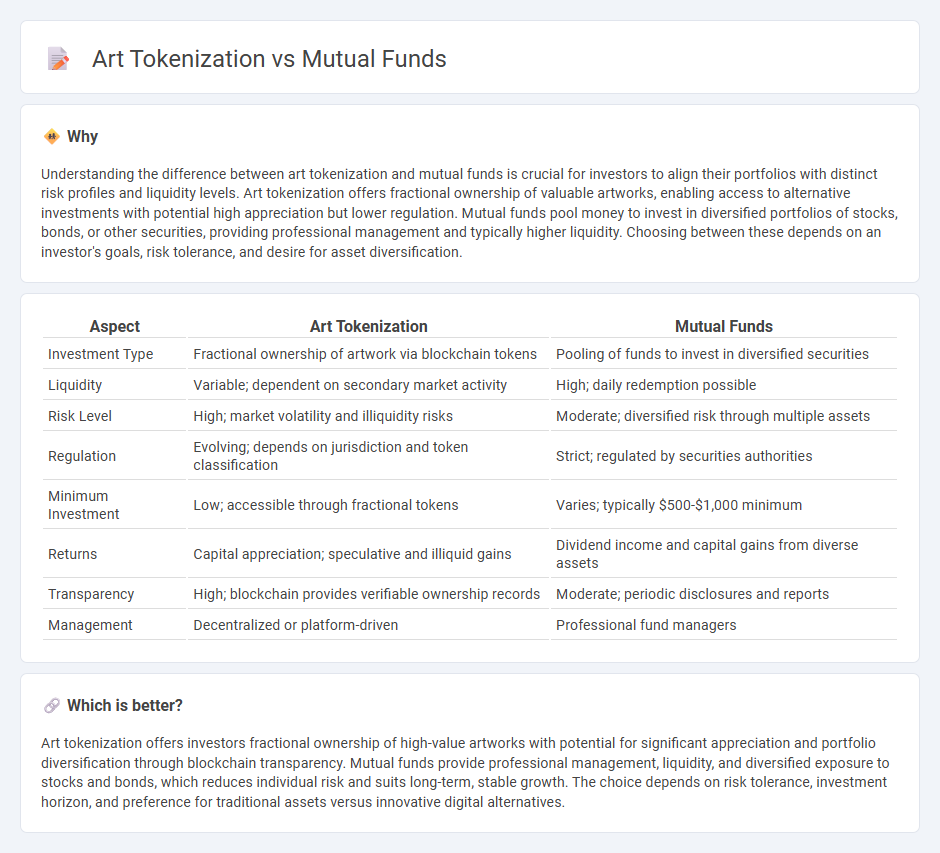

Understanding the difference between art tokenization and mutual funds is crucial for investors to align their portfolios with distinct risk profiles and liquidity levels. Art tokenization offers fractional ownership of valuable artworks, enabling access to alternative investments with potential high appreciation but lower regulation. Mutual funds pool money to invest in diversified portfolios of stocks, bonds, or other securities, providing professional management and typically higher liquidity. Choosing between these depends on an investor's goals, risk tolerance, and desire for asset diversification.

Comparison Table

| Aspect | Art Tokenization | Mutual Funds |

|---|---|---|

| Investment Type | Fractional ownership of artwork via blockchain tokens | Pooling of funds to invest in diversified securities |

| Liquidity | Variable; dependent on secondary market activity | High; daily redemption possible |

| Risk Level | High; market volatility and illiquidity risks | Moderate; diversified risk through multiple assets |

| Regulation | Evolving; depends on jurisdiction and token classification | Strict; regulated by securities authorities |

| Minimum Investment | Low; accessible through fractional tokens | Varies; typically $500-$1,000 minimum |

| Returns | Capital appreciation; speculative and illiquid gains | Dividend income and capital gains from diverse assets |

| Transparency | High; blockchain provides verifiable ownership records | Moderate; periodic disclosures and reports |

| Management | Decentralized or platform-driven | Professional fund managers |

Which is better?

Art tokenization offers investors fractional ownership of high-value artworks with potential for significant appreciation and portfolio diversification through blockchain transparency. Mutual funds provide professional management, liquidity, and diversified exposure to stocks and bonds, which reduces individual risk and suits long-term, stable growth. The choice depends on risk tolerance, investment horizon, and preference for traditional assets versus innovative digital alternatives.

Connection

Art tokenization transforms physical artworks into digital tokens on blockchain platforms, enabling fractional ownership and increased liquidity. Mutual funds can incorporate these tokenized art assets into their portfolios, offering investors diversified exposure to alternative investments. This integration enhances portfolio diversification while providing easier access to the traditionally illiquid art market.

Key Terms

Liquidity

Mutual funds offer high liquidity with shares that can be bought or sold daily on the market, enabling investors to access their money quickly. Art tokenization provides liquidity through fractional ownership of artworks, allowing investors to trade tokens on blockchain platforms, though market depth and regulatory factors can affect ease of liquidation. Explore how liquidity dynamics differ between these investment forms to make informed decisions.

Diversification

Mutual funds offer broad diversification by pooling investments across various assets like stocks, bonds, and sectors, reducing risk exposure. Art tokenization enables fractional ownership of high-value artworks, allowing investors to diversify into alternative assets traditionally inaccessible due to high entry costs. Explore how combining traditional mutual funds with art tokenization can optimize your investment diversification strategy.

Asset Valuation

Mutual funds value assets based on net asset value (NAV), calculated from the market price of underlying securities at the end of each trading day, providing liquidity and transparency. Art tokenization assigns fractional ownership through blockchain technology, leveraging expert appraisals and market trends to determine the valuation of each digital token representing a share of the artwork. Discover how these valuation models impact investment strategies by exploring the nuances of asset valuation in both financial instruments.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered, professionally managed investment pools that allow investors to buy a share of a diversified portfolio and redeem their shares daily at the net asset value (NAV).

Mutual fund - Wikipedia - Mutual funds pool money from many investors to buy securities such as stocks, bonds, or money market instruments, and are available in various structures, including open-end, closed-end, and index funds, with shares bought or sold directly from the fund at their NAV.

Understanding mutual funds - Charles Schwab - Mutual funds offer diversification, professional management, and lower transaction costs by pooling investor money to collectively purchase a broad mix of assets, and can be easily bought through banks or brokerages.

dowidth.com

dowidth.com