Litigation finance involves funding legal cases in exchange for a portion of the settlement or judgment, offering unique risk-adjusted returns less correlated with public markets. Public equities represent ownership in companies traded on stock exchanges, characterized by liquidity, market volatility, and dividend income potential. Explore the distinctions between these investment strategies to enhance portfolio diversification and risk management.

Why it is important

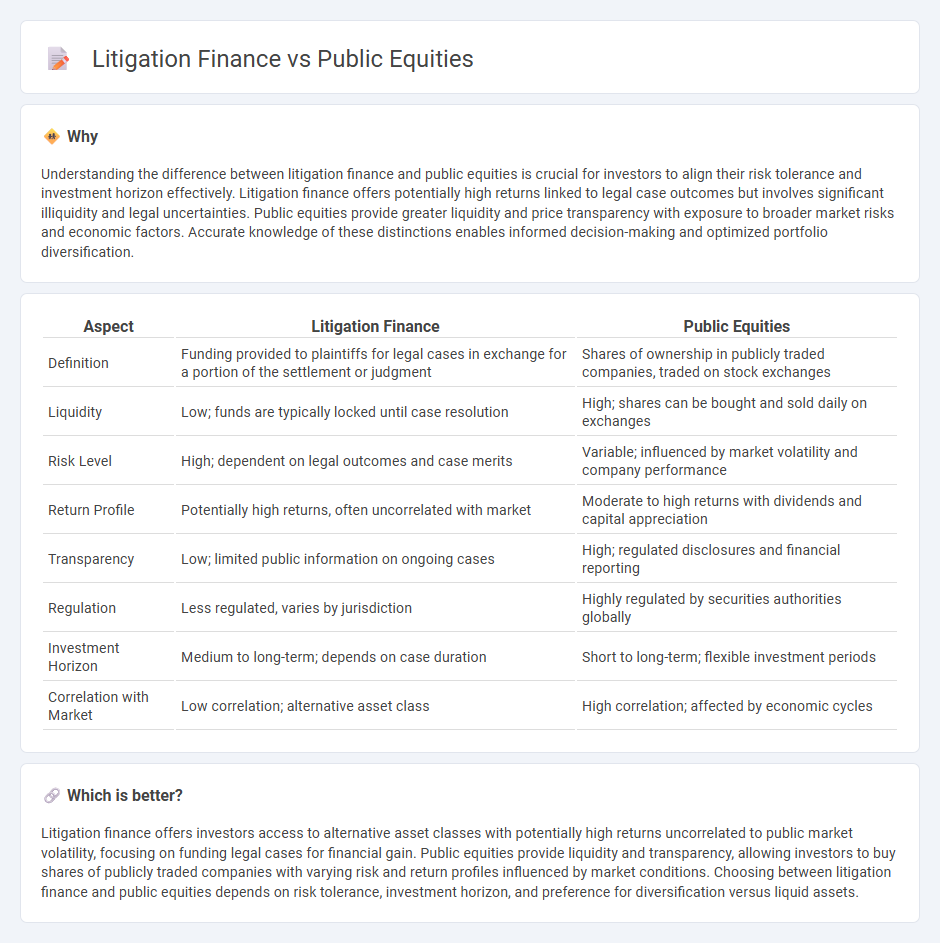

Understanding the difference between litigation finance and public equities is crucial for investors to align their risk tolerance and investment horizon effectively. Litigation finance offers potentially high returns linked to legal case outcomes but involves significant illiquidity and legal uncertainties. Public equities provide greater liquidity and price transparency with exposure to broader market risks and economic factors. Accurate knowledge of these distinctions enables informed decision-making and optimized portfolio diversification.

Comparison Table

| Aspect | Litigation Finance | Public Equities |

|---|---|---|

| Definition | Funding provided to plaintiffs for legal cases in exchange for a portion of the settlement or judgment | Shares of ownership in publicly traded companies, traded on stock exchanges |

| Liquidity | Low; funds are typically locked until case resolution | High; shares can be bought and sold daily on exchanges |

| Risk Level | High; dependent on legal outcomes and case merits | Variable; influenced by market volatility and company performance |

| Return Profile | Potentially high returns, often uncorrelated with market | Moderate to high returns with dividends and capital appreciation |

| Transparency | Low; limited public information on ongoing cases | High; regulated disclosures and financial reporting |

| Regulation | Less regulated, varies by jurisdiction | Highly regulated by securities authorities globally |

| Investment Horizon | Medium to long-term; depends on case duration | Short to long-term; flexible investment periods |

| Correlation with Market | Low correlation; alternative asset class | High correlation; affected by economic cycles |

Which is better?

Litigation finance offers investors access to alternative asset classes with potentially high returns uncorrelated to public market volatility, focusing on funding legal cases for financial gain. Public equities provide liquidity and transparency, allowing investors to buy shares of publicly traded companies with varying risk and return profiles influenced by market conditions. Choosing between litigation finance and public equities depends on risk tolerance, investment horizon, and preference for diversification versus liquid assets.

Connection

Litigation finance and public equities intersect through their shared reliance on risk assessment and capital markets dynamics. Litigation finance firms often raise funds via public equities to support legal claims, offering investors exposure to high-return, uncorrelated assets. Public equities enable liquidity and valuation transparency, enhancing the scalability and institutional appeal of litigation finance investments.

Key Terms

Stock Market

Public equities offer investors liquidity, regulatory transparency, and the potential for capital appreciation through ownership in publicly traded companies on stock markets like the NYSE and NASDAQ. Litigation finance involves providing capital to legal cases in exchange for a portion of the judgment or settlement, presenting a non-correlated alternative asset with unique risk-return profiles compared to traditional public equities. Explore further to understand how these investment strategies can diversify portfolios and manage risk effectively.

Capital Appreciation

Public equities offer capital appreciation through market-driven growth and dividend reinvestment, benefiting from broader economic trends and corporate performance. Litigation finance provides capital appreciation by investing in legal claims, often yielding uncorrelated returns that can diversify a portfolio while managing risk. Explore how blending these asset classes can optimize your investment strategy for sustained capital growth.

Legal Claims

Public equities offer liquidity and transparency through regulated stock exchanges, providing investors with accessible ownership stakes in companies. Litigation finance involves funding legal claims to potentially gain from settlements or judgments, often delivering uncorrelated returns independent of market fluctuations. Discover more about how investing in legal claims can diversify your portfolio and manage risk effectively.

Source and External Links

Public Equity investing - Public equities are shares of publicly traded companies characterized by market capitalization, styles (value, growth), volatility, and liquidity, allowing investors to buy and sell shares readily in public markets.

Public Equities Allocation-APFC - Public equities constitute the largest and most liquid asset class for many funds, including U.S. and international stocks traded on public markets, and are key drivers of growth in diversified portfolios.

Private Market vs Public Market: What's the Difference? - Public equities markets allow companies to raise capital by selling shares to the public, enabling any investor to purchase ownership in listed companies subject to regulatory and disclosure requirements.

dowidth.com

dowidth.com