Investing in viticulture land offers tangible assets with long-term value appreciation and steady income through vineyard yields, appealing to those seeking physical property and agricultural returns. Cryptocurrency presents high volatility with potential for rapid gains but carries substantial risk due to market fluctuations and regulatory uncertainties. Explore deeper insights into the comparative advantages and risks of viticulture land acquisition versus cryptocurrency investment.

Why it is important

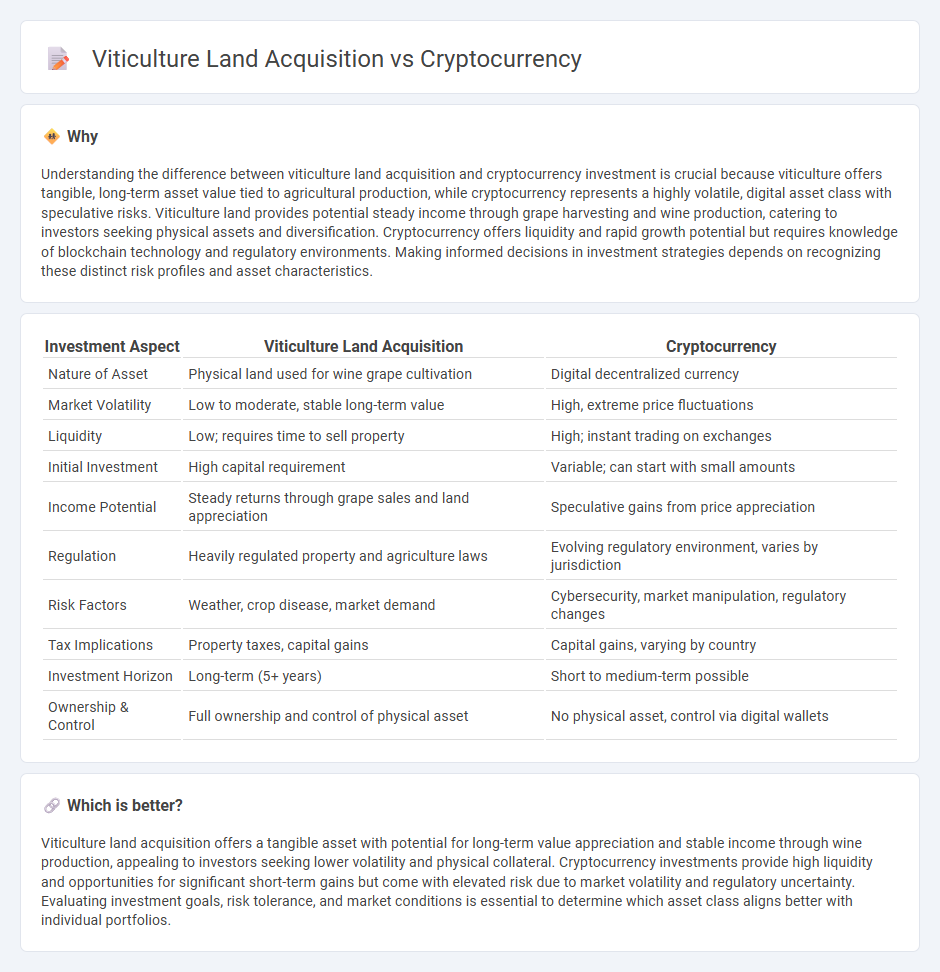

Understanding the difference between viticulture land acquisition and cryptocurrency investment is crucial because viticulture offers tangible, long-term asset value tied to agricultural production, while cryptocurrency represents a highly volatile, digital asset class with speculative risks. Viticulture land provides potential steady income through grape harvesting and wine production, catering to investors seeking physical assets and diversification. Cryptocurrency offers liquidity and rapid growth potential but requires knowledge of blockchain technology and regulatory environments. Making informed decisions in investment strategies depends on recognizing these distinct risk profiles and asset characteristics.

Comparison Table

| Investment Aspect | Viticulture Land Acquisition | Cryptocurrency |

|---|---|---|

| Nature of Asset | Physical land used for wine grape cultivation | Digital decentralized currency |

| Market Volatility | Low to moderate, stable long-term value | High, extreme price fluctuations |

| Liquidity | Low; requires time to sell property | High; instant trading on exchanges |

| Initial Investment | High capital requirement | Variable; can start with small amounts |

| Income Potential | Steady returns through grape sales and land appreciation | Speculative gains from price appreciation |

| Regulation | Heavily regulated property and agriculture laws | Evolving regulatory environment, varies by jurisdiction |

| Risk Factors | Weather, crop disease, market demand | Cybersecurity, market manipulation, regulatory changes |

| Tax Implications | Property taxes, capital gains | Capital gains, varying by country |

| Investment Horizon | Long-term (5+ years) | Short to medium-term possible |

| Ownership & Control | Full ownership and control of physical asset | No physical asset, control via digital wallets |

Which is better?

Viticulture land acquisition offers a tangible asset with potential for long-term value appreciation and stable income through wine production, appealing to investors seeking lower volatility and physical collateral. Cryptocurrency investments provide high liquidity and opportunities for significant short-term gains but come with elevated risk due to market volatility and regulatory uncertainty. Evaluating investment goals, risk tolerance, and market conditions is essential to determine which asset class aligns better with individual portfolios.

Connection

Viticulture land acquisition and cryptocurrency intersect through blockchain technology enabling secure, transparent land transactions and tokenizing vineyard assets for fractional ownership. This integration drives innovative investment models where investors can trade and leverage vineyard-backed digital tokens on cryptocurrency platforms. The fusion enhances liquidity in traditionally illiquid agricultural real estate markets while attracting tech-savvy investors into viticulture assets.

Key Terms

Volatility

Cryptocurrency investments exhibit extreme price volatility due to market speculation, regulatory changes, and technological innovations, often leading to rapid gains or losses. Viticulture land acquisition offers more stable, long-term value with lower volatility, influenced primarily by location quality, climate, and agricultural policies. Explore the risk dynamics and potential rewards of these investment types to make informed financial decisions.

Liquidity

Cryptocurrency offers unparalleled liquidity with 24/7 trading on global exchanges, enabling rapid buy-sell transactions and immediate access to funds. In contrast, viticulture land acquisition involves significant illiquidity due to lengthy sales processes, regulatory approvals, and market dependency on agricultural cycles. Discover more about the financial dynamics and long-term value of investing in digital assets versus agricultural real estate.

Tangible Asset

Investing in viticulture land offers a tangible asset with physical presence and potential for agricultural yield, contrasting sharply with the digital and volatile nature of cryptocurrency assets. Viticulture land provides long-term value appreciation through soil quality, grape production potential, and regional wine market dynamics. Explore the benefits and risks of tangible asset investment in viticulture land to enhance your portfolio diversification strategy.

Source and External Links

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency is a digital peer-to-peer payment system that uses cryptography for secure transactions and operates without central authority or banks.

Cryptocurrency - Wikipedia - A cryptocurrency is a decentralized digital currency that operates on a computer network, with ownership and transactions recorded on a blockchain, and does not rely on government or banking institutions.

Digital Currencies | Explainer | Education - Reserve Bank of Australia - Cryptocurrencies are digital tokens enabling direct online payments between people, have no legislated value, and are primarily traded for speculative investment rather than routine payments.

dowidth.com

dowidth.com