Farmland crowdfunding enables investors to pool resources into agricultural projects, offering diversification and access to tangible assets with potential for steady returns. Angel investing involves providing capital to early-stage startups, typically in exchange for equity, and carries higher risk with the possibility of substantial financial gain. Explore each investment type further to determine which aligns best with your financial goals and risk tolerance.

Why it is important

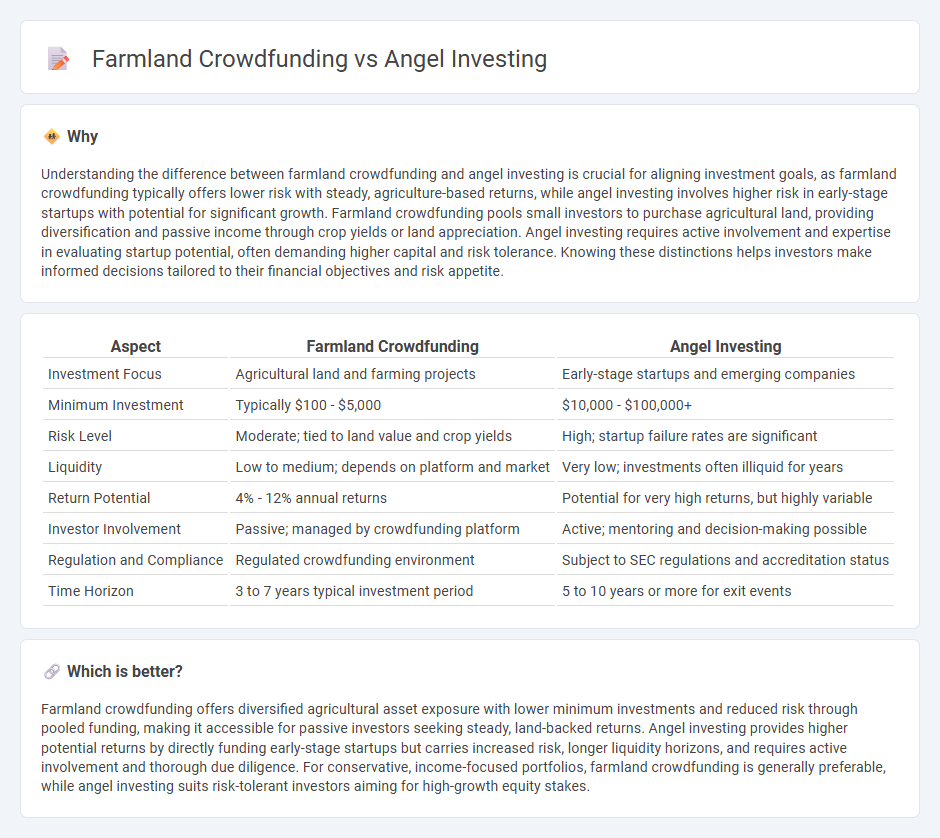

Understanding the difference between farmland crowdfunding and angel investing is crucial for aligning investment goals, as farmland crowdfunding typically offers lower risk with steady, agriculture-based returns, while angel investing involves higher risk in early-stage startups with potential for significant growth. Farmland crowdfunding pools small investors to purchase agricultural land, providing diversification and passive income through crop yields or land appreciation. Angel investing requires active involvement and expertise in evaluating startup potential, often demanding higher capital and risk tolerance. Knowing these distinctions helps investors make informed decisions tailored to their financial objectives and risk appetite.

Comparison Table

| Aspect | Farmland Crowdfunding | Angel Investing |

|---|---|---|

| Investment Focus | Agricultural land and farming projects | Early-stage startups and emerging companies |

| Minimum Investment | Typically $100 - $5,000 | $10,000 - $100,000+ |

| Risk Level | Moderate; tied to land value and crop yields | High; startup failure rates are significant |

| Liquidity | Low to medium; depends on platform and market | Very low; investments often illiquid for years |

| Return Potential | 4% - 12% annual returns | Potential for very high returns, but highly variable |

| Investor Involvement | Passive; managed by crowdfunding platform | Active; mentoring and decision-making possible |

| Regulation and Compliance | Regulated crowdfunding environment | Subject to SEC regulations and accreditation status |

| Time Horizon | 3 to 7 years typical investment period | 5 to 10 years or more for exit events |

Which is better?

Farmland crowdfunding offers diversified agricultural asset exposure with lower minimum investments and reduced risk through pooled funding, making it accessible for passive investors seeking steady, land-backed returns. Angel investing provides higher potential returns by directly funding early-stage startups but carries increased risk, longer liquidity horizons, and requires active involvement and thorough due diligence. For conservative, income-focused portfolios, farmland crowdfunding is generally preferable, while angel investing suits risk-tolerant investors aiming for high-growth equity stakes.

Connection

Farmland crowdfunding and angel investing intersect through their shared focus on providing capital to high-potential, often underserved markets, with investors seeking returns from asset appreciation and operational growth. Both investment types leverage digital platforms to democratize access, enabling individuals to fund agricultural ventures or startups with scalable business models. Synergies arise as farmland projects increasingly adopt agritech innovations, attracting angel investors interested in technological advancements driving sustainable agriculture.

Key Terms

Equity ownership

Angel investing offers direct equity ownership in early-stage startups, granting investors potential for high returns and influence in company decisions. Farmland crowdfunding allows investors to acquire fractional equity in agricultural properties, providing diversification and steady income through lease payments or crop yields. Explore the benefits and considerations of each investment type to make an informed decision.

Diversification

Angel investing offers diversification through equity stakes in multiple early-stage startups across various industries, potentially yielding high returns alongside high risks. Farmland crowdfunding diversifies portfolios by pooling smaller investments into agricultural real estate, providing steady income and reduced market volatility due to the tangible asset base. Explore how these investment strategies compare in risk, return, and portfolio balance to optimize your diversification approach.

Liquidity

Angel investing typically involves longer lock-in periods, limiting liquidity due to private equity stakes in early-stage startups, whereas farmland crowdfunding offers relatively higher liquidity through fractional ownership and periodic buy-back options. Farmland investments benefit from steady cash flow and asset-backed security, making them more accessible for investors seeking moderate liquidity and diversification. Explore the detailed liquidity profiles of both investment types to determine which aligns better with your financial goals.

Source and External Links

Understanding angel financing and investing - Angel investors provide early-stage capital to startups in exchange for equity or convertible debt, often bridging the gap between family/friends funding and institutional investment, while offering mentorship and industry connections.

Angel Investors - Angel investors are wealthy individuals who invest their own money in small businesses for equity, typically seeking an exit via acquisition or IPO, and often provide hands-on support beyond just funding.

Learn how to find and work with angel investors - Angel investors usually seek a 10-30% equity stake and can offer strategic value through networks, guidance, and customer introductions, making their involvement crucial for early-stage startup growth.

dowidth.com

dowidth.com