Fractional real estate investment allows multiple investors to purchase shares of a property, reducing individual capital commitment compared to traditional buy-and-hold residential rentals, which require full ownership and active management of the asset. This approach enhances portfolio diversification and liquidity, while buy-and-hold strategies benefit from long-term appreciation and steady rental income. Explore deeper insights into how these investment strategies can align with your financial goals.

Why it is important

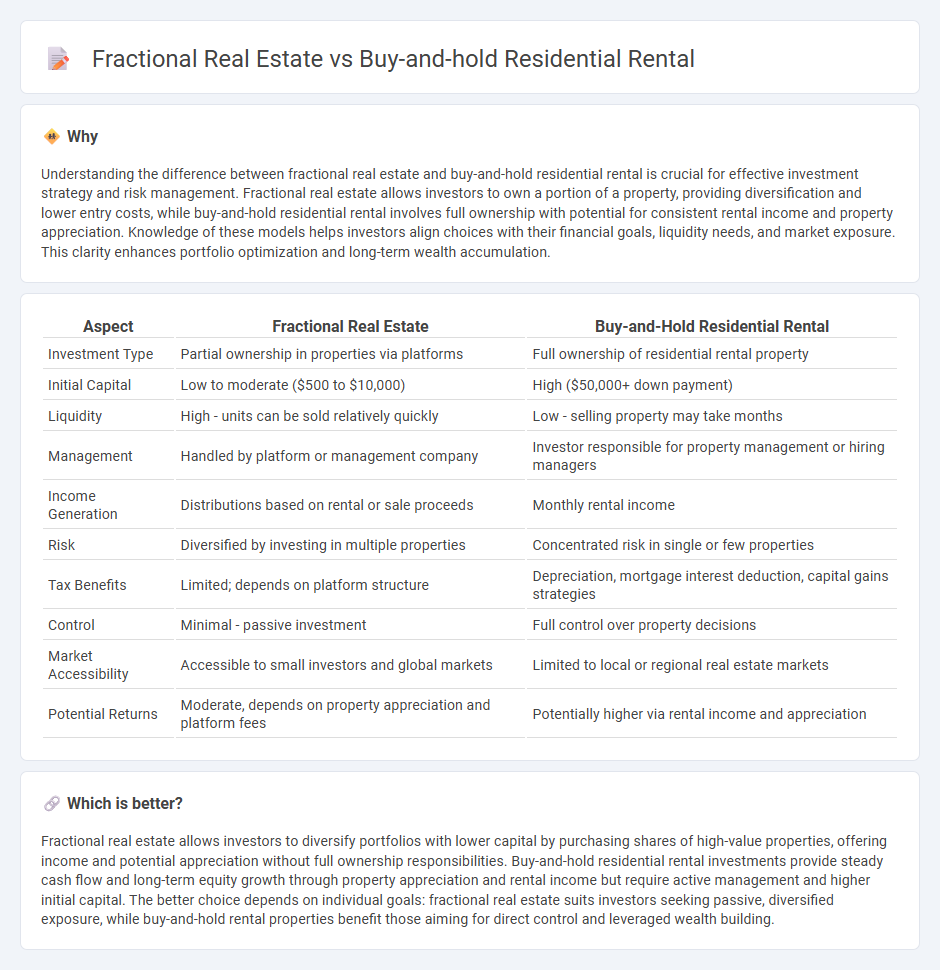

Understanding the difference between fractional real estate and buy-and-hold residential rental is crucial for effective investment strategy and risk management. Fractional real estate allows investors to own a portion of a property, providing diversification and lower entry costs, while buy-and-hold residential rental involves full ownership with potential for consistent rental income and property appreciation. Knowledge of these models helps investors align choices with their financial goals, liquidity needs, and market exposure. This clarity enhances portfolio optimization and long-term wealth accumulation.

Comparison Table

| Aspect | Fractional Real Estate | Buy-and-Hold Residential Rental |

|---|---|---|

| Investment Type | Partial ownership in properties via platforms | Full ownership of residential rental property |

| Initial Capital | Low to moderate ($500 to $10,000) | High ($50,000+ down payment) |

| Liquidity | High - units can be sold relatively quickly | Low - selling property may take months |

| Management | Handled by platform or management company | Investor responsible for property management or hiring managers |

| Income Generation | Distributions based on rental or sale proceeds | Monthly rental income |

| Risk | Diversified by investing in multiple properties | Concentrated risk in single or few properties |

| Tax Benefits | Limited; depends on platform structure | Depreciation, mortgage interest deduction, capital gains strategies |

| Control | Minimal - passive investment | Full control over property decisions |

| Market Accessibility | Accessible to small investors and global markets | Limited to local or regional real estate markets |

| Potential Returns | Moderate, depends on property appreciation and platform fees | Potentially higher via rental income and appreciation |

Which is better?

Fractional real estate allows investors to diversify portfolios with lower capital by purchasing shares of high-value properties, offering income and potential appreciation without full ownership responsibilities. Buy-and-hold residential rental investments provide steady cash flow and long-term equity growth through property appreciation and rental income but require active management and higher initial capital. The better choice depends on individual goals: fractional real estate suits investors seeking passive, diversified exposure, while buy-and-hold rental properties benefit those aiming for direct control and leveraged wealth building.

Connection

Fractional real estate and buy-and-hold residential rental both offer investors diversified exposure to property markets with comparatively lower capital requirements. Fractional real estate allows multiple investors to own shares in a single property, facilitating entry into residential rental investments without the need for full ownership. Buy-and-hold rental strategies benefit from this model by providing steady cash flow and potential appreciation through shared property management and maintenance costs.

Key Terms

Property Ownership

Buy-and-hold residential rental properties grant investors full ownership and control, including rights to rental income, property decisions, and appreciation benefits. Fractional real estate offers shared ownership, dividing the property among multiple investors who collectively benefit from rental yields and value growth without full responsibility for maintenance. Explore the key differences in property ownership models to choose the best real estate investment strategy for your portfolio.

Liquidity

Buy-and-hold residential rental properties typically offer lower liquidity due to lengthy tenant agreements and the time required to sell real estate assets. Fractional real estate investments provide enhanced liquidity by allowing investors to buy and sell shares of property on secondary markets with greater ease and speed. Explore the benefits and risks of liquidity in both investment strategies to determine the best fit for your portfolio.

Passive Income

Buy-and-hold residential rental properties generate steady passive income through consistent monthly rent, benefiting from property appreciation and tax advantages. Fractional real estate offers diversification and lower entry costs by allowing investors to own a share of high-value properties without managing tenants or maintenance. Explore detailed comparisons to determine which passive income strategy aligns best with your financial goals.

Source and External Links

Build Wealth With Rental Properties Through Buy & Hold Investing - Buy and hold is a long-term real estate investment strategy where an investor buys residential rental property to hold for 5 to 30 years, earning stable monthly rental income and benefiting from property appreciation over time, with positive cash flow typically covering ownership costs.

What is Buy and Hold (Rental Income) in Real Estate? - Rentastic - Buy and hold involves purchasing residential rental properties to generate long-term passive income through rent while benefiting from property value growth, with investors focusing on cash flow calculated as rental income minus mortgage and operating expenses.

What Is the Buy-and-Hold Real Estate Investing Strategy? - This strategy involves retaining rental properties to earn steady cash flow and build equity over time, leveraging tax benefits such as depreciation and capital gains deferral while focusing on properties in stable or growing markets for long-term wealth accumulation.

dowidth.com

dowidth.com