Patent monetization enables inventors to generate revenue by licensing or selling their intellectual property rights, providing a direct financial return on innovation. Crowdfunding leverages a large pool of individual investors to fund projects or startups, often in exchange for early access or rewards rather than equity or royalties. Explore the advantages and challenges of patent monetization versus crowdfunding to determine the best investment strategy for your innovation.

Why it is important

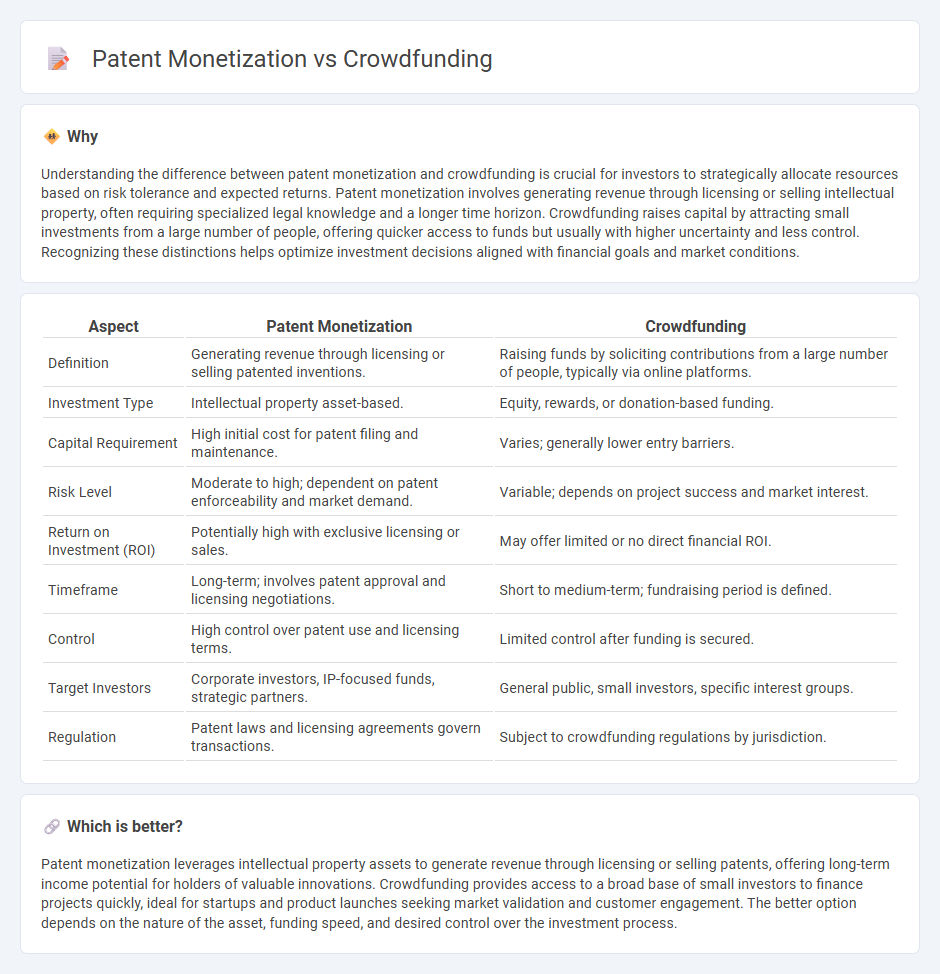

Understanding the difference between patent monetization and crowdfunding is crucial for investors to strategically allocate resources based on risk tolerance and expected returns. Patent monetization involves generating revenue through licensing or selling intellectual property, often requiring specialized legal knowledge and a longer time horizon. Crowdfunding raises capital by attracting small investments from a large number of people, offering quicker access to funds but usually with higher uncertainty and less control. Recognizing these distinctions helps optimize investment decisions aligned with financial goals and market conditions.

Comparison Table

| Aspect | Patent Monetization | Crowdfunding |

|---|---|---|

| Definition | Generating revenue through licensing or selling patented inventions. | Raising funds by soliciting contributions from a large number of people, typically via online platforms. |

| Investment Type | Intellectual property asset-based. | Equity, rewards, or donation-based funding. |

| Capital Requirement | High initial cost for patent filing and maintenance. | Varies; generally lower entry barriers. |

| Risk Level | Moderate to high; dependent on patent enforceability and market demand. | Variable; depends on project success and market interest. |

| Return on Investment (ROI) | Potentially high with exclusive licensing or sales. | May offer limited or no direct financial ROI. |

| Timeframe | Long-term; involves patent approval and licensing negotiations. | Short to medium-term; fundraising period is defined. |

| Control | High control over patent use and licensing terms. | Limited control after funding is secured. |

| Target Investors | Corporate investors, IP-focused funds, strategic partners. | General public, small investors, specific interest groups. |

| Regulation | Patent laws and licensing agreements govern transactions. | Subject to crowdfunding regulations by jurisdiction. |

Which is better?

Patent monetization leverages intellectual property assets to generate revenue through licensing or selling patents, offering long-term income potential for holders of valuable innovations. Crowdfunding provides access to a broad base of small investors to finance projects quickly, ideal for startups and product launches seeking market validation and customer engagement. The better option depends on the nature of the asset, funding speed, and desired control over the investment process.

Connection

Patent monetization leverages intellectual property assets to generate revenue streams, which can attract targeted crowdfunding campaigns seeking to finance innovation-driven ventures. Crowdfunding platforms enable inventors to validate market demand and secure capital by showcasing patented technologies directly to potential backers. Combining patent monetization with crowdfunding strategies enhances investment prospects by aligning investor interest with protected, scalable innovations.

Key Terms

Crowdfunding:

Crowdfunding offers startups and inventors a dynamic platform to raise capital by directly engaging a broad community of backers interested in innovative projects, bypassing traditional funding hurdles. This approach not only accelerates access to funds but also validates market demand, enhancing the project's appeal to future investors. Explore how leveraging crowdfunding can transform your innovation funding strategy and drive successful product launches.

Equity funding

Equity crowdfunding empowers startups to raise capital by offering shares to a broad base of investors, enabling rapid growth without incurring debt. In contrast, patent monetization leverages intellectual property assets to generate revenue or financing but often requires extensive legal and market expertise. Explore how equity crowdfunding can strategically accelerate your business funding.

Backers

Crowdfunding engages a broad base of backers who contribute funds in exchange for early access, rewards, or equity, fostering community involvement and market validation. Patent monetization targets a narrower group of investors or companies interested in licensing or acquiring intellectual property rights for competitive advantage and revenue generation. Explore the distinct benefits and strategies to determine which approach suits your innovation goals best.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, involving project initiators, supporters, and a platform that facilitates the process without traditional financial intermediaries.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding raises funds through collective efforts of many individuals via online platforms and social media, allowing startups and projects to get financing from a broad audience rather than traditional investors.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding can be donation-based, rewards-based, or equity-based, using online platforms to collect small contributions from many individuals for funding diverse projects including businesses, nonprofits, and social causes.

dowidth.com

dowidth.com